The April 18, 2017 tax deadline also marks your last chance to fund a new traditional IRA or Roth IRA for 2016. Both Lending Club and Prosper allow you to open up retirement accounts. You can also transfer money from an existing IRA to either company which can be done at any time. In this post I’ll share why it is most efficient to invest in p2p lending through a tax advantaged account and the basics of what Lending Club and Prosper offer. If you’re interested in learning about how to file taxes with Lending Club and Prosper investments you can review our recent tax post.

Lending Club and Prosper investments are different from investing in stocks. Borrowers repay monthly and this income is taxed at the same tax rate as your ordinary income. The losses or charge offs from loans are capital losses. Investors are able to deduct $3,000 a year of capital losses (Federal). Any losses over $3,000 are carried over to future years. There also may be a limit in capital losses you can claim each year at the state level.

Where I live in Wisconsin there is a $500 limit on the Wisconsin deduction for capital losses. While I remained below the $3,000 federal limit, I now am carrying over losses on the state level year after year since I invest through a taxable account. Capital losses first offset capital gains. With no capital gains, the losses will be deducted from ordinary income.

Depending on your ordinary income tax rate, your capital losses may be offset first by long-term gains that have more favorable tax treatment, usually 15% (depending on your income), as opposed to your potentially higher ordinary income tax rate. Short-term gains on the other hand have a higher tax rate, similar to the ordinary income tax rates (see Capital gains tax in the U.S.).

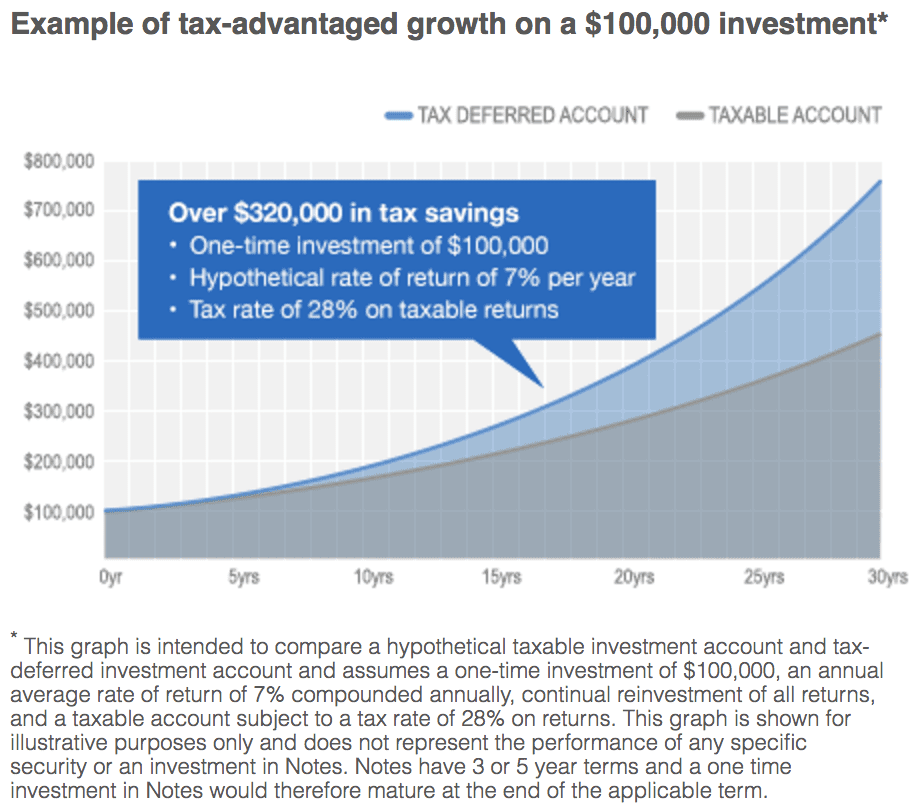

Lending Club shares the contrast of investing through a tax deferred account versus a taxable account:

Opening an IRA with Lending Club

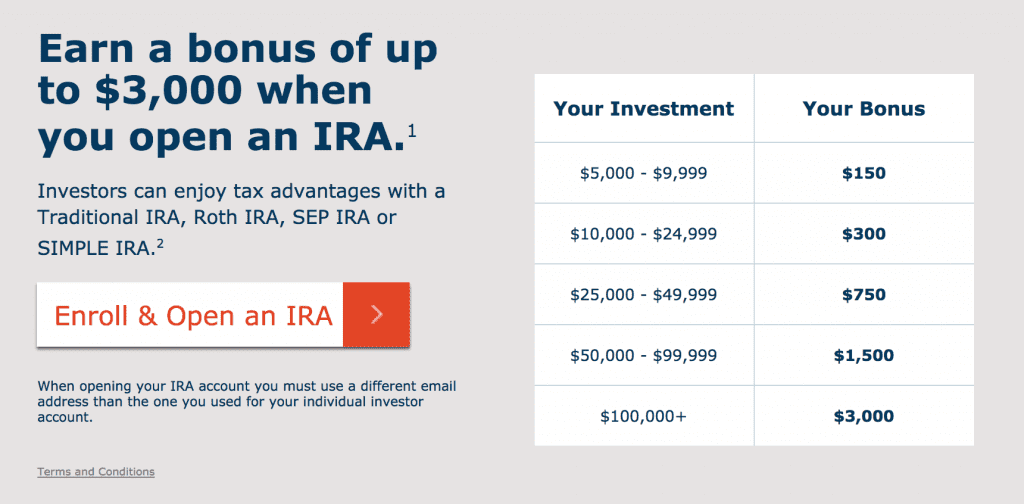

Lending Club offers 401(k) rollovers, IRA transfers and annual IRA contributions (Roth IRA or Traditional IRA). In addition to your contribution Lending Club is currently offering up to a 3% bonus, which is their best offer to date.

IRAs are available with Lending Club’s preferred custodian, Self Directed IRA Services, Inc. (SDIRA). There is an annual account fee of $100, but this is covered by Lending Club if your initial investment exceeds $5,000. Lending Club will continue to cover this fee in subsequent years if your investment in Lending Club notes exceeds $10,000 or more.

Only residents of the following states can open an IRA with Lending Club: Alabama, Arizona, Arkansas, California, Colorado, Connecticut, District of Columbia, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Iowa, Indiana, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New York, North Dakota, Oklahoma, Oregon, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, and Wyoming.

More information on IRAs can be found on Lending Club’s website.

Small Business and Self Employed Accounts

It’s important to note that Lending Club offers two types of employer sponsored accounts. One is a SEP or a Simplified Employee Pension plan. With the SEP, employers receive a tax deduction when they contribute to accounts of their employees. This type of account is available to any size of business, including self-employment.

Additionally, Lending Club offers a Savings Incentive Match Plan for Employees (SIMPLE) where employers and employees can make pre-tax contributions to a retirement account. However, this is only available for companies with less than 100 employees.

Opening an IRA with Prosper

Prosper, like Lending Club offers IRA transfers, rollovers and annual contributions. Prosper will also cover your first year IRA account fee to the custodian with a $5,000 contribution. If you have at least $10,000 invested on your one year anniversary, they will continue to pay the account fee. Prosper’s preferred IRA custodians are Millennium Trust and Equity Institutional.

Prosper is only available to lenders from Alaska, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Louisiana, Maine, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, New Hampshire, New York, Oregon, Rhode Island, South Carolina, South Dakota, Utah, Virginia, Washington, Wisconsin and Wyoming.

You can learn more on Prosper’s website.

Conclusion

You should consider own situation before making any actions on any of this information but in most cases an IRA is the best vehicle for p2p lending investments. Both Lending Club and Prosper have offered IRA accounts for many years. Peter Renton, the Founder of Lend Academy, has a majority of his accounts in IRAs.