Earlier this month, LGT Bank announced its partnership with SEBA Bank in a bid to launch custody and trading services for Bitcoin (BTC) and Ethereum (ETH). This marked a significant development for LGT, symptomatic of the rising trend of traditional institutions turning to crypto in response to customer demand.

LGT Bank is part of LGT Group, the largest family-owned private banking and asset management group globally, managed by the Princely Family of Liechtenstein. The group currently has over CHF 280 billion in assets under management.

“The demand for cryptocurrencies has also increased among our clients in recent years,” said Roland Matt, CEO of LGT Bank, Liechtenstein. “We are very pleased that we can now offer our clients easy access to this asset class.”

“When developing our new offering, we paid particular attention to security while focusing on clear, reliable processes and procedures. It is central to dealing with this dynamic and relatively young asset class. Thanks to our cooperation with SEBA Bank, our clients’ digital assets are held in the custody of a professional and certified provider with extensive experience in this area.”

SEBA Bank is focused entirely on digital assets, supporting a range of investment services. The company’s hot and cold storage solutions are where LGT has focused their partnership.

“SEBA Bank features state-of-the-art hot and cold storage solutions, with ISAE 3402 certification,” said Mathias Schütz, Head of Client and Tech Solutions at SEBA Bank.

“This enables the highest degree of protection available for our client’s digital assets. Our custody solution is built on leading-edge components from major international providers, which are maintained and further developed in-house to fully control the solution and act swiftly in changing market demand.”

Demand for crypto influencing institutional development

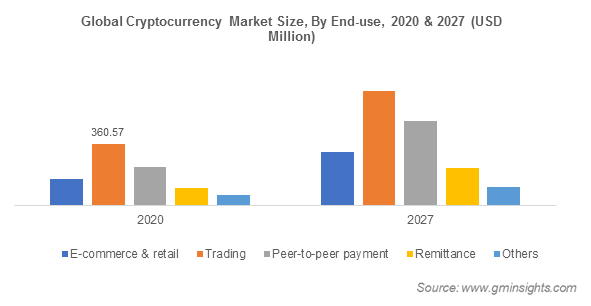

The demand for exposure to crypto-assets has risen significantly. In 2021 around 16% of Americans and 10% of Europeans invested in crypto-assets. Although there is some hesitation around the asset class, especially due to its volatility, this demand will likely continue to rise as the market matures.

Increasingly institutions are incorporating crypto assets in their offering to match this demand. “While motivations vary depending on the client, this move from LGT clearly demonstrates that the digital asset class has reached a broad level of acceptance,” said Schütz.

In February 2022, BlackRock announced its move into crypto, along with Goldman Sachs, KPMG, and many others. Bloomberg reported in June 2021 that institutional investment to fund diversification into crypto had reached $17 billion.

With its variety of solutions, SEBA has partnered with many companies to help facilitate this evolution.

“SEBA Bank provides institutional-grade trading and custody infrastructure, guaranteeing fast, safe and convenient access to market liquidity,” said Schütz. “Through the provision of our services, traditional institutions can bypass the need for building and maintaining their own specialized infrastructure. Instead, they can entirely rely on the sophistication and expertise of a fully integrated, FINMA licensed digital assets banking platform.”

According to Schütz, private banks have been under pressure from clients to add digital assets to their asset portfolio and make it an integral part of their offering. “In a similar vein,” he said. “An estimated 80% of central banks are either considering or actively developing Central Bank Digital Currencies (CBDCs).”

SEBA also has involvement in this aspect of digital aspects, contributing to Banque de France’s experiments with CBDCs in June 2021, testing the control and confidentiality of transactions on the blockchain.

LGT and SEBA’s two-dimensional rollout

This partnership with LGT Bank initially focuses on developing crypto wallets for Ethereum and Bitcoin, but this is only the start.

“The rollout is planned to happen on two dimensions: firstly, from a geographical point of view,” Schütz explained. “This means that other booking centers and RM locations would be given access to the offering.”

The second dimension will see the addition of other services and products. Starting with the addition of wallet capabilities with other coins and progressing onto integrating other services offered by SEBA.

According to Schütz, although the development of institutions into crypto starts with cryptocurrencies, they have seen progression into yield enhanced offerings such as Staking. SEBA caters to this demand with its SEBA Earn solution, which they plan to include in the future rollout with LGT Bank.

“We also see strong demand to add NFTs to the product range, i.e., provide safe and secure custody, fulfill reporting needs, etc.”

“Of course, stablecoins are a hot topic and provide a multitude of benefits; however, regulatory certainty has yet to be established globally. SEBA Bank is involved in developing stablecoin and tokenization technology and launched a landmark Gold Token in December 2021.”

“Acting as a regulated stablecoin, The SEBA Bank Gold Token provides investors with the best characteristics of a digital and physical hedge against inflation by enabling holders to redeem their physical Swiss gold from refineries on-demand.”

To learn more about the rise in Gold Token investment and SEBA’s Gold Token, read our article; Gold tokens: the low-risk digital asset?

RELATED