In the past five days the Dow Jones Industrial Average has slipped 10.36% and the past two days we have seen wild swings both up and down. The news of volatility in the stock market has been the leading story in most major news outlets. Many stocks took a large hit yesterday and recovered slightly throughout the day. Many investors panicked and sold their positions. Investors using TD Ameritrade experienced slowness due to historic volumes. Even Lending Club’s stock hit a 52 week low of 10.28 at market open yesterday, dropping around 11%. It now sits around $12.

Time will tell whether this was just a small correction and this bull market will continue or if this is the start of a sustained slump. It is impossible to know where the market will go from here. The important thing to remember is that these market fluctuations are common when you are investing in stocks. Investing in marketplace lending has and will likely continue to produce far less volatile returns.

The consistency of returns has long been reported as a benefit of investing in marketplace lending, but it isn’t until events like these that we actually come to appreciate the consistent returns. Since Peter Renton began reporting his returns in 2011, he has seen overall returns ranging from 8.12% to 12.44%. This performance should continue, despite whatever might be happening across the stock market, barring another recession or a spike in unemployment. This makes investing with companies like Lending Club or Prosper, a great diversifier. Investing in unsecured debt is an asset class that is uncorrelated to stocks.

I am not recommending a marketplace lending only strategy. I myself am diversified across stocks, bonds, REITs and physical real estate. My Lending Club and Prosper accounts account for just 14% of my investments overall. My opinion is that stocks are a long term investing strategy. Despite whatever short-term fluctuations we see in the market, I will continue to hold for the long run. My marketplace lending accounts serve a different purpose, and that is the consistent cash flow that long-time investors have enjoyed.

As of his last update, Peter now has his entire retirement portfolio invested in this sector, but is also invested in stocks. He is now earning over $52,533 in total interest annually. But most importantly, day after day, month after month, year after year his returns are very consistent.

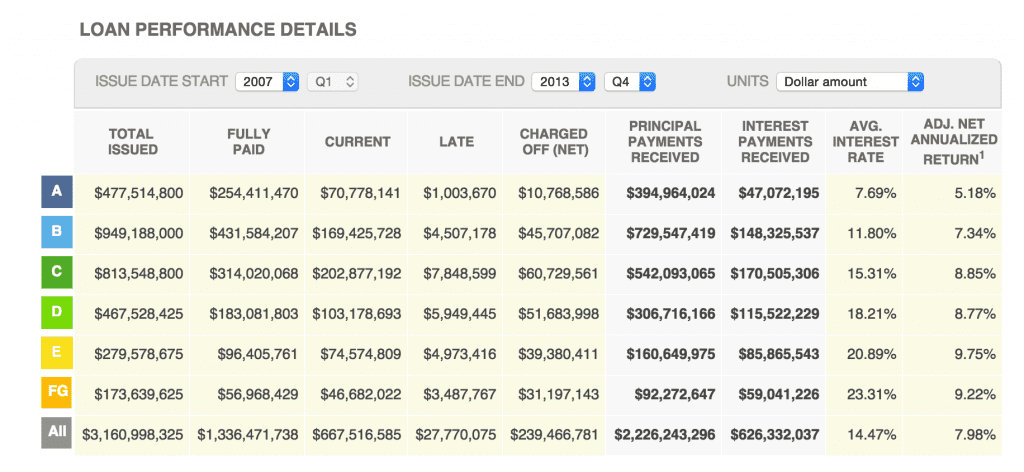

Take a look at the chart below, which outlines Lending Club notes originated in 2007 through Q4, 2013. Filtering through 2013 gives us a more accurate picture of returns since older notes have experienced a majority of the charge offs they will receive.

Across all grades, we see an adjusted net annualized return of 7.98%. Even the more conservative A grade loans return around 5%, which given what banks are paying is still an attractive return for many investors.

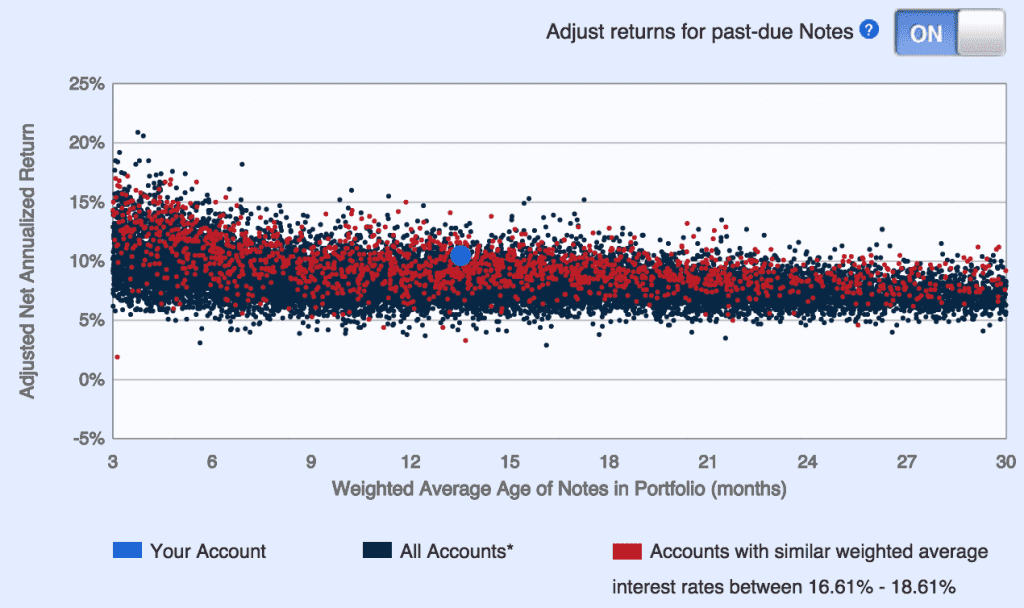

The graph below shows thousands of Lending Club accounts. I have filtered it to only include accounts with 250 notes or more, an amount of loans that I believe is the minimum for diversification. In addition, I selected to only show accounts that have no note greater than 0.5% of total portfolio value. This removes outliers on both the high and low end which have put more money into certain notes. Accounts similar in interest rate to mine are highlighted in red. The takeaway is positive returns across the board for thousands of investors.

As of late, It’s certainly a good time to have some money in Lending Club and Prosper. The consistency of returns is the reason many investors have flocked to this industry and it isn’t just unsecured credit either. Investors are seeing these types of returns in marketplace lending across asset classes including real estate, small business lending, student loan refinancing, and mortgages.

Stock market volatility will always be a reality for investors. While there are no guarantees for the future, a well diversified marketplace lending portfolio should have consistent returns with very low volatility.