The finance industry is poised for massive disruption with the influx of blockchain and DeFi adoption.

However, there are weaknesses to the technology that could challenge institutional adoption.

The decentralized nature of blockchain means that databases and protocols are distributed over multiple nodes. Despite this, the failure of one or more nodes can negatively impact the network performance and, at times, make the network useless.

Node failure is a common occurrence. Nodes can be down for hours, and currently, there are few formal ways of resolving this downtime.

“There is a very common pattern,” explained Nikos Andrikogiannopoulos, CEO of Metrika. “Everybody runs Prometheus and Grafana, open source, right next to their nodes as local monitoring. At some point, they get an alert that there is an issue. And the first question they ask is, ‘Is it the node? Or is it the network?’ Nobody knows the answer.”

“So they then go on social media and post screenshots of what they see and ask other node runners about their experiences. By the time they figure out what the issue is, by the time someone steps up as the hero in the ecosystem, it can be 17 hours, 20 hours a day, or more for the network recovery.”

“That’s not the level of operations that Web3 can scale.”

Increased speed could bring increased transparency requirements

As more blockchains speed up network functionality and, like ethereum, switch to the PoS consensus mechanism, this issue becomes even more critical to resolve.

“As we scale the Web3 world, and the networks become faster. In theory, those applications will have more requirements. It’s no longer going to be the discussion just about gas fees. It’s going to be, ‘What’s my response time? Is the network slowing down? What am I experiencing through that?'” said Andrikogiannopoulos.

Switches to PoS could also increase reliance on node functionality for transactions and implement increased punishment for node downtime.

“Also, when you’re using PoS, now you have faster processes,” he continued. “You will have applications that will, instead of building on layer two infrastructure, could build straight on layer one. And they will need a level of transparency to answer these questions.”

More reliability needed at institutional level

Mass adoption on an institutional level also brings with it a level of reliability. Blockchain technology has the potential to support many more functions than simple transactions of cryptocurrencies.

Smart contracts open DeFi to multiple uses within institutions like Goldman Sachs, which may explain their exploration of digital asset use cases. However, possible downtimes of over 15 hours may be unacceptable at this scale.

Andrikogiannopoulos believes that although regulation is needed within DeFi to support mass adoption on an institutional level, improved reliability is critical.

“If you have open finance infrastructure, which is what blockchain is, it’s public infrastructure. It’s like a highway. It’s a public good,” said Andrikogiannopoulos. “You cannot have a highway going down for 17 hours and blame the community at large that it’s not working.”

“There needs to be an infrastructure that ensures traffic gets restored following a process, having the right rules and that we’re back in business based on acceptable timeframes.”

Metrika provides transparency to issues

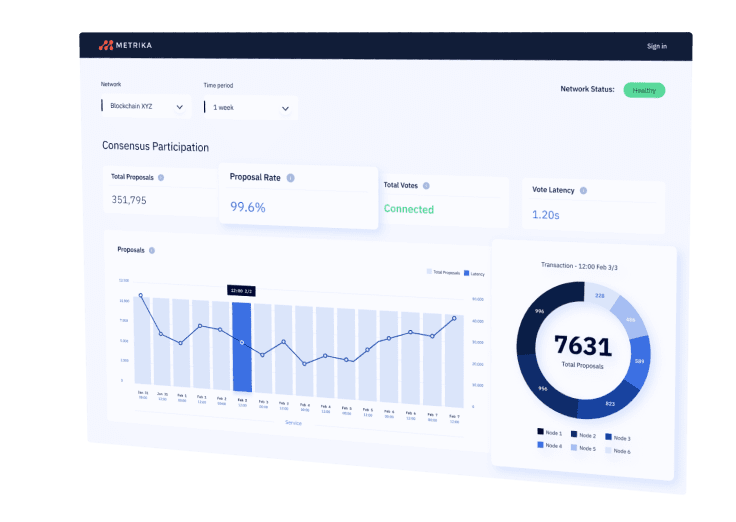

Aimed at improving the reliability of a blockchain infrastructure, Metrika is developing tools for monitoring and operational intelligence, as well as an insight platform for applications to assess the health of the blockchain they are built on.

In this way, they hope to improve the efficiency of issue identification and troubleshooting.

“If you think about Web2, the protocols are things like HTTP, SSL. All those protocols are very thin. The application has all the logic in it,” said Andrikogiannopoulos. “In Web3, the application is thinner, handling things like transactions. The protocol takes care of its smart contracts.”

“All of the logic doesn’t reside anymore in the application. A lot of functionality is being performed on the blockchain. So the application will need to know the health of the blockchain network that it depends on for some part of its functionality.”

In response to this shift in application makeup and dependence on the blockchain, Metrika has focused on improving the visibility of network issues to applications.

“The application would know immediately of issues and be able to notify users and implement strategies to avoid significant disruption,” he continued. “The world we imagine is where Metrika is an operational layer that helps the infrastructure run properly, but also services and helps applications be aware of the network’s health.”

First infrastructure, then app integration

Currently, they have launched phase one, which is directed towards alerting node managers of possible issues and providing community dashboards to visualize network performance trends. In September, the company plans to release a node agent and monitoring system into the Flow network, which supports major NFT projects and games. The long-term goal is to make the tools available to all applications, integrating them to facilitate troubleshooting directly from the apps themselves.

“Right now. We’re focusing more on the infrastructure, and then we will take our tools and make them available to the applications. We indirectly serve the applications through the underlying infrastructure. Apps on Algorand or Flow can access our dashboards and see how the network is doing. But it’s not yet directly integrated into the application.”

The application integration will likely be developed and rolled out over the coming year.