Marqeta reported third-quarter 2023 financial results after the bell yesterday and overall it was a solid quarter.

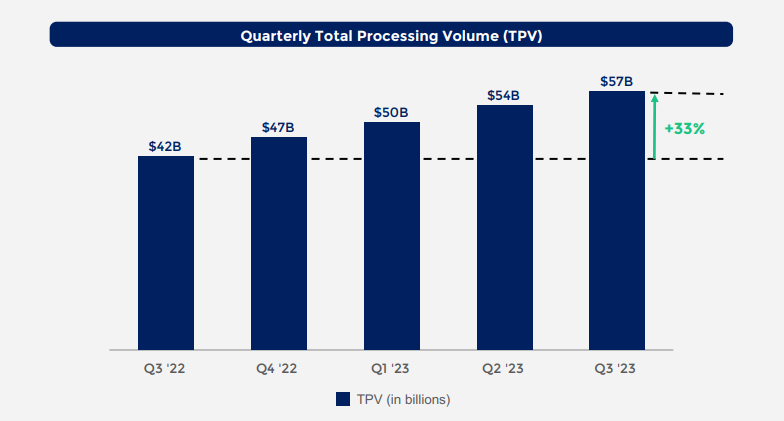

The company reported a total processing volume of $57 billion, which is a 33% increase year-over-year from $42 billion in the third quarter of 2022. They reported an adjusted EBITDA loss of $14 million in the third quarter of 2023, which is a decrease from the previous year. However, the adjusted EBITDA margin was -2%, an increase of 5 percentage points year-over-year.

Net Revenue was down dramatically to $109 million, a decrease of 43% year-over-year. But this is misleading because of an accounting change due to the Block contract extension. Without that accounting charge net revenue would have also increased significantly.

Speaking of Block, that company has been Marqeta’s largest customer for some time, making up as much as three-quarters of the company’s revenue. In August, the company announced a four-year contract extension but changed how revenue is recognized in that relationship.

While Block is a key partner for Marqeta, providing issuing processing and related services in markets outside of the U.S., the gross profit concentration from Block has decreased, which has led to a growth in non-Block gross profit.

Marqeta also highlighted the growth of their BNPL offering. The cards offered by BNPL providers give their customers the ability to pay in installments at any merchant that accepts cards. The company claims these cards resulted in almost 10% of all BNPL processing volume.

CEO, Simon Khalaf, seems to view the results positively emphasizing the company has renewed contracts with customers accounting for over 75% of its total processing volume (TPV) in the last 6 quarters, which Khalaf sees as a solid base for future growth. Marqeta also announced the completion of its new credit platform, which is expected to contribute to the company’s growth.

Our Q3 results represent the new baseline for Marqeta, post Block’s Cash App renewal. We’ve shown continued sales bookings momentum against a backdrop of operational discipline, continued scale, and new innovations through the launch of our credit platform,

Simon Khalaf, Marqeta CEO

In the Q&A section of the earnings call analysts focused on a number of key areas:

1. Revenue and Profitability: The analysts are interested in the company’s revenue and profit growth, particularly in relation to recent bookings and the impact of changes in pricing structure.

2. Expense Management: There were questions about the company’s operational expenses and where there might be flexibility to adjust these in the short term.

3. Business Strategy and Future Projections: The analysts are keen to understand the company’s future plans, including how bookings will convert into gross profit and the potential for scaling certain areas of the business.

4. Impact of Macro-Economic Factors: There were queries about the impact of macro-economic factors on the company’s performance, particularly in relation to certain sub-verticals.

5. Restructuring and Efficiency Initiatives: The analysts were also interested in the realized savings from recent restructuring and efficiency initiatives, and how these are affecting the company’s financial performance.

Marqeta’s stock popped today as the market digested these earnings, up 20.5% as of this writing.