Lending Club’s second quarter earnings marked an important milestone for the company – a return to growth. It seemed as though there was a general consensus that this was a make or break quarter for the company. Originations have been hovering around $1.9 billion since Q2 of last year. This quarter Lending Club announced originations of $2.15 billion for the quarter, up 10% from the prior quarter of $1.96 billion. While this is still down from their previous highs, it shows that the company is back on a growth trajectory.

Also of significance was net revenue of $139 million, up 35% year over year. The second quarter marked the second highest revenue generating quarter for the company. Lending Club anticipates that the third quarter will be their best quarter yet from a revenue perspective. Below are the other financial highlights for the company.

The earnings call focused on a couple of initiatives for the quarter. One was Lending Club’s first sponsored securitization of near prime loans. This brought in 20 new investors and is an additional revenue source for the company. Many of the analysts on the earnings call were interested in learning more about the financial impact of the securitization program. Lending Club anticipates they will do one securitization per quarter with the next one being a prime securitization.

The other initiative was focused on borrower take rates. Lending Club redesigned their website and developed testing infrastructure to better understand what prompts borrowers to say ‘yes’ to a loan. This included analysis on many different factors including testing pricing sensitivity as well as experience tests.

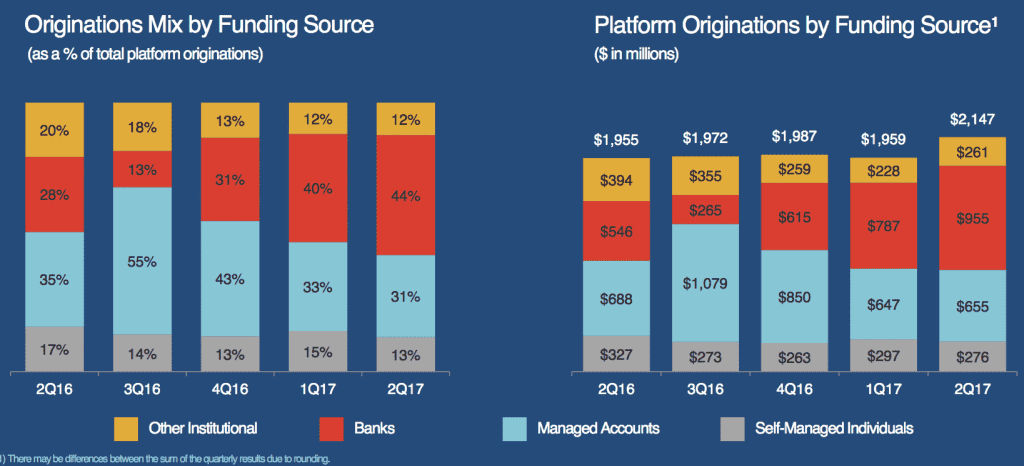

Bank participation has been an important part of the turnaround story for Lending Club. Last quarter the company announced banks were funding 40% of loans, but that reached higher in the second quarter to 44%. Lending Club was able to land new banks in the quarter and cited that the asset class continues to be attractive in the low interest rate environment. With bank funding stable, Sanborn stated that they would be increasing their efforts on the retail investor.

On loan performance the company continues to be vigilant due to high debt levels of consumers. However, early signs of delinquencies on recent vintages are in line with expectations which has resulted in no significant changes to pricing. With respect to auto loan refinancing, Lending Club is still working on ramping that business up and it is not making up a meaningful part of originations.

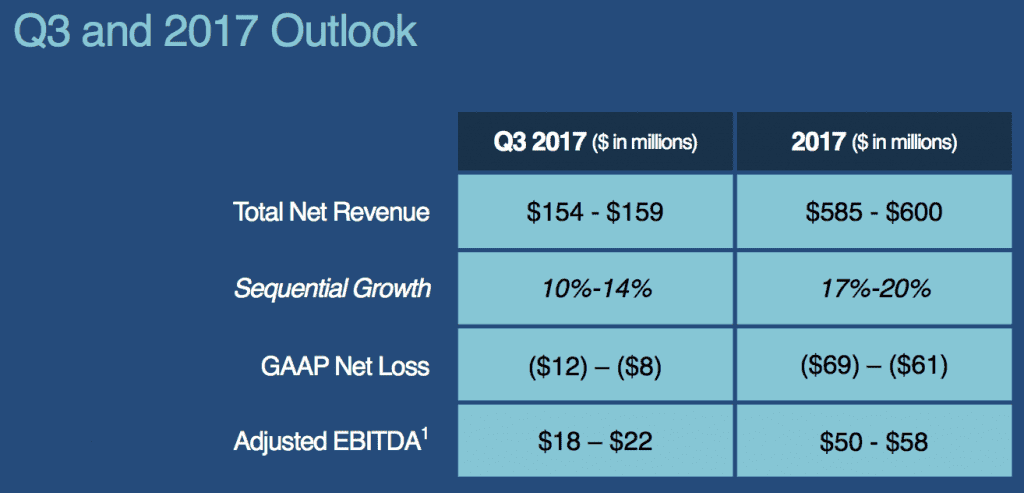

Given that Lending Club beat expectations the company adjusted their earnings outlook upwards.

Conclusion

What struck me the most in the earnings call was that this was the second highest revenue generating quarter. To close out 2017 the company expects to generate between $585 and $600 million. That is substantial revenue. Now, the company is not profitable yet, they generated a GAAP net loss of $25.4 million but they are making progress and they have come a long way since last year. Lending Club CFO, Tom Casey and CEO Scott Sanborn believe Lending Club will be able to deliver on margins while also investing in the business for further growth. It seems as though the new securitization program could be a big driver of additional revenue in quarters to come.

Disclosure: Peter Renton, the founder and CEO of Lend Academy, and Ryan Lichtenwald, the author of this article both own LC stock.