Third party investment tools are becoming increasingly popular among investors who are looking to deploy capital to p2p lending. One of the most recent developments has been the ability to buy and sell loans on the secondary market via an API. LendingRobot, who has already made available custom automated selling and buying now is expanding their product offering with a feature they are calling Adaptive Portfolio Rebalancing (AdPR). I spoke with Emmanuel Marot, CEO and Co-Founder of LendingRobot to learn more about AdPR.

The new feature furthers LendingRobot’s desire to automate the entire investing experience with p2p lenders Lending Club and Prosper. Available for users who have at least $20,000 actively managed by LendingRobot, the new technology will comb through your portfolio to look for opportunities to buy underpriced loans or sell underperforming ones. This feature is currently only available for Lending Club investors.

From the press release, Emmanuel stated:

Robo-advisors have largely been considered tools that perform two basic functions: create a properly diversified portfolio and reinvest new cash or income according to a static investment strategy, but we are capable of so much more. The real dream of these kinds of algorithmic solutions is a super-human financial advisor that monitors and takes advantage of every single opportunity to improve your returns 24 hours a day. With Adaptive Portfolio Rebalancing, we are taking a massive step in that direction.

I asked Emmanuel to first touch on the current state of the secondary market with Lending Club. He noted that there has certainly been an increase in volume in the last year, but the total market still remains fairly small. Given the recent news with Lending Club, there has actually been an increase of notes for sale which Emmanuel said has been an opportunity for some of their clients. However, the secondary market remains an inefficient market with many loans priced too high and some too low, but LendingRobot felt there was an opportunity to be opportunistic and they are certainly looking to the future with AdPR.

The introduction of AdPR continues their focus on the passive market. Some investors are scared or intimidated by the secondary market and the complexity of pricing. This lets these types of investors to leverage inefficiencies. Emmanuel said that AdPR is sophisticated, but accessible.

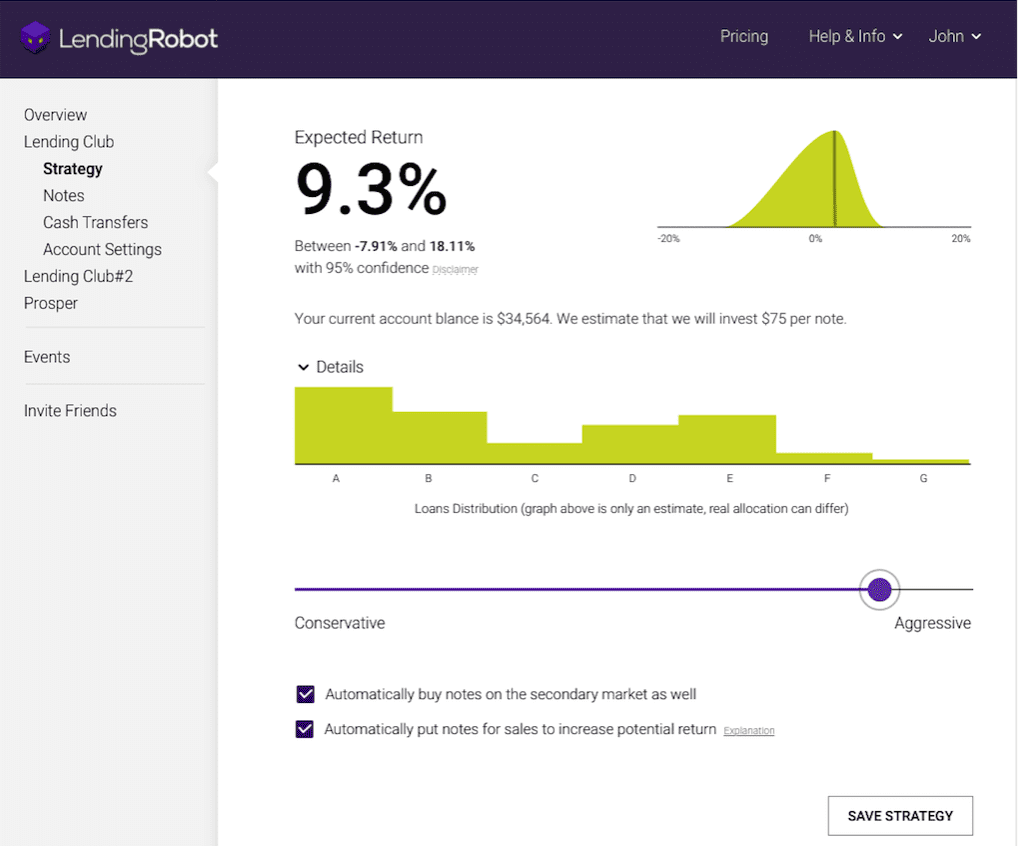

After selecting risk tolerance from conservative to aggressive, investors are given the option to enable “Automatically buy notes on the secondary market” and “Automatically put notes for sale to increase potential returns”. Notes listed for sale will be those which LendingRobot believes will increase your returns and notes purchased will meet the risk tolerance you select. The user interface is shown below.

Emmanuel told me that we will have to wait 6 months to see what kind of boost in returns investors see as this will depend on supply and demand in the secondary market. He stressed that the current scoring model is extremely conservative when determining notes to buy and sell. The model considers all factors of the loan, including the 1% transaction fee that FOLIOfn takes.

For investors wondering about competition with other clients of LendingRobot who use this feature, Emmanuel stated that everything is run in parallel, so there is no favoritism when determining who ends up purchasing any one note for sale.

We also spoke about the future of the secondary market given a few shortcomings that currently exist. One of the biggest downfalls is the lack of transactional data. This means it is difficult to get an idea of what someone is willing to actually pay for a given note. With the API you are able to see the price of a note for sale, but it isn’t possible to determine whether an investor actually purchased the note since listings can expire and they can be removed by the seller. This information could make the entire secondary market much more efficient and allow for more innovation with technology like AdPR.

Conclusion

A robust secondary market has been on many minds over the past couple of years and was even featured in the recent response from the U.S. Treasury on marketplace lending. We still have a long way to go for this dream to be realized, but LendingRobot is certainly pushing the boundaries in this area with Adaptive Portfolio Rebalancing.