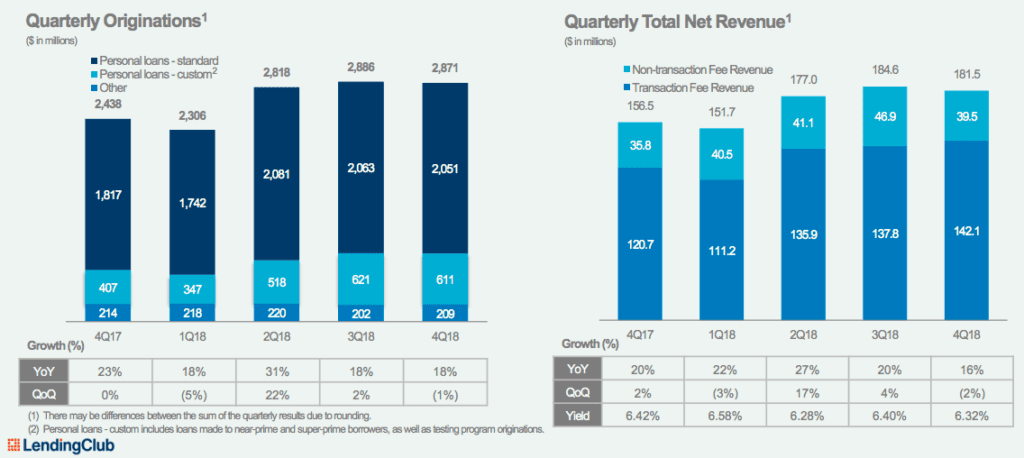

Earnings season is in full swing and today LendingClub announced their results for the 2018 year. The numbers were quite strong in most areas with the company originating $10.9 billion in new loans in 2018, up 21% year over year and a new high water work in yearly originations. For Q4 loan originations were $2.87 billion down slightly from the previous quarter but up 18% year over year.

Here is a graphic showing the origination growth along with revenue growth over the last five quarters.

This marks the first time any company in the online personal loan space has originated more than $10 billion in one year and it demonstrates both the popularity of personal loans and the ability for LendingClub to maintain their dominant position in this market. But when it comes to making money, while 2018 was better than 2017 and 2016, LendingClub still has a long way to go. They lost $128 million in 2018 with a $13 million loss in Q4.

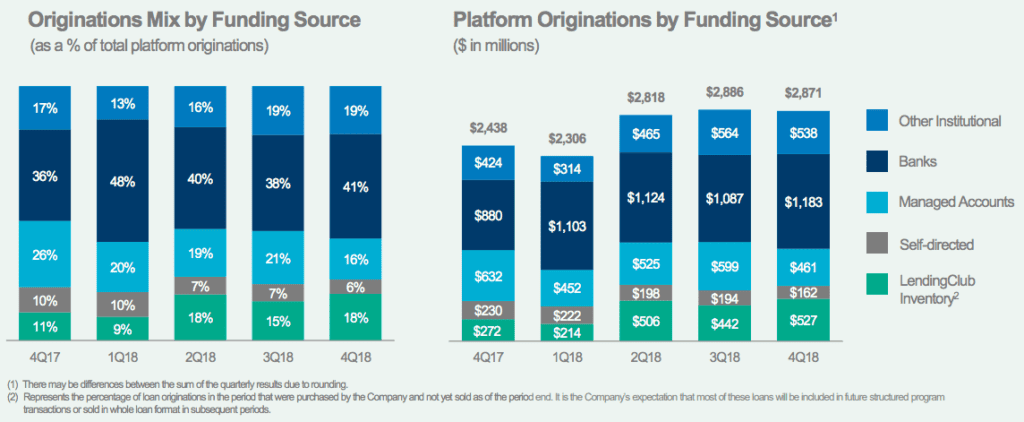

LendingClub’s origination mix is also a closely watched metric and it remained fairly stable last quarter as you can see in the graphic below. It is interesting that the participation of banks has remained quite steady over the past 12 months ranging between $1.1 and $1.2 billion per quarter.

In the earnings call CEO Scott Sanborn described a focus in 2019 of cost simplification to drive margin expansion while pursuing responsible growth. He also said that the company expects to make a profit in the second half of 2019 as a result of these efforts. Here is a quote from Scott from the press release:

With more than a trillion dollars of U.S. credit card debt, our mission to help our customers improve their financial health has never been more urgent. Our record results in 2018 prove that our business model and strategy are working and our investments in innovation and simplification mean we are targeting Adjusted Net Income profitability over the second half of 2019.

One real success story for LendingClub in 2018 was the popularity of their CLUB certificates. This is a new kind of security that allows a wider range of investors to participate. They launched this initiative in December 2017 and in the first year issued $1.1 billion in certificates with $478 million coming in the fourth quarter alone.

LendingClub issued the following guidance for 2019:

Full Year 2019

- Expect full year 2019 Net Revenue to be in the range of $765 million to $795 million

- GAAP Consolidated Net Loss and Adjusted Net Loss both in the range of ($29) million to ($9) million

- Adjusted EBITDA in the range of $115 million to $135 million.

First Quarter 2019

- Expect Net Revenue to be in the range of $162 million to $172 million

- GAAP Consolidated Net Loss and Adjusted Net Loss both in the range of $(20) million to $(15) million

- Adjusted EBITDA in the range of $13 million to $18 million.

Wall Street was a little disappointed with LendingClub’s results and 2019 guidance. They were looking for $0.02 per share in earnings vs a loss of $0.01 per share. Revenue guidance for 2019 of $765 million to $795 million was below consensus estimates of $804 million. LendingClub also stated that they expected to make a profit in the second half of 2019 whereas analysts expected a profit in every quarter. Consequently, LendingClub shares were down in after hours trading, losing around 6% of their value as of this writing.

My Take

While this was a solid quarter for LendingClub investors are getting a little impatient and that is understandable. The company went public over four years ago and we are yet to see them produce a consistent profit. While their cost cutting initiatives are worthwhile the time is overdue for them to turn the corner on profitability. They need to stick to this plan and be profitable in the second half of the year and then continue this positive trajectory going forward.

Disclosure: Peter Renton, the founder and CEO of Lend Academy and the author of this article owns LC stock.