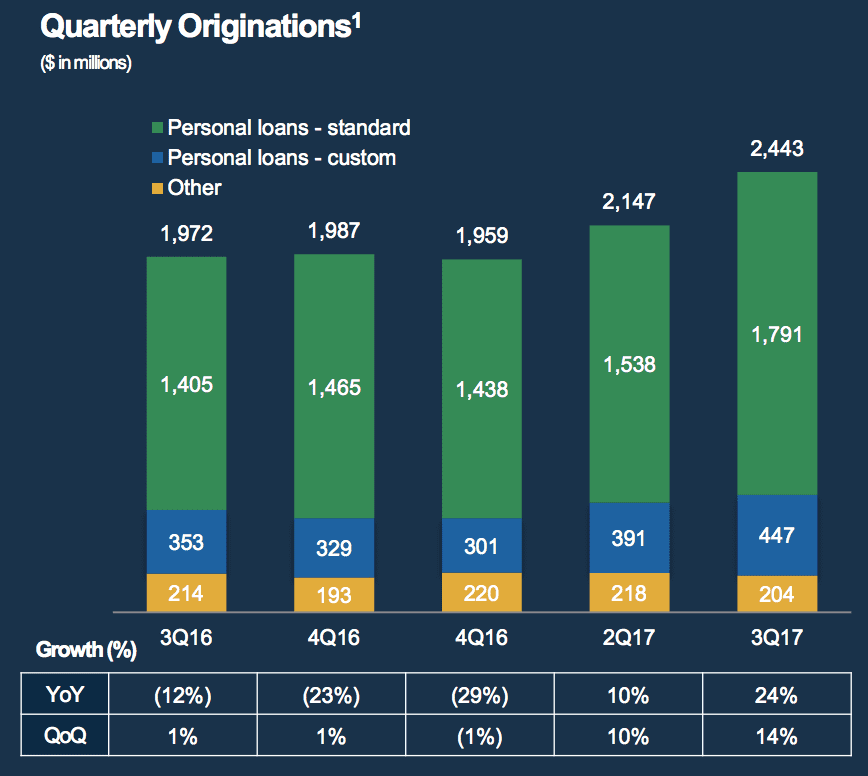

Last quarter we reported that LendingClub had returned to origination growth. It was a relatively small amount, compared to historical growth, at just 10%, but it was a noticeable change from the several quarters of flat originations. Today, LendingClub announced their third quarter financial results which included $2.44 billion in originations, an increase of 14% from the prior quarter ($2.15 billion).

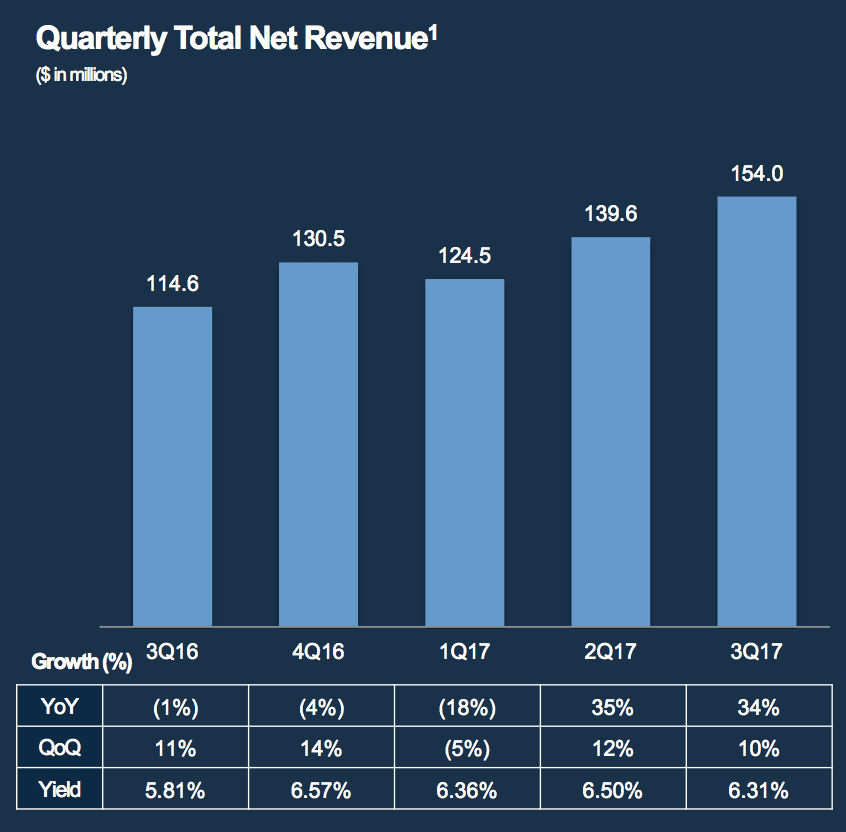

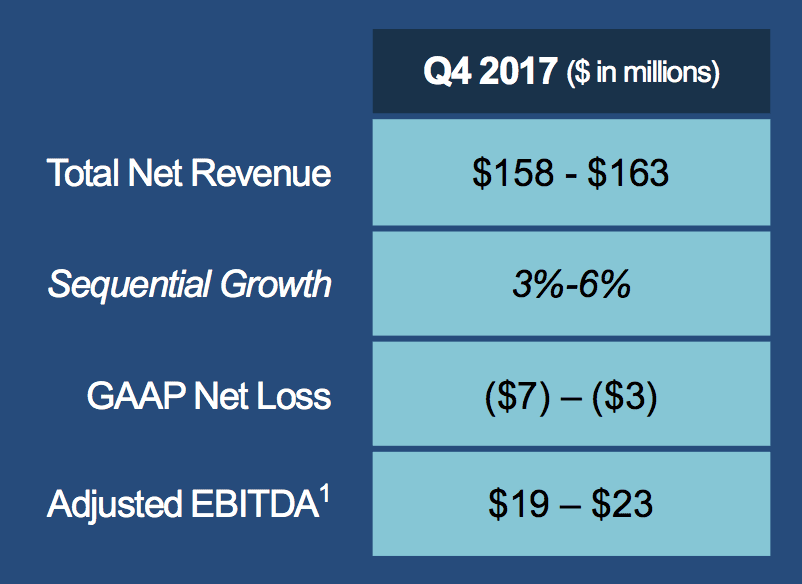

The company also delivered their highest revenue to date at $154 million, up 34% year-over-year. This was on the low range of guidance for the quarter ($154 – $159 million). The company had a GAAP net loss of $6.7 million, which was better than their third quarter guidance of losses between $12 million and $8 million. Adjusted EBITDA came in at $20.9 million which was in the middle of guidance between $18 and $22 million.

While the company delivered on the lower end of revenue they made significant progress in narrowing their losses by almost $19 million compared to the prior quarter. Other milestones for the quarter include the closing of their second self-sponsored securitization which included 10 new investors (33 total investors).

Lending Club’s cash, cash equivalents and securities available for sale totaled $603 million. The decrease in cash relates to the securitization program as LendingClub uses cash to purchase loans to be securitized. According to the press release:

Loans invested in by the company at the end of the third quarter were $187 million, with the intent to contribute a large portion to future securitizations.

LendingClub is planning for two securitizations in the fourth quarter of 2017.

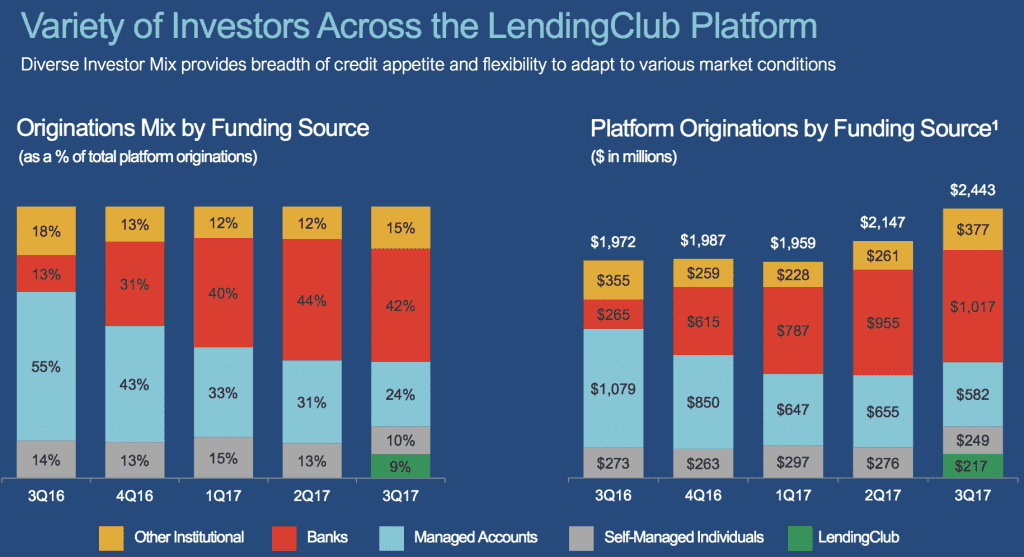

The addition of LendingClub as a funding source is shown below. Also, you will notice a decrease in bank participation as a percentage of total. CEO Scott Sanborn noted that LendingClub is in a very different position than it was a year ago and all of the banks are back purchasing loans.

Back in Q3 2016, Lending Club announced a $1.3 billion loan purchase agreement with Credigy, a subsidiary of the National Bank of Canada. While LendingClub will continue to work with Credigy, they will do so in a different format. Sanborn stated that the program made a lot of sense at the time as they made sure they had sufficient demand for loans while other banks did their due diligence.

In an email to Lend Academy LendingClub also highlighted data from TransUnion which shared that fintech companies now represent 32% of all personal loans in the US. This is up from 1% in 2010 when the industry was in its early days. Speaking of growth, LendingClub shared that they have now served over 2 million borrowers. It took 8 years to get their first million and they reached their second million in the last two years. The Federal Reserve of Philadelphia also completed a study using LendingClub data which explored how LendingClub is expanding access to credit.

Other takeaways from the earnings call include LendingClub bringing F and G loans into a testing portfolio. These loans have not performed up to expectations and will temporarily no longer be available to investors. This represented a small amount of LendingClub’s volume and prepayments were part of the issue with these higher interest rate loans.

There were also a lot of questions about LendingClub’s next generation credit model that was announced in the quarter. Sanborn stressed the significance of the new models and how they are using more recent data that reflects the current environment to better underwrite borrowers. Half of the attributes are unique to LendingClub and the model looks at borrowers over time instead of just a snapshot in time. Many analysts were interested in what effects this will have on loan volumes as volume is the driver of revenue for the company.

LendingClub will soon host their investor day (on December 7) and it sounds like there are new products for both investors and borrowers in the works. Sanborn noted that individual investors are an important part of the mix and they are thinking broadly about the right way to bring in investors using structures where investors can buy loans the way they want. They are also ramping up their investments in auto and highlighted one borrower product that is getting traction: joint applications. Joint applications now represent 13% of the population, up from 5%.

Conclusion

While this wasn’t a banner quarter in terms of beating Wall Street expectations it’s hard to ignore the progress they have made. LendingClub has begun to grow originations and has now built out their securitization program. With the closing of LC Advisors’ funds they have put much of the challenges from 2016 behind them. Now the question is whether the company can continue to grow revenue by increasing originations without jeopardizing loan quality.

The fourth quarter outlook is as follows:

Disclosure: Peter Renton, the founder and CEO of Lend Academy, and Ryan Lichtenwald, the author of this article both own LC stock.