Just last month we wrote about the 2015 UK Alternative Finance Industry Report and now a similar report has been released on the largest alternative finance market in the world. The report titled Harnessing Potential can be downloaded here and covers the Asia-Pacific market. It was produced by the Cambridge Centre for Alternative Finance, the University of Sydney, and Tsinghua University.

The report included survey data from a staggering 503 alternative finance platforms. 376 of these companies are located in mainland China where some of the largest companies in marketplace lending exist today.

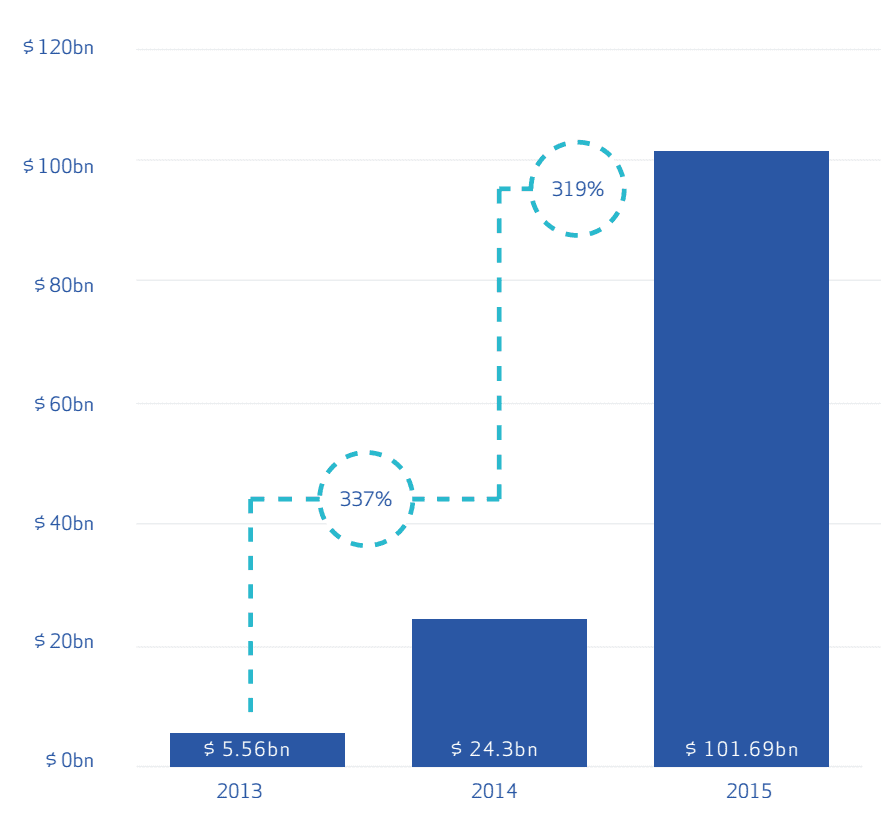

According to the report, this covered an estimated 70% of the market that grew 323% year over year to total $102.81 billion in 2015. The market in China continues to be much larger than the US where we estimate that originations totaled $30 billion across the industry in 2015. UK originations totaled $4.5 billion in 2015.

To give you an idea of the growth in China the report highlights that originations were just $5.56 billion in 2013 and $24.30 billion in 2014.

Although the growth in China has been impressive, countries outside of China continue to report impressive growth but from a much smaller base. This includes the markets in Japan, Australia, New Zealand, South Korea, India and Singapore. Volume outside of China totaled $1.12 billion in 2015.

The UK report and now the Asia-Pacific report are the most comprehensive studies done on the respective markets. Many people have been waiting for hard numbers on just how big the industry is across the globe in China and it’s great to see such a detailed report. If you’re interested in digging deep into the industry and understanding the markets I highly recommend giving them a read. Next month, the highly anticipated report on the United States will be made available at LendIt and we will be sure to share it on Lend Academy.