Investors from both Texas and Arizona will be happy to hear that as of today, they can now invest in Lending Club. Previously, investors from Texas and Arizona could only invest in notes through the secondary market FOLIOfn, but now they will be able to participate in the primary market. Although secondary market access is better than no investing at all, investing in the secondary market can be a labor intensive process and might have often resulted in investors paying a premium markup for newly originated loans.

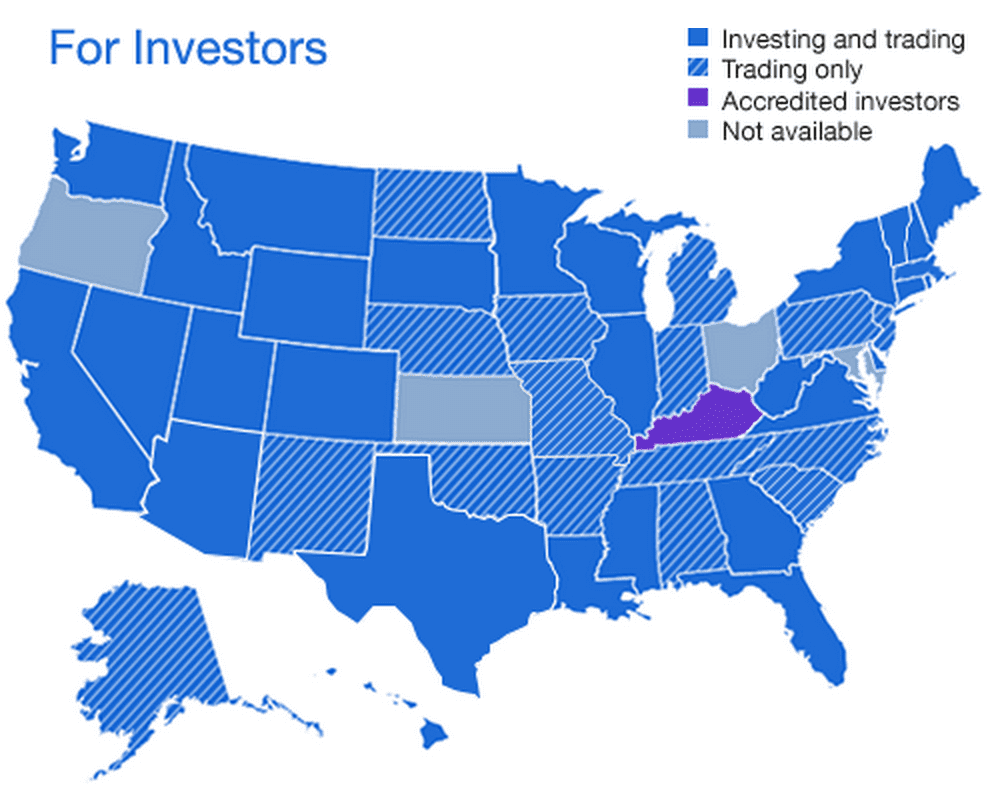

We reached out to Lending Club for comment today and spoke with CEO Renaud Laplanche this evening. He indicated that these new states were added as part of a continuing strategy to open up Lending Club to more investors. They became available to Massachusetts investors in December and now have added two more states to bring the total to 30 states. When we asked Laplanche about more states he said that they are hoping to add additional states before the end of the year. But it is a labor intensive process involving extensive dealings with state regulators one by one, so it is not a quick process.

There are still several states that still remain as shown in the below image from Lending Club.

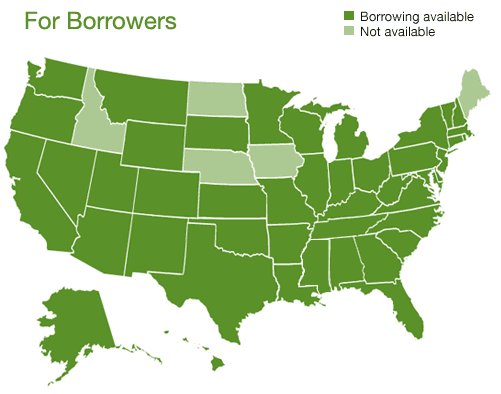

State availability is much better on the borrower side with only five states that are not open for borrowers to apply for a loan: Idaho, North Dakota, Nebraska, Iowa, and Maine.

The large variance to states that are open to borrowers versus investors is largely due to the perceived risk by state regulators. Since Lending Club went public late last year, there has been talk that state availability would be widespread due to the blue sky laws, but so far this has not been the case. It is a slower process than many investors had hoped. We published a guest post about this issue back in November of last year.

Regardless of how long it took for these new states to approve lending, it’s great to see their addition as marketplace lending becomes mainstream across the U.S. With Texas being a large state, this is a big win for Lending Club and we hope this momentum can continue with more states added soon.