Today LendingRobot launched a new alternative lending hedge fund called LendingRobot Series to add to its suite of products. This fund will allocate to Lending Club, Prosper, Funding Circle and other online loan origination platforms. Their fees are on the lower end of the spectrum with a 1% management fee and fund expenses capped at 0.59%. The minimum investment is $100,000 and the fund is open to accredited investors.

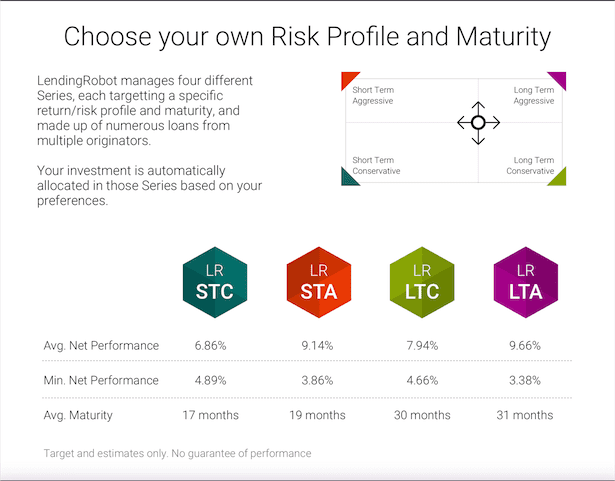

The fund is structured as a series investment trust, which means that they can offer several different strategies at once. Investors can choose between aggressive or conservative strategies and between short and long term time horizons (20-36 months). Net returns are expected to yield up to 9.66%.

In typical LendingRobot fashion, the fund will use technology to keep expenses low. LendingRobot’s technology platform will be used to select loans and execute trades. It will use blockchain technology to deliver a ledger of all transactions to see exactly which loans have been selected for the fund, thereby increasing transparency while simultaneously making the annual audit more efficient and less expensive.

LendingRobot offers individuals and wealth managers fully automated investment accounts on Lending Club, Prosper and Funding Circle. They have 6,500 clients representing over $125m in assets under management and they have submitted over 4 million trade orders to date. The company has raised $3m in a Series A funding round led by Runa Capital.