LendingRobot, an automated investing service for p2p lending announced a new mobile app yesterday. This is the first app of its kind and is something that will be welcome news to the retail investment community. The app tracks the overall status of an account and also provides insights to what is going on within a p2p lending portfolio. I spoke to Emmanuel Marot, CEO and Co-Founder of LendingRobot to get some more information about why they decided to create an app and what they have planned for future iterations.

When I asked Emmanuel about the reasoning behind an app he had an interesting response. From the start, they have positioned LendingRobot to be a set-it and forget-it type service. However, what they found was that 30% of their clients login several times a week and some even once per day. About 20% of these users were already coming from their phones using the website so the app was a natural addition to their offering. They aren’t changing their strategy, but they want to serve these users who want insight and access to their account right from their mobile phone. Marot stated it’s no surprise that a portfolio with a 1000 or more notes always has something new happening and investors will be able to see exactly what’s happening with the new app. Finally, none of the current marketplace lenders they service, including Lending Club, Prosper and Funding Circle have a mobile app for investors. Emmanuel noted in the press release that it was baffling that no one has created a ‘Mint’ for this industry.

The LendingRobot app is available as a free download on the iOS App Store and Google Play Store. There is no cost to use the free monitoring and a signed agreement with LendingRobot isn’t necessary until you begin using automated investing. LendingRobot also offers this same free functionality on their website for users.

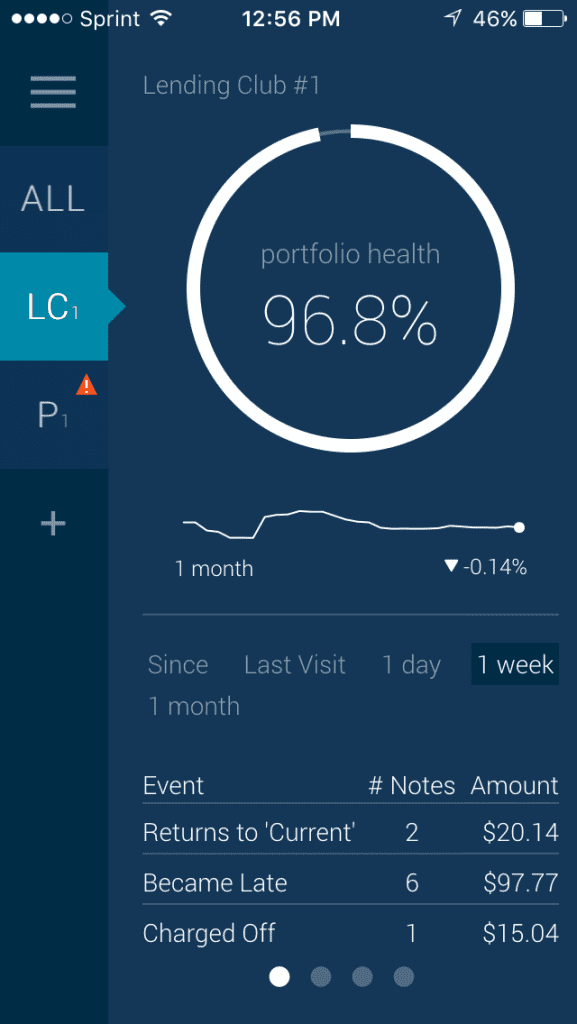

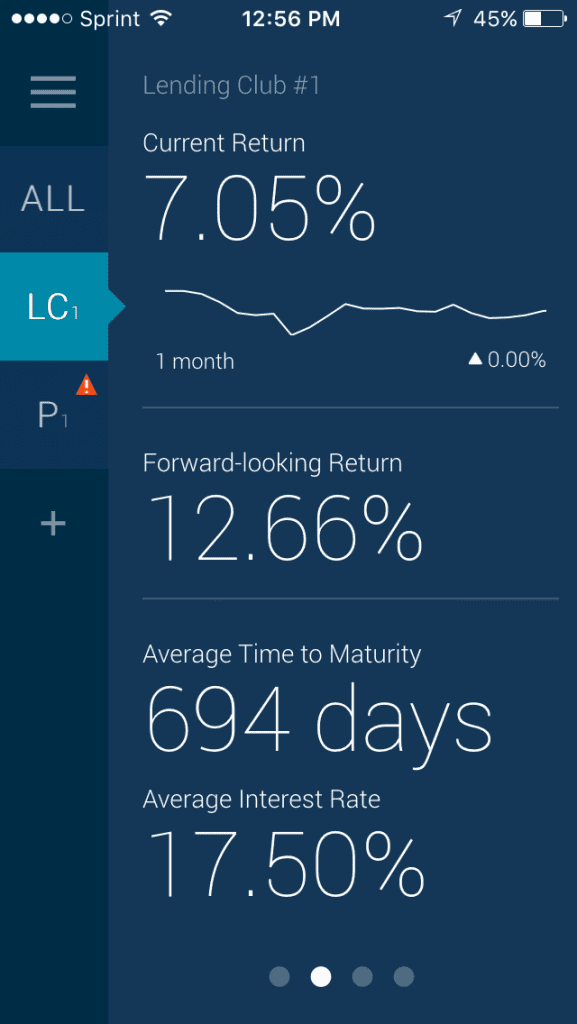

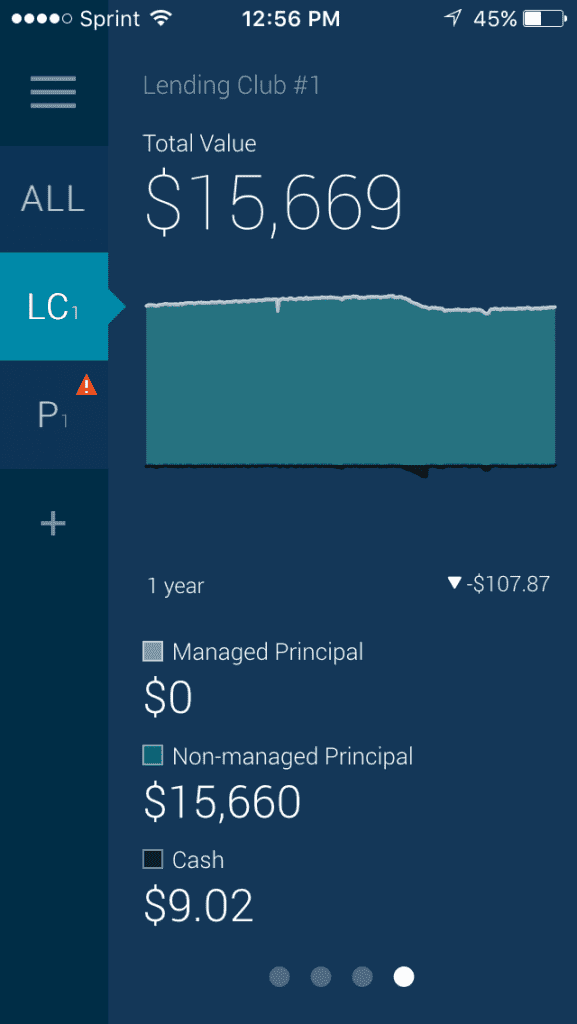

Since I already had my account I was able to login with my existing LendingRobot credentials and the screenshots below are taken from my account with my Lending Club account connected. On the first page it gives you an overview of your account, highlighting the most recent note changes within your account which is a valuable feature. The second shows information on returns and average interest rate of the account.

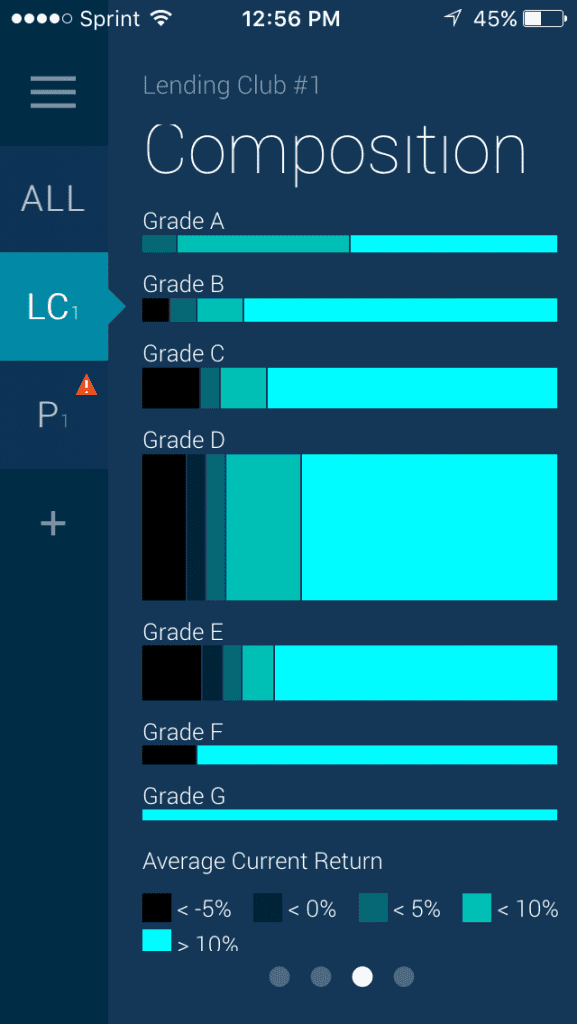

The next two screenshots provide an overview of loan composition and account values.

Conclusion

While speaking with Emmanuel it was clear that this is just the beginning of their plans related to the LendingRobot mobile app. There eventually will be many more features, including the addition of functionality currently available to paying customers on LendingRobot.com. We also discussed how mobile notifications might help users better manage their p2p lending portfolios. It’s nice to finally see a polished mobile app for retail investors and its a trend that is likely to continue in the coming years.