Retail investors have been longing for a more robust secondary market feature set, something that wasn’t possible until this year when FOLIOfn, Lending Club‘s secondary market provider, announced their API. NSR Invest has dedicated a significant amount of time to building support out for the secondary market this year and last month they released it to the world. In this post, we will share the features and what makes NSR Invest’s offering unique.

The Components of the NSR Invest’s Secondary Market Technology and What is New

For many years retail self directed investors have used the NSR Invest platform to develop loan purchasing strategies on the primary market. To buy notes on the FOLIOfn secondary market that met their filter criteria, investors would have to sift through loan listings by hand, using limited filters offered on Lending Club’s website. The secondary market functionality has been incomplete and investors have wanted more for quite some time.

Recently, Lending Club has updated their API, which has been adopted by FOLIOfn and has improved their secondary market by making it possible to buy and sell notes in an automated fashion.

NSR Invest has built features and functionality to improve their clients’ secondary market experience. Specifically, they have expanded beyond just sharing loan listings to also offering additional functionality including the ability to:

- Filter loans that are listed on the secondary market

- Purchase loans that are listed on the secondary market

- Automate a buying strategy for continued purchase of loans that meet your filter criteria

- Automatically sell loans on the secondary market

Automated Selling on the Secondary Market

Many investors have used FOLIOfn to sell their notes for some time. But this has always been a manual and laborious process with no way to set an automated selling strategy. With their new roll-out NSR brings these features in house.

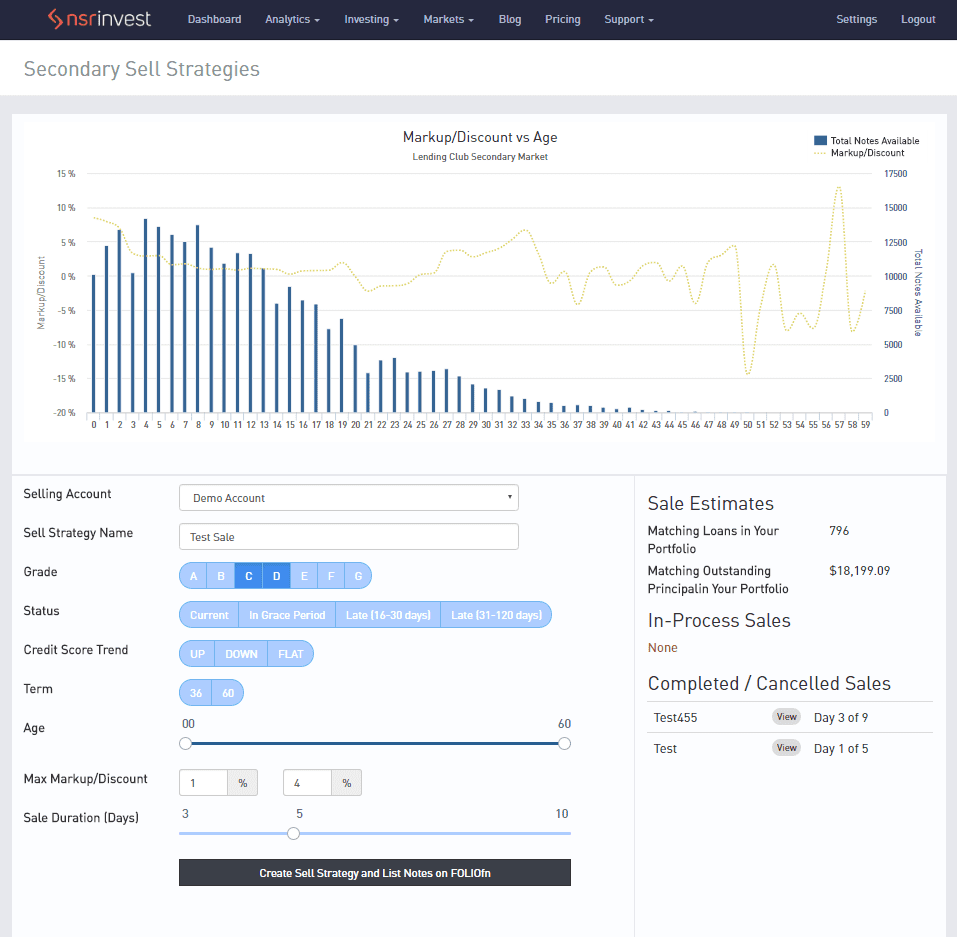

Now NSR investors can access selling by clicking on “Investing” and then “Sell Strategies.” You are presented with the below chart and filters. Modifying the filters below the chart allow you to understand the average markup/discount of similar notes. For instance, if you were interested in selling your 36 month riskier grade notes in grace period, you could select E,F,G, 36 months and “In Grace Period”. This will give you the average markup/discount by remaining payments. However it’s important to understand that this includes current listings, not transactions where the notes have actually sold. Thus, these figures should only be used as a guide. Changing the filter criteria also allows you to see the notes and principal remaining that match your selected criteria, pictured under the Sales Estimates section.

[slb_exclude]

[/slb_exclude]

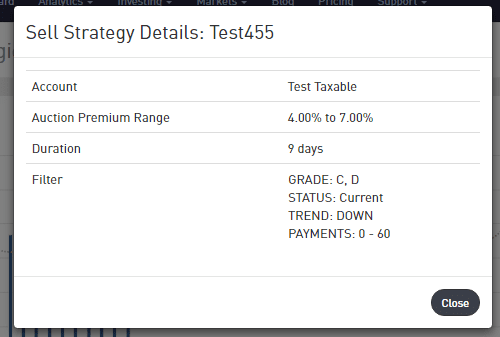

Once you’ve selected your criteria you can create a sell strategy. In the example below the notes will be initially listed at a 7% markup, eventually decreasing to 4% over 9 days. Each day the markup decreases evenly across the 9 days, in this case 0.33% each day ((7%-4%)/9 days). Listings will be removed after the 9th day.

Automated Buying on the Secondary Market

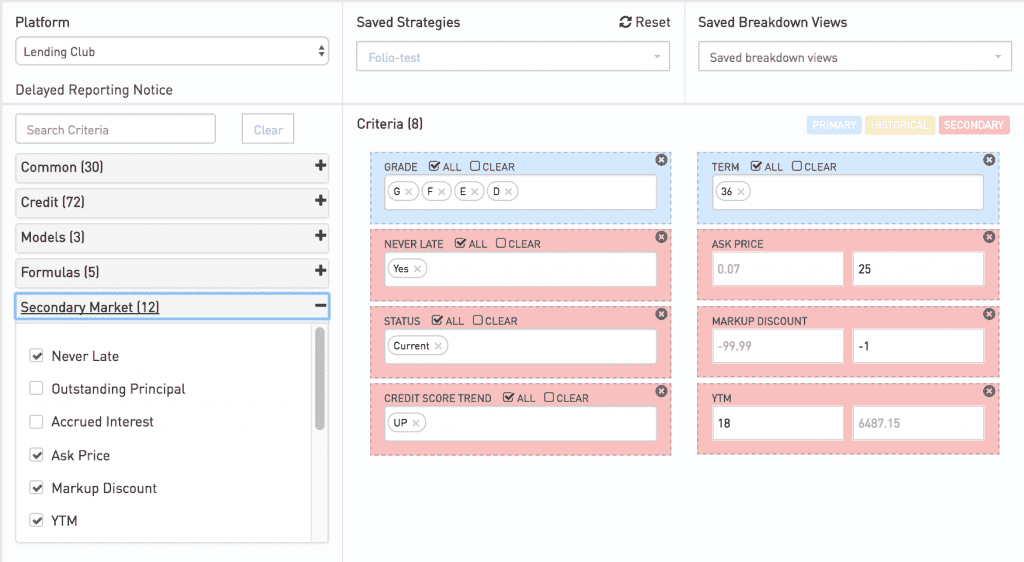

For investors who are familiar with setting up filters on NSR Invest, setting up an automated buy strategy on the secondary market is largely the same, albeit with 12 additional filter criteria specific to the secondary market. Filters can be built by selecting the “Markets” tab and then “Secondary” under Lending Club.

All of the existing filters available on the primary market are also available to use on the secondary market, which is where NSR’s offering really shines. If you were to login directly to FOLIOfn, you’d only have access to 12 criteria to filter note purchases. With NSR you have over 100 filters you can apply to narrow down the notes you want to invest in. Additionally, investors who backtest filter strategies can easily make them compatible with the secondary market. This makes it easy to use the same filters on the secondary market as you do on the primary market, a first for the industry, and a request that some investors have had for many years.

In the example below the red colored filters are specific to the secondary market.

[slb_exclude]

[/slb_exclude]

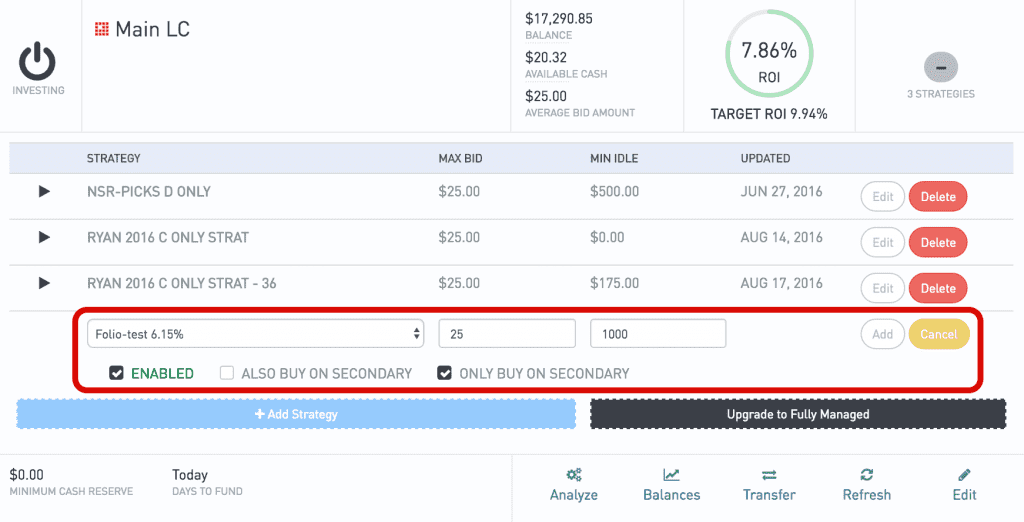

Once you’ve saved your filter strategies they can be applied in the accounts section. Here you can select your bid amount and whether you would like to purchase on the primary market, secondary market or both.

[slb_exclude]

[/slb_exclude]

Pricing

All NSR Invest clients may take advantage of the new selling functionality as well as the ability to individually filter and select FOLIOfn notes for purchase. Clients with over $20,000 in connected marketplace accounts (the amount that NSR Invest starts charging for self directed users) may also setup automatic buying for their Folio strategies. NSR Invest charges 0.45% on the outstanding principal of any notes purchased on the secondary market. Sell strategies are free for paying customers.

Conclusion

It’s nice to officially have a secondary market API with FOLIOfn and NSR Invest has integrated buying and selling seamlessly into their existing platform. There are many investors who have had a great deal of success investing in the notes on FOLIOfn and now it’s much easier to do.

Now that investors have this functionality, one of the common topics brought up, especially on the Lend Academy forum is transparency around pricing. Since completed transactions are hidden by FOLIOfn it is impossible to know what the value of a given note is and what investors are willing to pay. If this data would be made available it would lead to a much more efficient market and offer even more liquidity to investors. While automated buying and selling is a great step we look forward to a time when investors can liquidate an entire portfolio almost instantly as opposed to over days, weeks or months.

Full disclosure: NSR Invest is a sister company to Lend Academy.