Yesterday LendingClub announced as part of their Q4 2019 earnings call that they are acquiring a bank, something no other US fintech has done. The move may not be all that surprising given LendingClub has long shared their vision of becoming a full service financial institution, but their path is unique.

What’s interesting about this announcement is LendingClub didn’t pursue just any bank, they are buying the leading digital only bank Radius Bank. Radius Bank is frequently listed among the top digital bank offerings on various comparison sites for consumers (for a deep dive on Radius listen to Peter’s recent podcast interview with CEO Mike Butler). For example, Bankrate named them best online bank of 2020 thanks to their mobile app, unlimited ATM fee rebates and competitive interest rates. The bank currently has around $1.4 billion in assets.

CEO of LendingClub Scott Sanborn spoke about why they chose Radius and why they are pursuing acquiring a bank now. Sanborn noted that Radius has an ethos and culture of bringing tech into banking. It will be a marriage of two digital innovators bringing together both sides of the balance sheet, asset generation from LendingClub’s perspective and the online deposit gathering from Radius. Radius as noted earlier is a digital only bank with no legacy branch network but has a national footprint. LendingClub has been executing on their plans which has put them on a path to sustainable profit, a critical metric for approval of this acquisition.

LendingClub is paying $185 million in cash and stock for Radius Bank, a transaction that they believe will pay for itself in two years. Sanborn shared that when surveyed 90% of LendingClub customers said they would consider opening up a LendingClub bank account. While not a guarantee of success, it demonstrates the rapport LendingClub has with its customers. The deposit base will be a new funding source for LendingClub and they will no longer be beholden to their current bank partners which will reduce costs. In addition, they will no longer need their warehouse line. LendingClub also plans to balance sheet some higher interest rate loans in order to generate additional interest income. One of the benefits to new and existing investors will be the comfort of an established regulatory structure. It is expected that the transaction will officially close in 12 to 15 months.

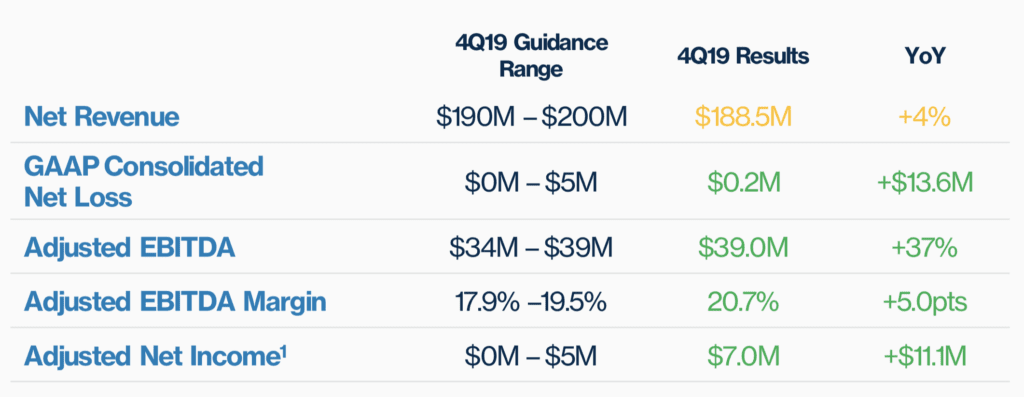

Moving on to LendingClub’s Q4 2019 results, the company achieved GAAP profitability by a small margin though fell just short of expectations for revenue. LendingClub is still seeing strong consumer demand but credit tightening across the market will likely slow the personal loan market growth. They also see the economy growing more slowly with increased recession concerns.

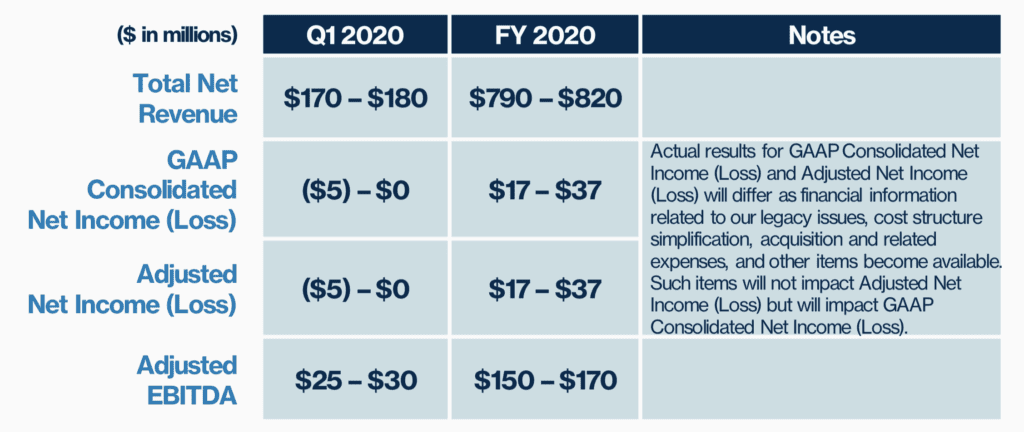

Looking forward LendingClub is focused on profitable growth and investing in their infrastructure as they prepare for the bank charter.

Conclusion

LendingClub caught many by surprise with this announcement particularly when it came to the bank they were acquiring. They were well positioned to buy a bank with significant cash reserves but many did not expect it to be a big brand like Radius Bank. This was apparent during the Q & A section of call where many analysts expressed enthusiasm for the transaction. Clearly LendingClub thought this was the best route to take in their quest to reimagine banking so it’s going to be interesting to see how this plays out over the next two years.