The march towards a cashless future is well underway.

The British Retail Consortium (BRC) found in its 2022 payments survey that card transactions within the UK accounted for almost 90% of retail transactions in 2021.

The BRC noted that cash usage had dropped significantly to an all-time low of 15% yet remained the second most used payment method after debit cards.

While the ongoing pandemic measures may explain the cash drop, a wave of cashless options for payments and budgeting has materialized. Budgeting apps and mobile banking have become the tools of choice for the younger, more tech-savvy generations. Cash is essential for specific demographics; however, the organization predicted that users would continue to drop, reaching 6% of all retail purchases in 2031.

Card processing fees soar in the cashless environment.

While card payments may be more convenient, they carry costs critical to the retailer’s financial health.

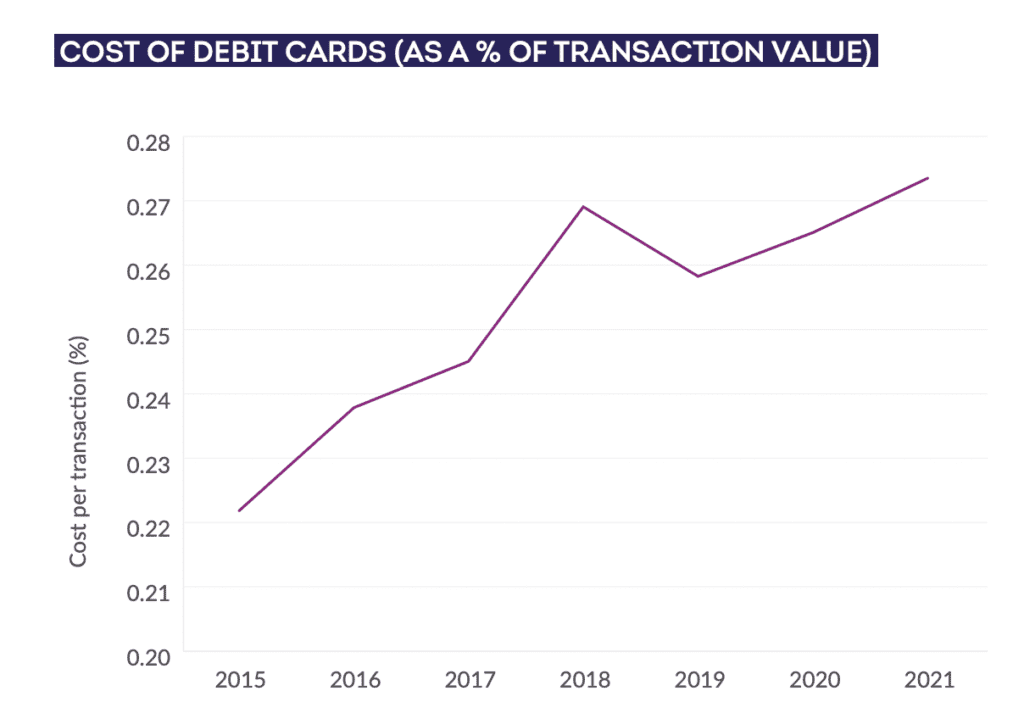

The BRC found that in 2021, retailers spent £1.15 billion on processing card transactions, with the average fees for using a debit card rising significantly. This, paired with the higher volume of transactions, resulting in an additional £141 million spent on debit card transactions.

As part of the “Axe the Card Tax” Campaign, led by the BRC and other organizations, it was noted these rising fees are part of a trend. The initiative claims that card payment “scheme and processing” fees have recently increased by around 600%, stating that the current system is “anti-competitive.” The hardest hit is SMEs, which are more susceptible to cost fluctuations within a challenging economic environment.

To combat this, the BRC and other companies are turning to increased adoption of open banking as a source of hope.

Brian Hanrahan, CEO of Nuapay, said, “While card payments are a familiar and relatively safe option for retailers, merchants should consider leveraging open banking for customer payment processes.”

“For merchants, open banking is an easy and efficient method for facilitating consumer transactions compared to cash or cards and is more cost-effective. Open banking enables account-to-account (A2A) payments, which have significantly lower per-transaction costs than card payments.”

How open banking could help

Adopting alternative payment options driven by open banking frameworks comes with challenges. The BRC has noted that consumers continue to rely on card services, citing a lack of incentive to switch.

“Without any incentive to switch, consumers still rely on retailers offering card services as a payment option and are very likely to continue…until offered a material reason to change,” the report stated.

This could result in an impasse where retailers are reluctant to introduce new payment options without consumers’ demand, despite the associated savings. Conversely, their customers are likely only to switch if the option is useful and widely accepted.

Increases in open banking solutions have, however, left their mark. In a study published by Nuapay, 25% of merchants believed that it could become the most popular payment method within the next 5 years, citing an increase in uptake over the past two years.

Online checkouts have seen the most adoption, including additional options for A2A payment without significant disruption. An increase in mobile wallets and contactless transactions could assist in-person usage.

“The survey results are encouraging, demonstrating a step change in merchant awareness and appreciation of open banking payments. The increase in uptake observed by respondents and predictions for the technology to become the most popular payment method in the next 5 years point to a growing understanding of the value of open banking,” said Hanrahan.

This could spell the end of the “uncompetitive” payment processing environment for merchants while providing options to meet consumers’ diverse needs.