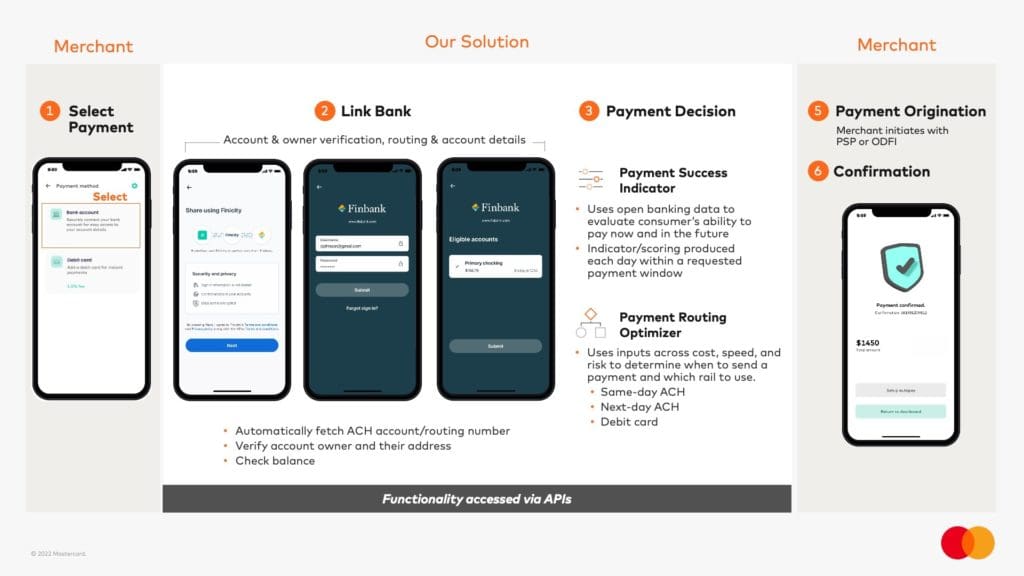

Mastercard launched a set of open banking tools under the Finicity services multitool, enabling b2c transactors to check user accounts before requesting an ACH.

They call them Smart Payment conditioning Tools: a Payment Success Indicator that checks an account and a Payment Routing Optimizer that interprets and finds the best option for payment.

“By fundamentally improving the payment experience and solving real-world challenges, we are delivering new technologies to offer more ways to pay with greater speed, convenience, and confidence,” Chiro Aikat, EVP of Product & Engineering Mastercard North America, said.

Real-time ACH

The solution enables a merchant, a bank, a digital wallet, or payment service providers to assess a consumer’s balance and historical behavioral risk patterns in real-time.

Users who set up payments with a partner company already choose to use ACH payments; the new tools bring some open banking insight to those payment options, explained by Silvana Hernandez, SVP of Digital Payments.

“Consumers can quickly and easily set up ACH payments — like rent, tuition, utilities, healthcare,” Hernandez said. “Then, merchants receive scores and recommendations — based on consumer permissioned data – to ensure that consumers are not surprised with payment failures.”

Hernandez said that offering these tools aims to diminish failed ACH payments, which can happen due to errors when providing bank account details or due to insufficient balance.

“For example, [erros can happen] due to misalignment between the time a consumer receives a payroll deposit and the time a recurrent payment is applied,” Hernandez said. “In a nutshell, these tools aim to provide consumers and merchants with peace of mind of knowing ACH payments will be successful.”

Set and Forget

The release said it’s a friction-free user experience that supports more reliable payments for merchants: users can set and forget the ACH option for paying rent or bills.

The system will automatically choose the best timing for payment that keeps cash flow in mind. It’s the user’s option to give the merchant that private account access is the users,

Bilt Rewards Alliance, a collection of more than 2 million rental homes enabling members to pay rent through a credit option and earn points, will be one of the first fintech partners to launch Payment Success Indicator.

“Our mission is to help renters get the most value out of one of their biggest expenses, and returned payments create significant expense and friction for residents and landlords,” said Ankur Jain, founder, and CEO of Bilt Rewards.

“Payment Success Indicator should significantly reduce the potential for returned payments, delivering a digital payment experience that works harder and smarter for everyone.”

The solution is an addition to one of the many factors in the Finicity banking suite. Mastercard acquired Finicity in June 2020 for around $825 million.