The total amount of p2p loans issued by Lending Club and Prosper in October was just over $97 million. I really thought this month was going to break $100 million but Lending Club slowed down at the end of the month and Prosper ended with a down month. No doubt that milestone will be passed in November.

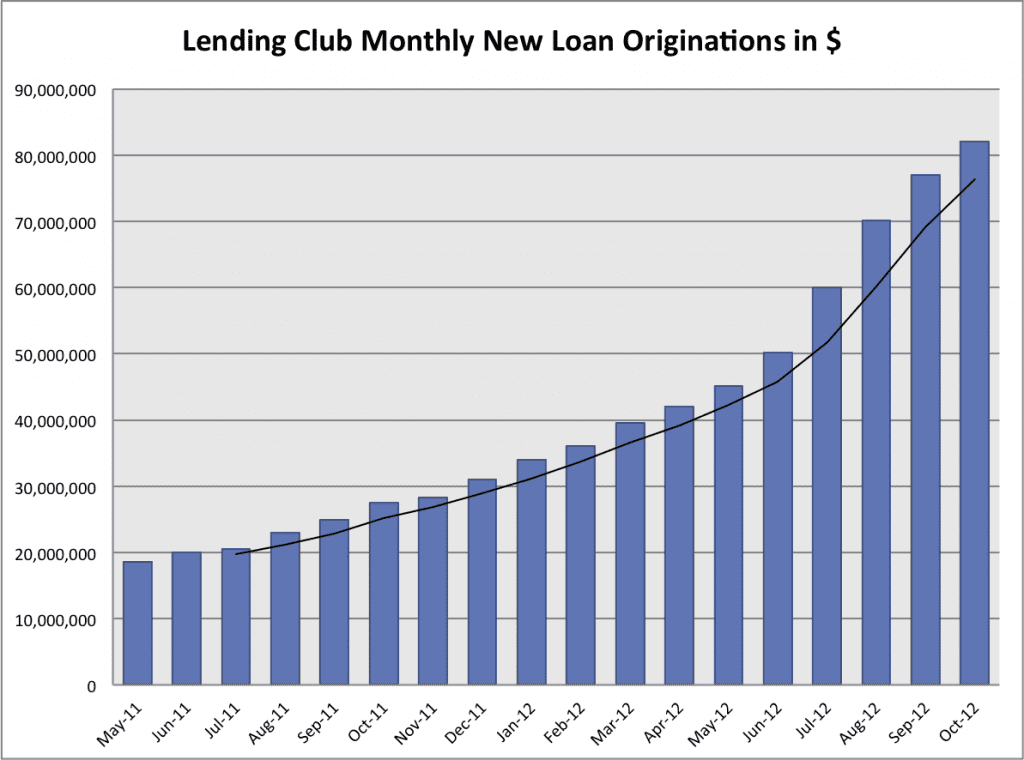

Lending Club Up $5 Million to $82 Million in New Loans

Another record month at Lending Club makes it 23 months in a row now of record growth. But this was a slow month by recent Lending Club’s standards. The $5 million increase was in fact the smallest monthly increase in five months. But I wouldn’t read anything into this relative slowdown. In fact, I expect Lending Club will break $100 million in December to finish the year with a bang.

Total loan volume since inception is tantalizingly close to $1 billion, at $996 million, so it is now a formality that milestone will be crossed very shortly. In October, Lending Club issued 6,263 loans at an average loan size of $13,098.The average loan size has stayed between $12,500 and $13,500 for seven months now – it is obviously an amount they are comfortable with.

It seems that we have reached a new normal with the number of loans on the platform. For most of the month there were between 500 and 800 loans on the platform. The other part of this new normal is that loans are spending less time on the platform than ever before – I don’t have any hard numbers to back this up but I see most loans being funded within five days or less.

Below is the 18-month chart for Lending Club. The black line is the three-month moving average.

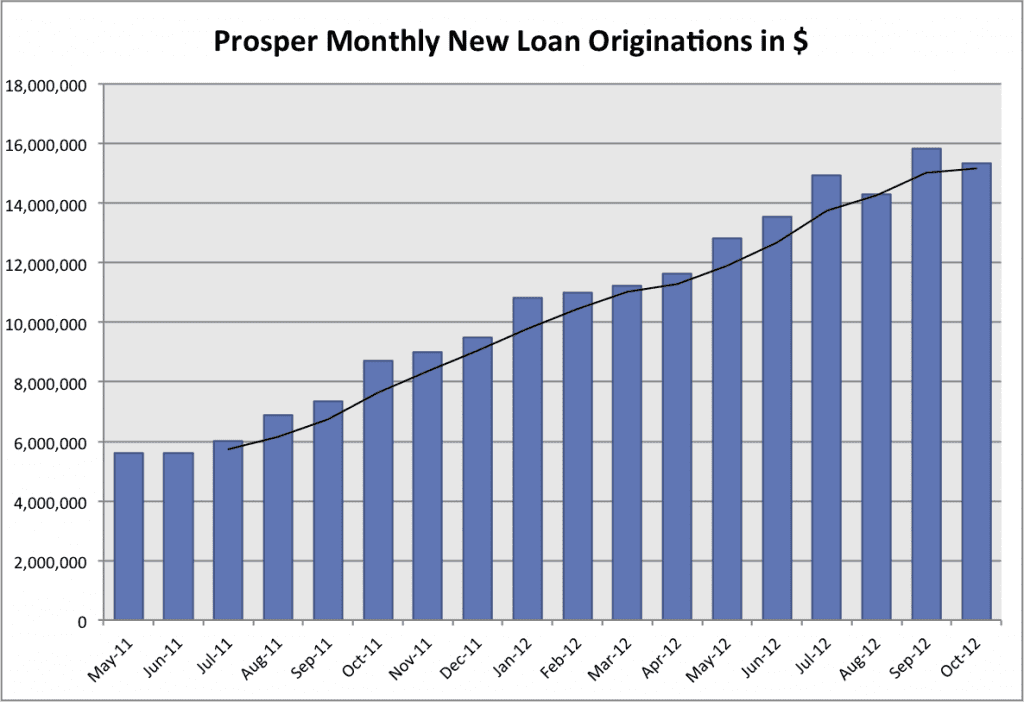

Prosper Issues $15.3 Million in New Loans Down 3.2% From September

Prosper had much stronger loan volume on their platform this month but it didn’t result in more loans being issued. In last month’s roundup I lamented that there were less than 100 loans available on the platform for most of September. That number jumped back to a more normal 300-400 loans in October which was good to see. Despite more available loans the total volume of loans issued by Prosper in October was down slightly to $15.3 million. The number of loans issued was also down to 1,823 resulting in an average of $8,411 per loan.

According to the new statistics site called Prosper Stats part of the blame for this down month can be linked to the top institutional investors. While I am working with the site’s owner to verify the numbers it appears that Worth-blanket2 was down significantly from last month.

Prosper has a tough act to follow with Lending Club growing so rapidly and about to pass $1 billion while Prosper is still months away from crossing $500 million. They have become the tortoise to Lending Club’s hare. Their 18-month chart reflects that difference.