Until April Lending Club updated their loan statistics every day. But in preparation for their upcoming IPO they moved to a quarterly update cycle instead of daily. So now, we have to wait several weeks after the end of the quarter before we can see the full loan data for loans Lending Club issued in that quarter.

So, in mid-August Lending Club quietly updated the data file on their Download page. Soon after I downloaded the updated 2014 data and started doing some digging. There were plenty of surprises here. So, I reached out to Lending Club (pre-IPO announcement) to get some comments.

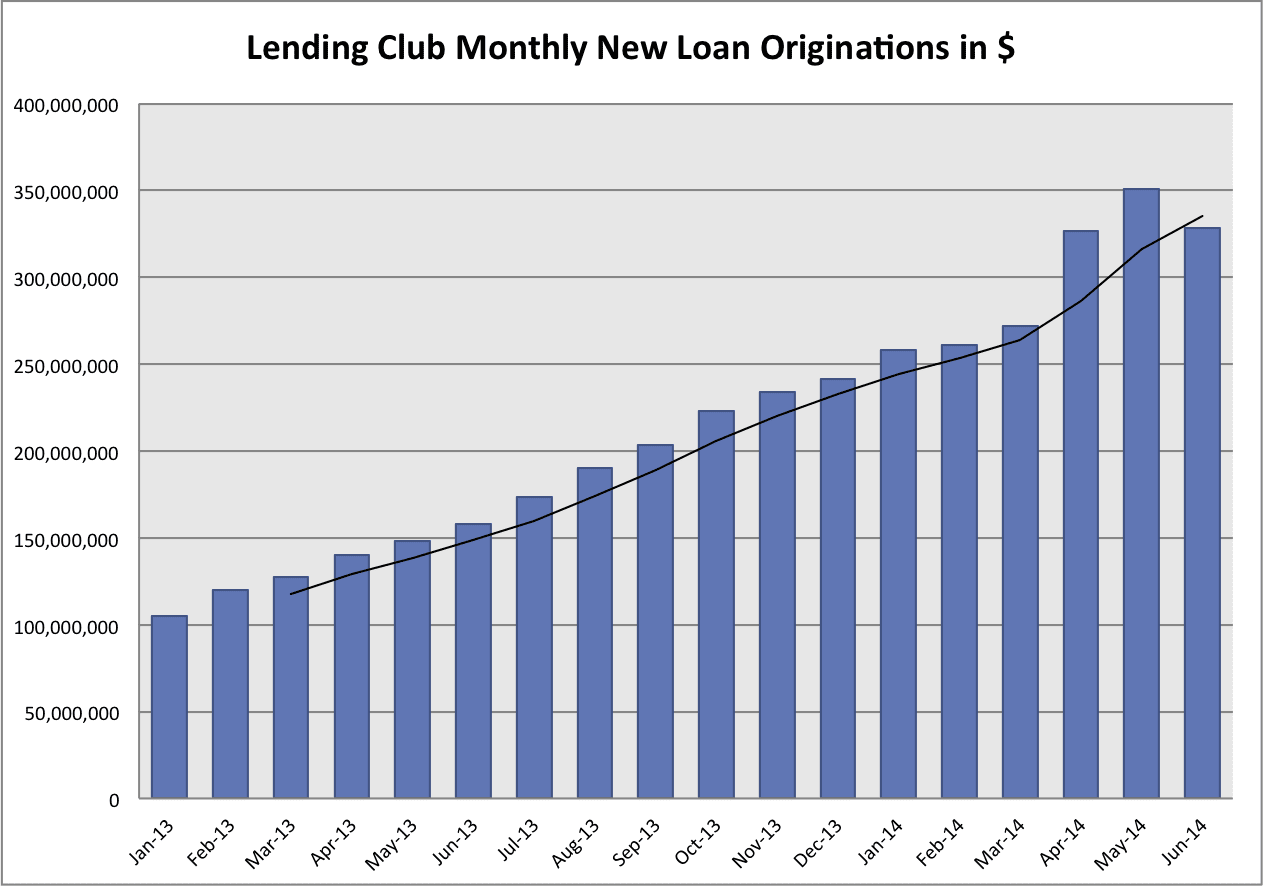

But before we get to these comments take a look at the 18-month chart below. The second quarter of 2014 is certainly bucking the smooth growth trend that we have come to expect from Lending Club.

The thing that surprised me the most was that June was a down month at Lending Club as far as loan volume goes. This is the first down month in loan volume at Lending Club since February 2011. I know that CEO Renaud Laplanche has been very proud of Lending Club’s consistent growth trajectory so I certainly wasn’t expecting this when I started analyzing the numbers.

When we look at the month over month growth at Lending Club we see a very consistent pattern until the second quarter. Most months show between a 5% and 10% growth over the previous month. So, I asked about this and other interesting data from their second quarter numbers.

The Down Month in June

The biggest surprise here turned out to have a very simple explanation. Lending Club is no longer focusing on monthly origination growth. Instead they are now driven by quarterly numbers. So, showing consistent monthly growth in loan volume is not that important any more. Rest assured, we can continue to expect strong quarterly loan growth from Lending Club going forward.

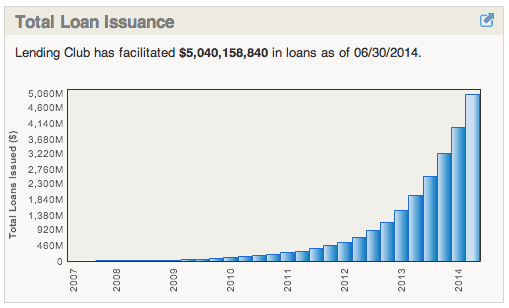

This movement to a quarterly focus is evident on their statistics page – the chart below used to show monthly originations, it now shows quarterly numbers. And the quarterly growth has been impressive – $1.01 billion in Q2 up from $791 million in Q1.

Small Business Loans

Lending Club is not sharing any details of their small business loan volume, at least not yet. But that doesn’t mean we can’t glean some information from their public data.

I have told you about Policy Code 2 loans before. They are basically loans that fall outside of Lending Club’s primary underwriting model. Well, these small business loans have been deemed Policy Code 2 loans, a category that also includes some consumer loans.

So, we have no way of knowing the exact volume number small business loans. We do know Lending Club started their dedicated small business loan program in March and Laplanche stated on a recent Lend Academy Podcast that they would be growing this business somewhat slowly.

This is what we can tell from the data. We know the maximum amount for consumer loans is $35,000 and for small business loans it is $100,000. We know that Lending Club made 207 loans of greater than $35,000 in the second quarter totaling $11.4 million. These were Policy Code 2 loans that we can assume are all small business loans. Lending Club would not confirm or deny this.

We also know there would have been many small business loans of less than $35,000 but we cannot differentiate these loans from consumer loans. So, it looks like Lending Club’s small business lending operation is gaining steam although it likely represents just 1-2% of the total second quarter loan volume.

Springstone Financial Loans

In April Lending Club made their first acquisition – they purchased Springstone Financial for $140 million. Springstone is a consumer lender focused on patient financing and private school education loans. Lending Club confirmed that these loans are now included in their download as Policy Code 2 loans.

We can see some of these loans because many are less than $1,000 and that is the minimum to obtain a loan through Lending Club’s platform. In fact, there were 1,117 loans of less than $1,000 in the second quarter – we can assume these were all Springstone Financial loans.

A Statistical Snapshot of the 2nd Quarter Data

These many small medical loans have meant that Lending Club’s average loan size has dropped to the lowest number since 2011. This happened despite the fact that small business loans up to $100,000 are now included in this average. Another interesting data point is the huge increase in Policy Code 2 loans. This is mainly because they now include all small business and Springstone loans in that group.

- Average loan size: $12,241

- Total Policy Code 2 loans: $285.9 million (28.5% of the total)

These next three data points are only for Policy Code 1 loans – the regular Lending Club loans.It is not surprising that the percentage of whole loans continues to rise but the interest rate and loan term breakdown are remaining consistent. The average FICO has dropped slightly over previous periods.

- Percentage 36/60 month loans: 68.4%/31.6%

- Average interest rate: 14.08%

- Percentage of whole loans: 57.2%

- Average FICO score: 695

While Lending Club will continue to make their loan data available it is difficult to learn much about their new lines of business from this data. As Lending Club transitions to become a public company they are changing the way they are sharing data. We will continue to be able to analyze Lending Club’s core consumer loans data but getting much meaningful information about the rest of their business will likely be difficult.