Last year in our roundup of the leading real estate crowdfunding platforms we shared that LendingHome had originated over $200 million in loans. Now, just over a year later LendingHome announced today that they have originated $750 million in mortgage loans.

The vast majority of the $750 million in originations come from LendingHome’s primary product which is the fix & flip loan. Due to the shorter duration of these loans, LendingHome has already returned $300 million in principal and $25 million in interest to investors. The company has larger ambitions though and are currently testing out consumer mortgages. The LendingHome team told us that they are starting small with the new offering so they can focus on the customer experience, meet regulatory requirements and accurately determine creditworthiness.

LendingHome currently offers their fix & flip loans in 23 states, but 80% of originations volume come from ten states: Florida, Illinois, California, Nevada, Michigan, Texas, Maryland, Pennsylvania, Georgia and Missouri. Accredited individual investors on the platform now account for more than 10% of all loan originations and this percentage continues to climb.

The other big news from LendingHome today is the announcement of a bankruptcy remote vehicle (BRV) with the formation of LendingHome Marketplace LLC. The BRV was put in place to protect investors from claims by creditors in the event of a LendingHome bankruptcy and seems to be similar to that of what consumer lender Prosper has in place. They have also structured an agreement with Delaware Trust to put in place backup servicing.

Investors in marketplace lending often talk about platform risk as an additional risk beyond the risk of the loans that they are investing in. Although a bankruptcy for some of the larger platforms is unlikely, investors should take comfort in knowing that they are protected from creditors and a backup servicer is in place.

LendingHome for Investors

For investors considering an investment in LendingHome the minimum investment is $5,000 per loan. Gross returns have historically been 11.07% less a 10%-of-interest servicing fee. Below are the performance highlights of the over 2,750 loans issued:

- 6.74% delinquent rate (60+ days)

- 2 foreclosures

- Historical losses under 0.01%

- LTV: 70.40% weighted average

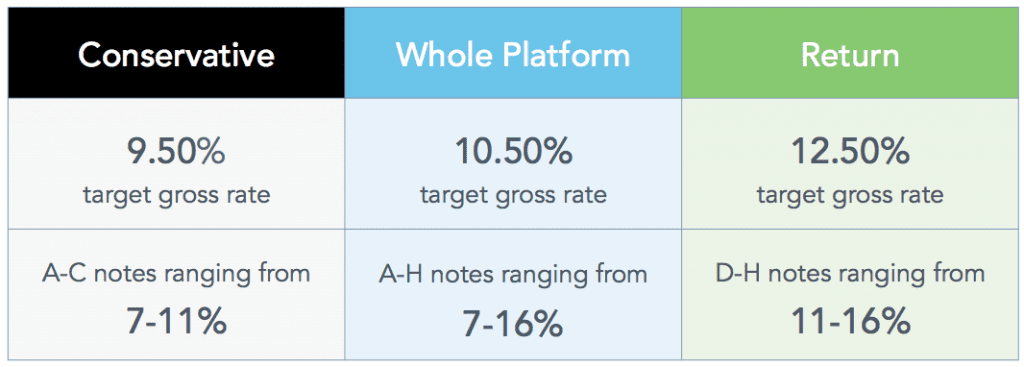

Loan terms are 12 months with interest rates between 7% and 16.75% for borrowers but the average maturity is under 7 months. The short duration itself makes this investment more liquid than some of the other verticals in marketplace lending. For a more hands off approach investors are able to enroll in one of three auto invest programs with various target returns. The below figures were taken from LendingHome’s investor guide and are up to date as of March 31, 2016.

Conclusion

LendingHome is leading the way in real estate crowdfunding both in originations and now lender protection. The addition of a bankruptcy remote vehicle marks a maturing of sorts for this asset class. Investors can now be more confident that their investment is safe from external risks such as a platform bankruptcy. It wouldn’t be surprising to see their competitors follow suit as investors begin to demand such protections.

It’s important to note that this is only the beginning of real estate crowdfunding as it has the potential to outpace any other marketplace lending asset class in the US. What remains to be seen is just how long this will take. Although LendingHome’s growth has been impressive, they have only scratched the surface of the potential market opportunity.