What a great start to the year it has been for both Lending Club and Prosper. January saw the companies jump out of the gate fast this year with very impressive months. They combined to issue $325.4 million in new loans this month.

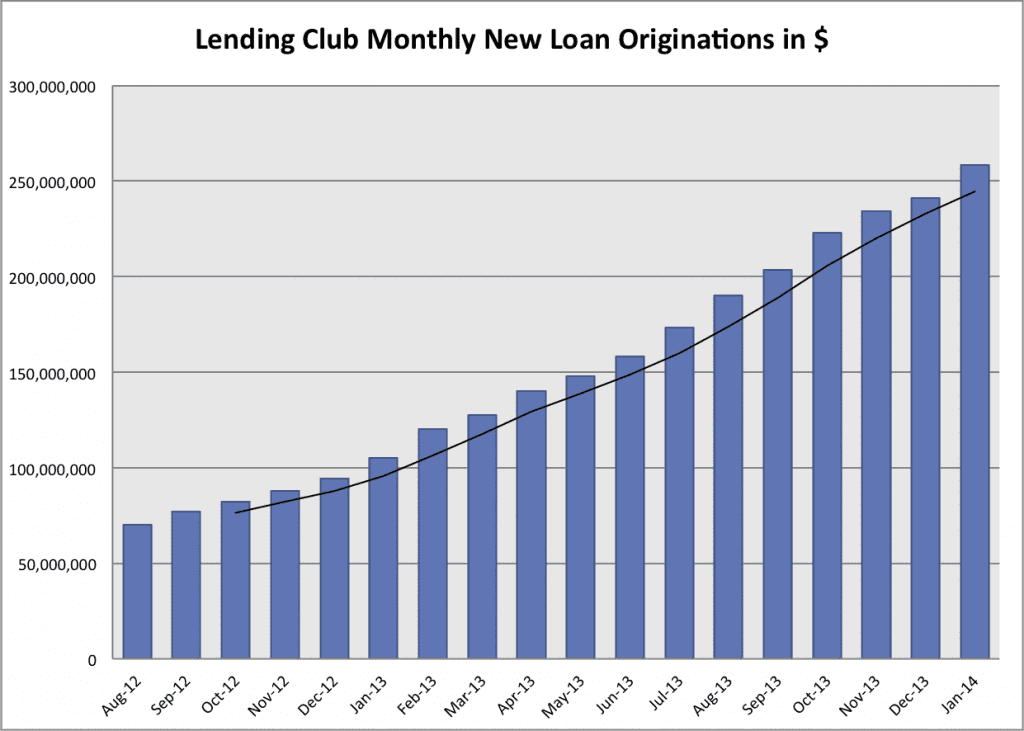

Lending Club Tops a Quarter Billion Dollars in January

It was exactly 12 months ago when Lending Club first issued more than $100 million in loans in one month. Now, we have them issuing $258.4 million, topping the quarter billion dollar mark for the first time. They are now on an annual pace of $3.1 billion in new loans but, of course, we know they will keep growing at their steady 5-10% a month clip which should put them at well over $4 billion in 2014.

Lending Club issued 18,547 loans in January which amounts to 833 loans every working day. Their workforce has expanded to 400 people and they continue hiring at a rapid pace. They ended the month at $3.5 billion in total loans issued since they began in 2007.

Below are the monthly statistics for Lending Club as well as the 18-month loan volume chart (the black line is the three-month moving average).

Average loan size: $13,930

Average dollars issued per business day: $12.3 million

Percentage 36/60 month loans: 77.4%/22.6%

Average interest rate: 15.79%

Percentage of whole loans: 41.2%

Total Policy Code 2 loans: $22.5 million (8.7% of the total)

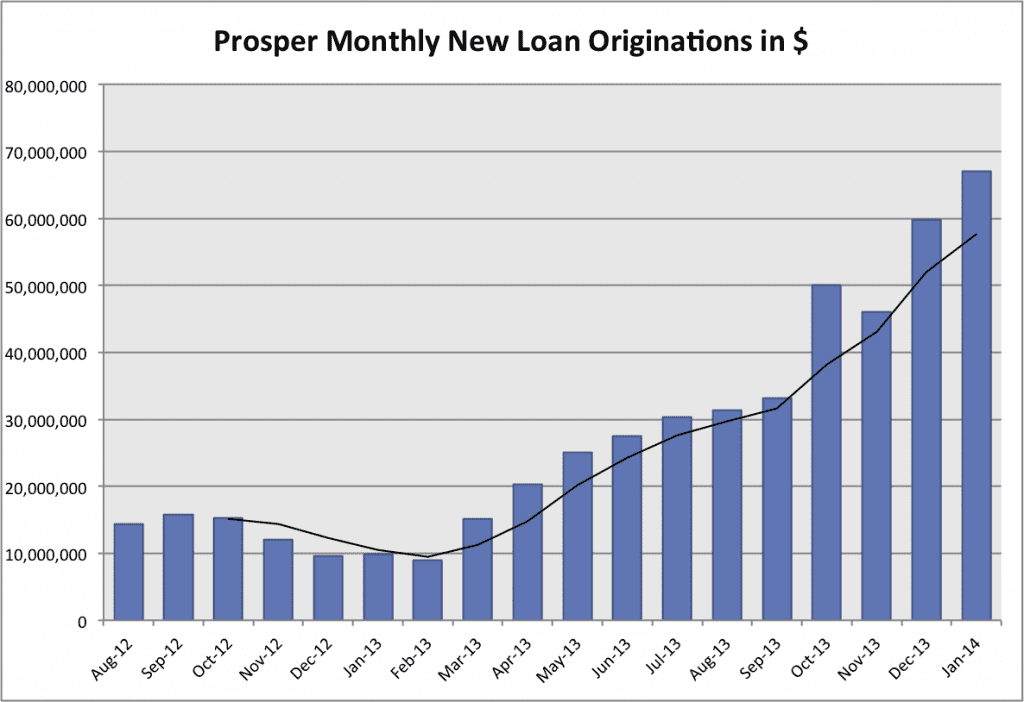

Prosper Loan Volume up 12.2% to $67 Million in January

If Lending Club’s growth in the last 12 months has been solid then we would have to say Prosper’s growth has been spectacular. It was just last January that the new management team took over at Prosper and we all wondered whether they could turn things around. Well, I think it is safe to say they have done just that with growth in the last 12 months a staggering 645%. Even in this fast growing industry that is record growth. Prosper ended January with 5,675 loans issued totaling $67.1 million.

Here are some of the stats from this month as well as Prosper’s 18-month loan volume chart. One data point I found particularly interesting this month is that, for the first time since I have been following this industry, Prosper’s average interest rate for the month was below Lending Club’s. Now, keep in mind this is not a weighted average rate – it is just the raw interest rate taken from the download files. Still it marks a very interesting development.

Average loan size: $11,818

Average dollars issued per business day: $3.2 million

Percentage 36/60 month loans: 68.7%/31.3%

Average interest rate: 15.49%

Percentage of whole loans: 73.4%

Average FICO score: 703