We close out September with another solid month for Lending Club, although their rate of growth did slow down slightly from the breakneck pace of previous months. Prosper was back with a great month and between the two companies $92.9 million in new loans were funded. I think it is safe to say that in October we will have our first ever $100 million month.

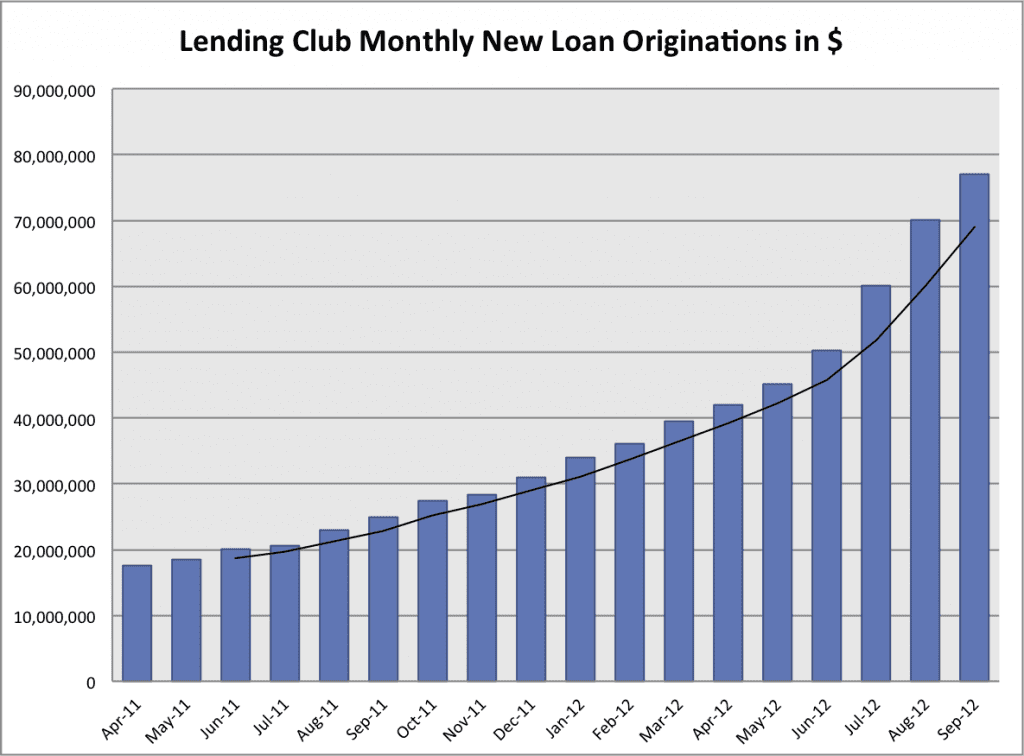

Lending Club Finishes With $77 Million in New Loans Issued

After two consecutive months of $10 million increases in loan volume some of us were expecting an $80 million month from Lending Club. That was not to be but it was an excellent month nonetheless with $77 million in new loans, bringing Lending Club’s total loans issued since they began to $914 million. They are within shouting distance now of the $1 billion mark something that will likely happen on November 1st I expect.

When you dig inside the numbers you can see how busy the underwriters are at Lending Club these days. They issued 6,087 loans in September, well over double the number of six months ago. The average loan size dipped slightly to $12,654, which is the lowest level in the last year. This amounts to around 300 new loans every working day.

Below is the 18-month chart for Lending Club – the black line is the three month moving average.

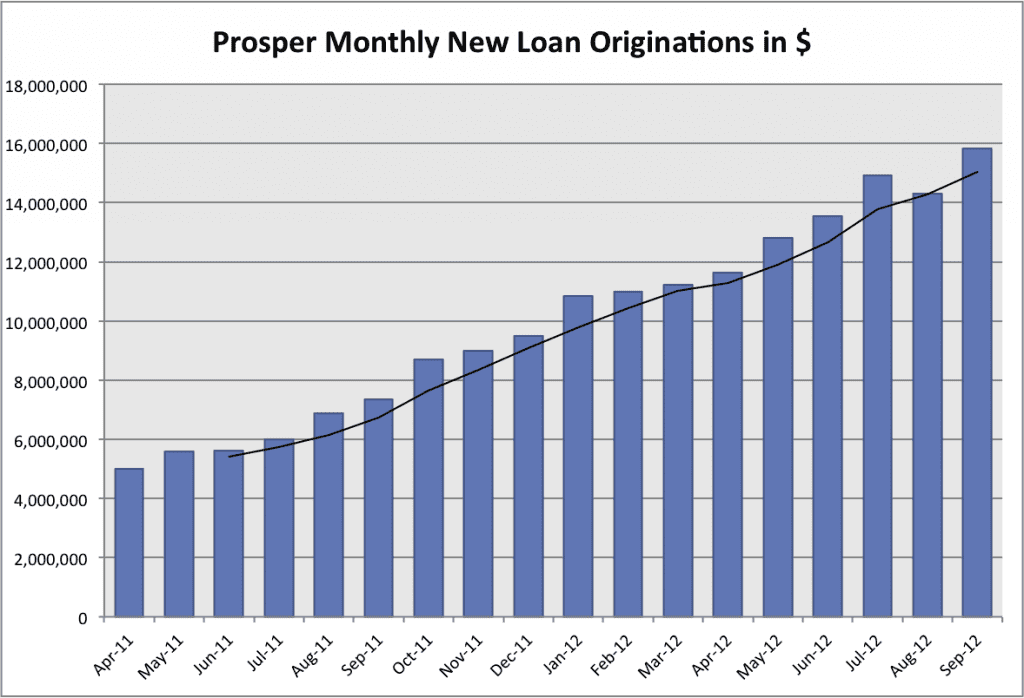

Prosper Back to Another Record Month with $15.8 Million in New Loans

Prosper finished the month with a flourish and are back into record territory with over $15.8 million in new loans issued in September. The new underwriting standards are starting to have an impact. You may recall that I mentioned last month the higher loan maximums now allowed for B and C grade borrowers – this change cause a record high in average loan size in September: $8,553.

The big problem for Prosper this month was the loan inventory. For most of this year Prosper has had 300-400 new loans available for investor at any one time. For most of this month it was 75-100 loans which is really not good enough. The investor interest in Prosper is strong, as demonstrated by their record month, but the loans are just not staying on the platform long enough. Many loans are fully invested in barely 10 minutes as many investors compete with the large institutional investors for the most popular loans. I spoke with Joe Toms, the chief investment officer at Prosper, earlier today and he acknowledges that they need to do much better here.

The good news is that this month one of my readers shared a new Prosper utility he has developed that allows anyone to run queries on the Prosper loan history. Since Lendstats went offline in July investors have had no tool to do any analysis. Why I am mentioning this here is that this tool allowed me to look at the loan volumes of the largest investors this past month. The landscape has certainly changed from three months ago.

Prosper’s number one investor, Worth-blanket2, had a typical month with $2.3 million invested in September. Index_plus has dropped back from their pace of a few months ago and invested just $498,000. The number two investor in September as far as I can tell was MI2, an institutional investor that just signed up in August but kicked in $638,000 in September. What is interesting is that the large investors are not taking up the lion’s share of the volume like they did 6-9 months ago – Prosper has a very diversified investor base these days.

Below is Prosper’s 18-month loan volume chart.