How rising interest rates would affect marketplace lenders has been a question that many people have been asking for a long time. Demand for loans, credit performance and supply of capital to the platforms are all things that may be affected as interest rates increase. Today, we found out how the leader in marketplace lending is going to react. Lending Club announced in this press release today an average interest rate increase of 0.25% for all new loans going forward.

Last week, the Fed raised rates 0.25% for the first time in nearly a decade. Now this was a very minor move, but it is important symbolically as it gives us a window into how marketplace lenders will respond to interest rate increases. Renaud Laplanche, CEO of Lending Club, has regularly gone on the record to state that Lending Club is not interest rate sensitive at all.

This suggested that Lending Club’s marketplace continues to operate in an equilibrium. As short term credit interest rates increase, Lending Club will charge their borrowers more, thus passing on higher yields to the investor. And that is precisely what they are showing by this move today.

Lending Club Increases Interest Rates

Lending Club’s announcement today was that they are raising rates by an average of 0.25% in response to the Fed announcement. For some history on Lending Club interest rates, Lending Club noted in their Q2 2015 earnings call that risk premiums required by investors had declined 270 bps over the last 3 years due to investor confidence. This included an average rate decrease of 200 bps for 36-month loans from 13.2% (June, 2012) to 11.2% (June 2015).

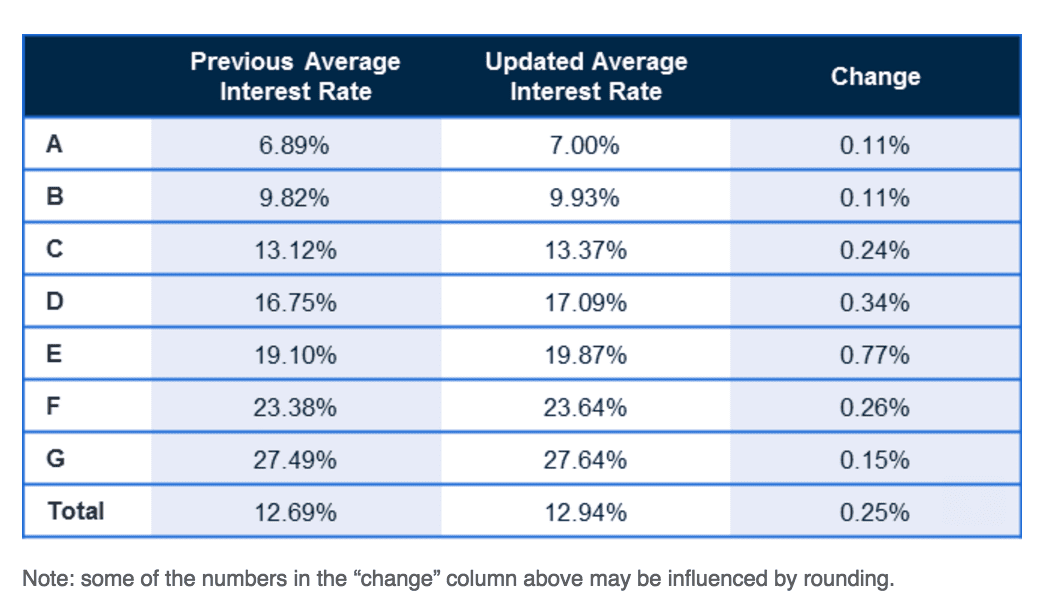

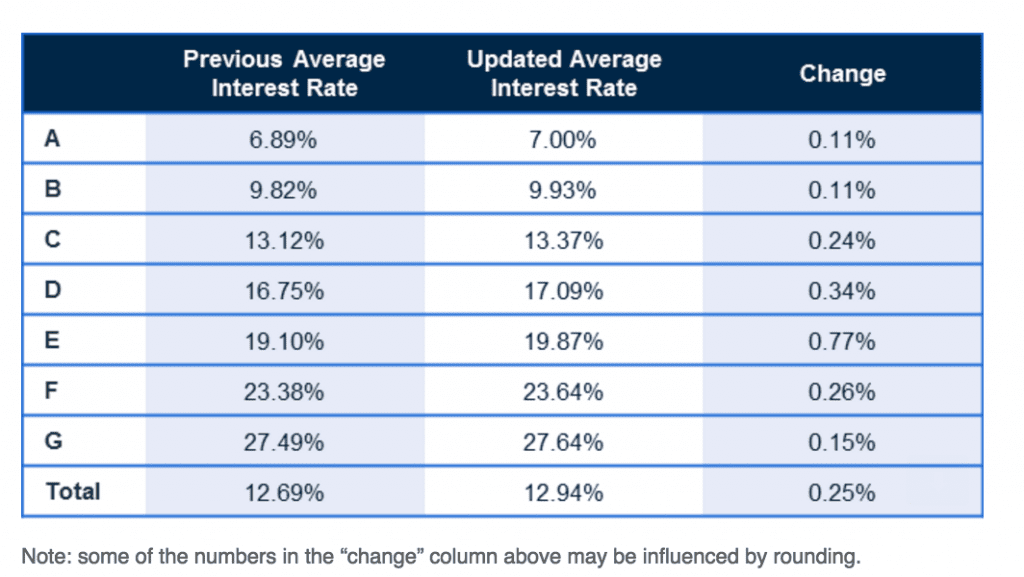

Below is table from an email received today from Lending Club which outlines the rate increases across loan grades. The most significant rate increase comes from E-grade loans which is interesting. Could it be that rates on E-grade loans had dropped too far? Clearly, that is an outsized increase compared to all other loan grades. Interest rates by sub-grades can be found in Lending Club’s 8-K.

Here is Renaud’s official statement on the change today:

The value we deliver to our customers is not dependent on the absolute level of interest rates. Our marketplace’s rates will continue to adjust in such a way that borrowers benefit from the same savings against credit card rates, and investors continue to find very attractive risk-adjusted returns compared to other fixed income alternatives. Our ability to compress the spread between these two rates, using technology and low-cost operations, remains unchanged irrespective of the rate environment.

Lending Club is a True Marketplace

This move makes it clear that Lending Club plans to react immediately to the Fed adjusting interest rates. If they had chosen to keep rates the same, the typical borrower would have benefited and the investors would have suffered albeit in a small way. But this sends the message going forward that Lending Club is a true marketplace that will adjust to a changing interest rate environment.

In the Wall Street Journals coverage of this news Renaud states that interest rate increases will not slow their growth due to their marketing efficiencies. He maintains that they are neither borrower nor investor constrained. It will be interesting to see whether other marketplace lending platforms follow suit in raising rates as well.

What do you think of Lending Club’s decision to increase interest rates? Let us know in the comments below!