Despite leaders’ assurances, the banking crisis continues to unfold. This past week all sights were set on First Republic Bank.

In a fall that started before the Silicon Valley Bank Run, the distressed bank saw outflows of deposits despite being thrown a liferaft by a consortium of industry players.

An abrupt first-quarter earnings call on April 24 only fuelled the flames of doubt.

In the early hours of this morning, Monday, May 1, 2023, regulators’ much-anticipated seizure of First Republic was finally announced. The bank’s assets and many of its deposits will be acquired by JPMorgan.

As part of the agreement, the FDIC will share losses on First Republic loans with JP Morgan, with its insurance fund taking a hit of $13 billion. JPMorgan has also said it will receive $50 billion in financing from the FDIC.

The failure marks the second biggest bank failure in U.S. history, topped only by Washington Mutual Inc’s 2008 collapse. It is the third bank failure in under two months.

Deposit outflows without an end

In the bank’s Q1 2023 earnings call, the March bank runs’ devastating effect, and the precarious financial position became undeniably clear. With deposit outflows amounting to $100 billion in just a few days, the $30 billion aid package, received six days later, did little to save the bank’s eventual demise.

It seemed that bank was already in trouble before the crippling bank runs. On top of the kamikaze drop in deposits, profits and revenue had also declined. While many regional banks had reported declines in deposits during the quarter, their profits were reportedly stable, leaving analysts concerned about First Republic’s stability.

Expensive loans taken on from the Federal Reserve and the Federal Home Loan Bank were likely to add even more pressure to an already precarious balance sheet.

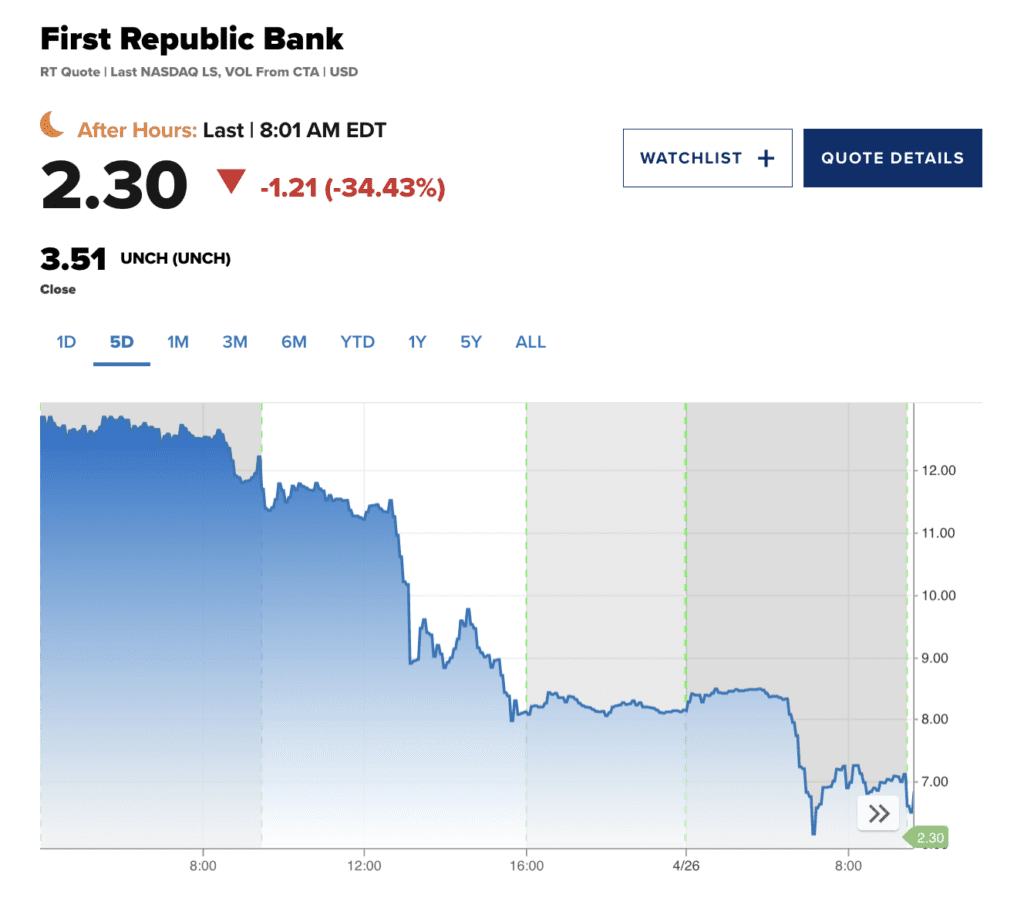

Hollow efforts from CEO Mike Roffler to assure analysts that the bank had a strategy to strengthen its business were perhaps undermined by the call’s brevity and lack of Q&A. First Republic, already having dropped 90% in share value, continued its downward spiral.

Desperately searching for a rescue deal, hopes had dimmed come Friday, April 28. Shares of the floundering bank had dropped another 43%, despite multiple halts due to volatility.

On Friday, First Republic told CNBC’s David Faber, “We are engaged in discussions with multiple parties about our strategic options while continuing to serve our clients.” The bank had reportedly spent the week formulating a plan to pitch the sale of assets above market rate to large banks to raise equity and avoid seizure.

However, it became clear its demise was imminent, and regulators opened out a “highly competitive bidding process,” of which JP Morgan emerged the victor.

“Our government invited us and others to step up, and we did,” said Jamie Dimon, Chairman and CEO of JPMorgan Chase. “Our financial strength, capabilities, and business model allowed us to develop a bid to execute the transaction to minimize costs to the Deposit Insurance Fund.”

“This acquisition modestly benefits our company overall. It is accretive to shareholders, helps further advance our wealth strategy, and is complementary to our existing franchise.”