In early March at LendIt USA 2017, Lending Club teased that an iOS app was coming soon. The app, which launched today is entirely focused on investors, it is not a borrowing app. The Lend Academy team was able to get exclusive access to the app pre-launch to check it out for ourselves. For the first time Lending Club’s 148,000+ individual retail investors will be able to manage their account and direct investments all on their iOS device. New investors will also be able to create a new account right through the app.

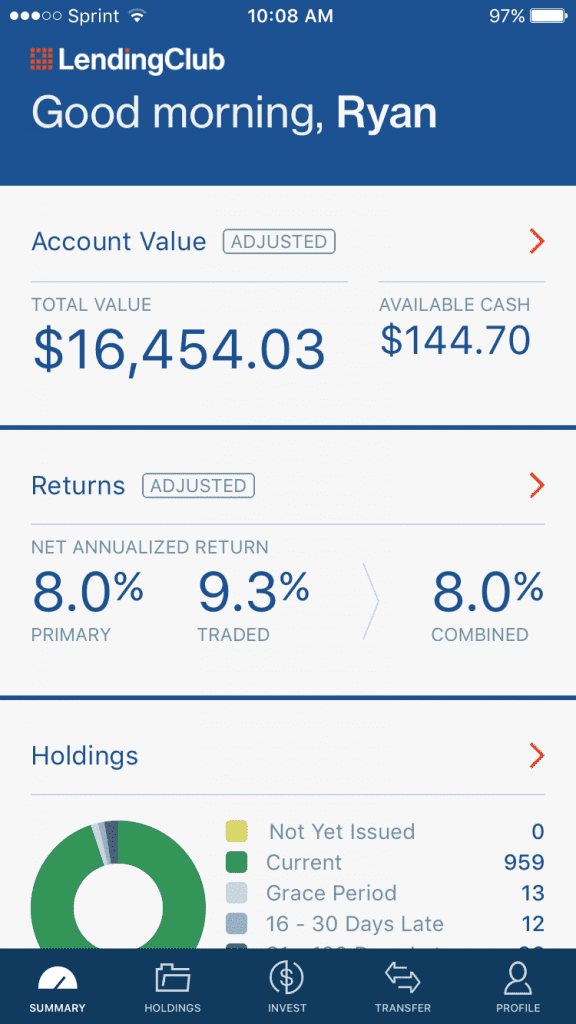

After login the app presents you with a summary dashboard which includes much of the same information you’d see after logging on to the website. For me personally this is the page I will get the most value out of. The quick glance overview is often what I am looking for when I login to the website.

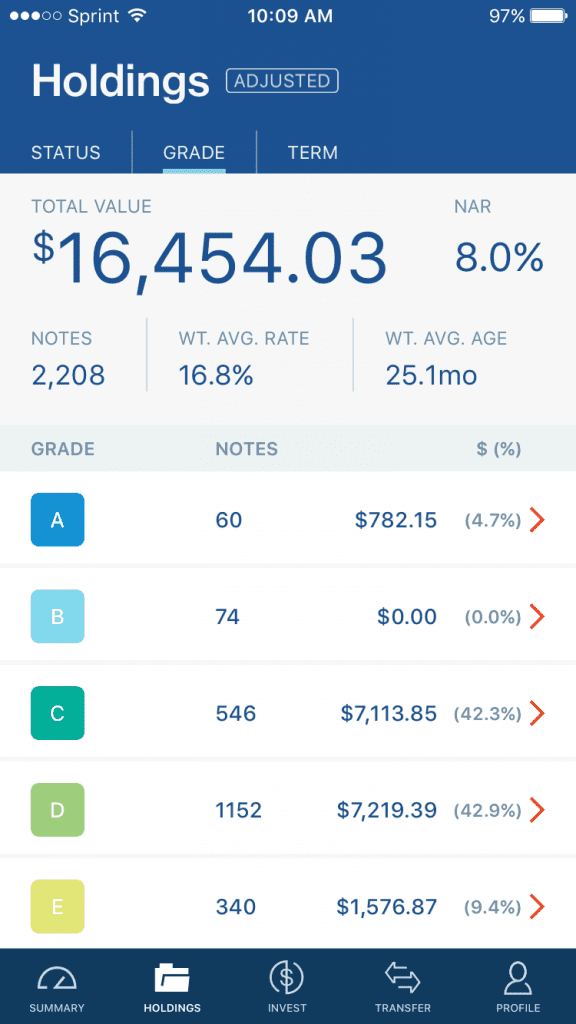

At the bottom there are four other sections of the app: Holdings, Invest, Transfer and Profile. On the holdings screen shown below you can dig deeper into your account by breaking it down by loan status, grade and term. The grade breakdown from my account is shown below.

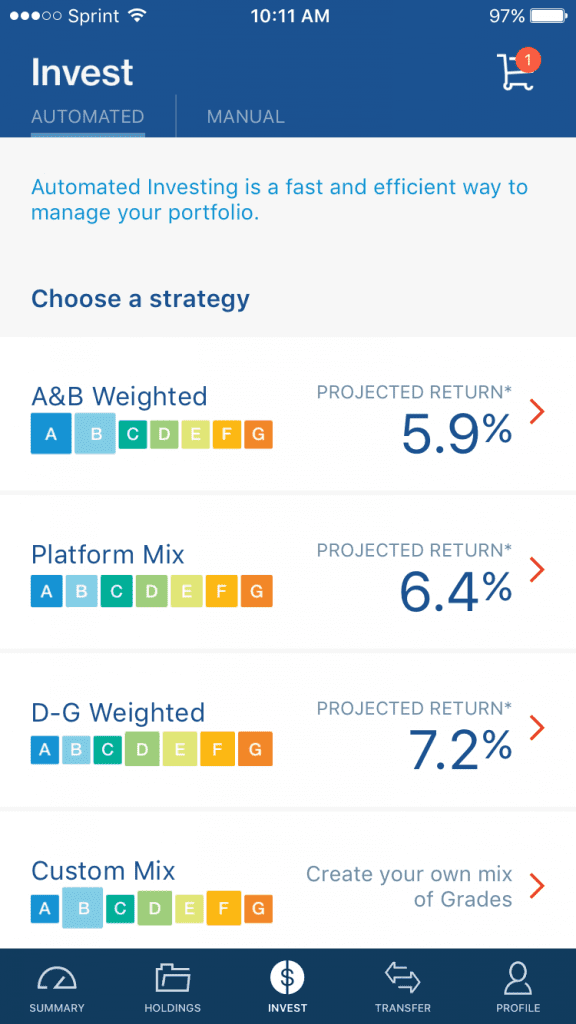

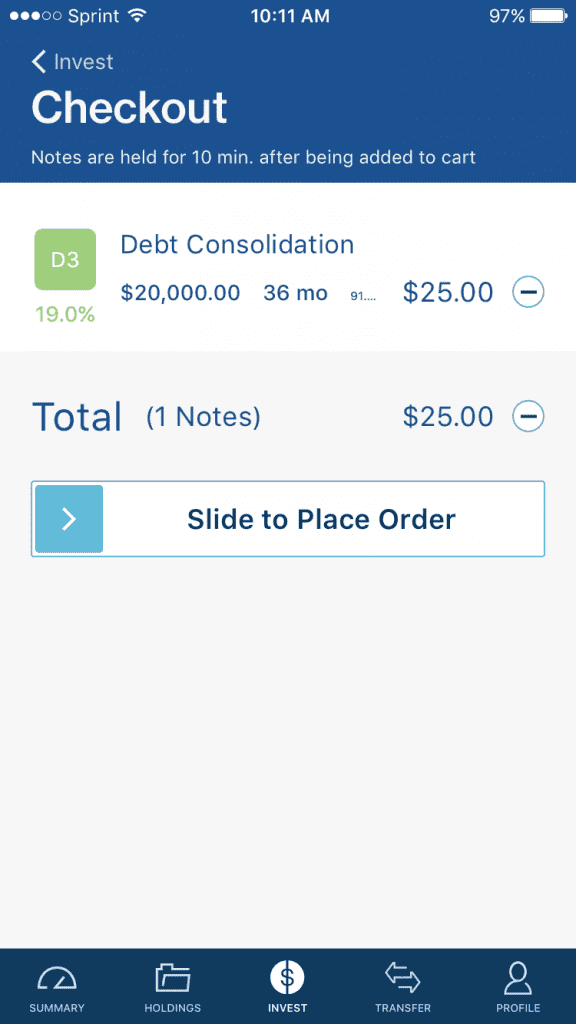

The app allows investors to setup Lending Club’s automated investing or invest in individual loans manually. The manual investment page allows you to sort by key criteria such as grade, term FICO etc. and also select website created filters, but you are not able to create filters within the app. This limitation makes sense since this would be complicated to do on a mobile device with the 36 filters Lending Club offers. Actually making a manual investment is easier on the app that it is on the website, particularly if you use one of your saved filters.

The transfer page is self-explanatory – it allows investors to add funds or withdraw funds. Finally, the profile page provides general account information, FAQs, a way to contact investor support and provide feedback on the app. There is also the setting to toggle adjusting for past due notes. The default setting is to see your account with adjusted account values and NARs, you need to go to the profile page if you want to change this.

Conclusion

The introduction of a mobile app shows Lending Club’s continued focus on the retail investor. These days almost every financial services company has an app to accompany their website offering and it’s great to see Lending Club make the investment. I found the app very user friendly and it matches very closely to the experience you’ll find on Lending Club’s website.

Having said that the app is certainly not perfect, as you would expect from a version 1.0 product. There is no fingerprint login verification like many banking apps have, so every time you close the app you have to manually log back in. I would also like to be able to view my portfolios in the Holdings screen. And it would be good to be able to choose a saved filter from the automated investing screen although that is not a deal breaker. But if those things were present I think I would rarely use the website.

Lending Club has said they are aware of these shortcomings and will likely include some or all of them in an upcoming release based on investor feedback.

Another drawback which will likely annoy anyone without an iPhone, right now this app is only available on iOS. An Android app will be forthcoming we have been told but for now the iOS app is Lending Club’s only mobile offering. For those Lending Club investors with an iPhone I think they will definitely benefit from having an easy way to check their account, make an investment and transfer money. Overall, it is a good first effort.

You can download the Lending Club app from the Apple App Store here.