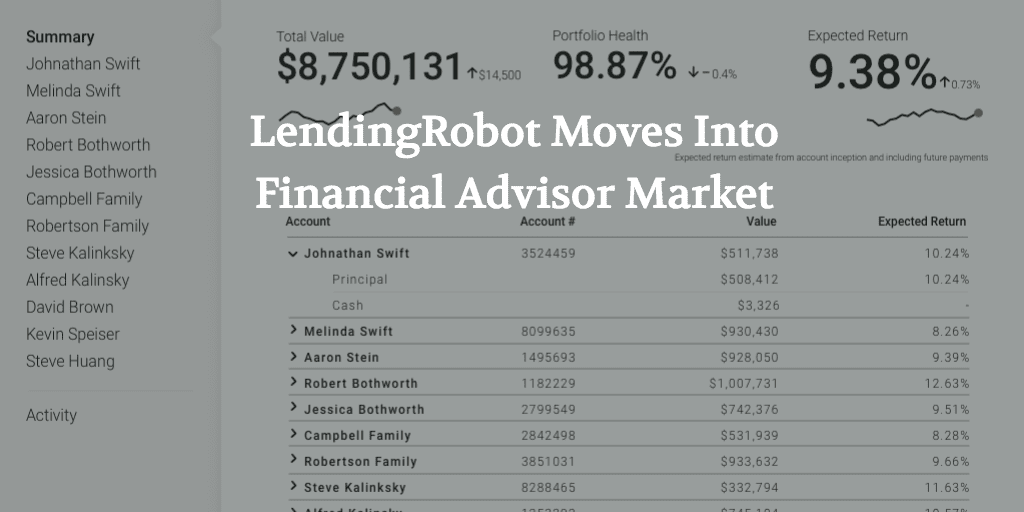

Last week, LendingRobot announced “LendingRobot for Advisors” to bring investing in Lending Club to a broader audience. They have partnered with Millennium Trust as a custodian who has long been involved in the online lending industry. Financial advisors will be able to manage all of their accounts through a new dashboard built by the LendingRobot team.

Emmanuel Marot, CEO of LendingRobot stated:

Today, if you are a financial advisor with 30 clients all interested in diversifying with peer lending, that task is next to impossible. Even the best chess players today are a team of 2: a computer and a human.

Advisors can sign up by creating a parent account and subsequently link client accounts. The advisor can modify the profiles of their clients and adjust settings based on the risk preferences of the particular investor to create a diversified portfolio of Lending Club notes. Reporting is available at the individual or advisor level. The fees are 3.75 bps monthly AUM or 45 bps on an annual basis. Client assets remain secure in Millennium’s custody.

For advisors interested in this product they can learn more at www.lendingrobot.com/advisors.

Conclusion

LendingRobot is the second p2p investment advisor to build investment tools specifically for investment advisers. Lend Academy’s sister company NSR Invest, launched its RIA-focused portfolio construction tools last year. Now, LendingRobot, NSR Invest and even Lending Club itself have been busy trying to convince investment advisers to entrust their clients’ money to p2p portfolios, ostensibly solving a yield problem that seems to be universal.

A majority of the retail investors currently taking an interest in this industry are self-directed. This type of investor group can only be scaled so far since they are typically power users or investment enthusiasts — a small portion of the total investor base. As a general rule, however, most investors prefer a hands-off investment experience and many of these people choose to invest through a financial adviser. This is a relatively untapped investor category among p2p originators, and it’s nice to see companies like LendingRobot joining in the effort to serve the financial advisor market. Hopefully this will bring more investors into p2p lending who can benefit from the diversification and returns that this asset class offers.