This crypto winter has blown in with winds of fear and uncertainty for DeFi businesses.

Many have cut jobs, and some have been rendered bankrupt.

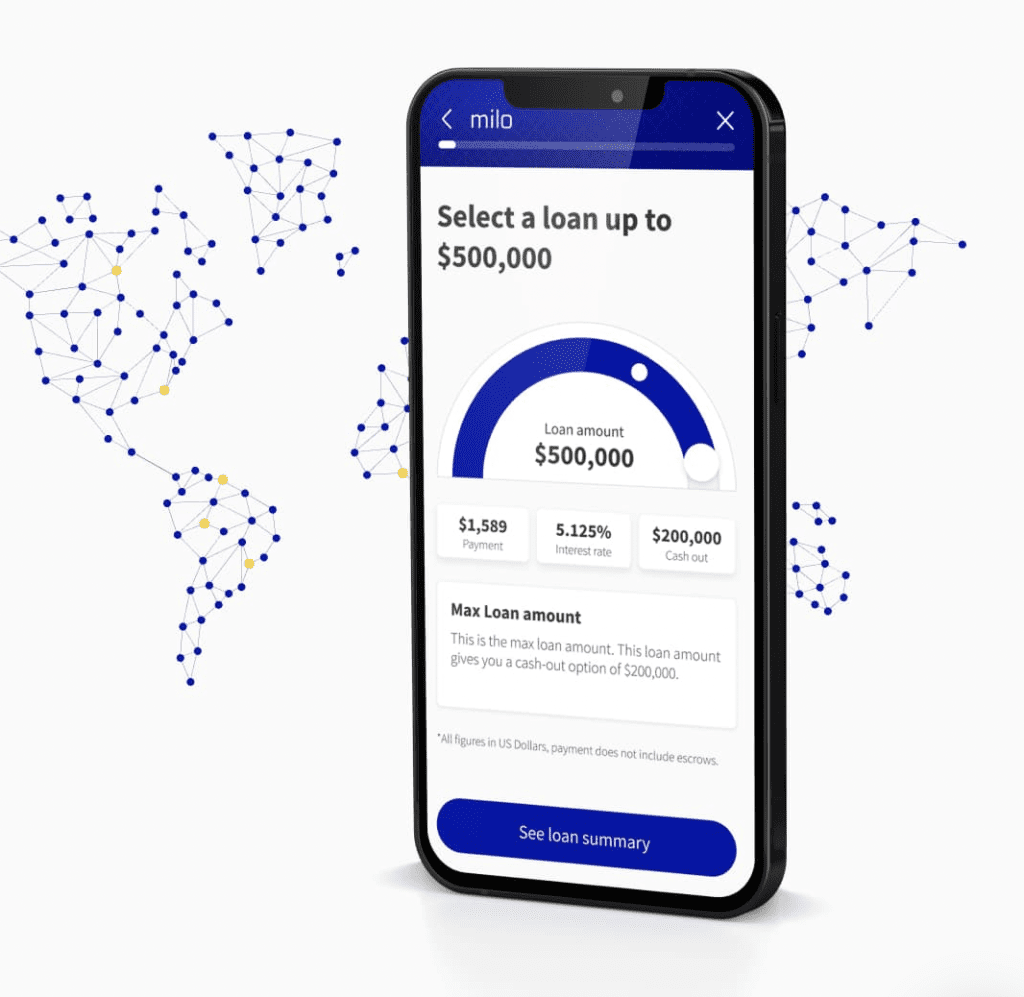

However, Milo, a crypto mortgage provider, has powered on, recently launching both refinancing capabilities and an under-collateralized mortgage product.

“How, when the winter winds bite at crypto wallets ever more furiously?” you may wonder. Perhaps the climate is, in fact, perfect for such a product.

Opening out the crypto mortgage

Milo hit the ground running with their first crypto mortgage. With the value of properties backed entirely by the equivalent in either bitcoin, ethereum, or USDC, they found themselves high and dry when the winter set in.

“We had no margin calls since we started originating the product despite the crypto world selling off,” Josip Rupena, CEO and founder of Milo, told Fintech Nexus in late July.

“It’s been in line with our models. The individuals that take out a loan with us are watching the markets very closely, but ultimately, it has sufficient collateral protection, which helps lower the risk.”

However, on Sept. 6, the company launched the new loan product, requiring only 40% USDC collateral.

The use of USDC is key. As a stablecoin pegged to the dollar, the asset is regarded by many to be a bridge between fiat and the DeFi world.

“We started to get consumers that actually had USDC. They’re earning in USDC and living in a USDC digital world. They’re living in a different foreign currency world,” said Rupena.

Due to the lower levels of volatility associated with the stablecoin compared to bitcoin and ethereum, Milo saw an opportunity to reduce the amount of required collateral. This reduction could open the mortgage to a broader client base within the digital community.

“We are on a mission to drive financial inclusion, and our crypto mortgage can do that for so many crypto consumers. We knew from day one that an under-collateralized crypto mortgage was needed, and we are now one step closer to helping more clients qualify to buy real estate,” said Rupena.

“Many crypto consumers already earn and spend exclusively in the digital world. Our USDC offering simply helps these consumers build a bridge to the real world.”

The rise and rise of USDC

USDC has seen high growth in the past year. The coin, as well as being backed by fiat currency, is distributed by Circle, which for some is seen as highly conservative. Working with governmental authorities, USDC was distributed to Venezuela’s healthcare workers earlier this year, and Circle has since launched the Euro-backed version, EUROC.

For many, the stablecoin acts as a lifeline. For some years, there have been reports on the growth of stablecoins in LatAm, with citizens using digital currency to hedge against the high inflation of their local currency.

RELATED: How to increase adoption of DeFi in LatAm

Milo initially started as a mortgage provider assisting overseas clients in buying property in the U.S. As the crypto market exploded, they shifted their offering, providing the additional crypto mortgage for international investors with wealth in DeFi.

For many digital natives, with much of their wealth stored in DeFi, the ability to diversify investment portfolios into tangible real estate is valuable, especially in the unsteady times of crypto winter.

Liquidity is king, especially in uncertain times

The other product launched by Milo earlier this month gives these digital natives the opportunity for refinancing.

“We’re in this interesting environment right now for many consumers,” said Rupena. “With the headlines that we’re going to go through an economic slowdown, people want to have cash. They want to have something that they can deploy quickly.”

“I think people learned their lesson that those individuals that had liquidity during previous financial crises are the ones that benefited the most from it. The consumers that we’re working with understand that.”

The refinance offering is geared towards this demographic. Working on a similar one-to-one ratio to their original crypto mortgage, customers can refinance up to 100% of the value of the property. Milo uses a combination of cryptocurrency and property value as non-payment protection.

Despite some considering the current market to be higher risk, Rupena remains confident that this is precisely the environment that calls for such a product.

“We’re in an environment where home prices may come down a bit, but they’re not going to go down as much as they were a couple of years ago,” he said. “So we’re still going to remain elevated from a price perspective. If you zoom out maybe over the last 10 years, we might get just back to the average home price trend line that it should have been. So I wouldn’t necessarily say it’s riskier, just we’ve structured it differently.”

“We’re learning that, even with the counterparts that we interact with, lenders, capital providers, regulators, the structure has never really existed where you’ve had dual collateral wrapped into a real estate transaction. And that’s unique because the risk profile is different.”

Acting as a safety blanket, the dual collateral allows clients to refinance while retaining their assets, freeing up liquidity that could be invested elsewhere.

The company stated, “Milo’s crypto refinance offering is a game-changer for those who previously sold their crypto or took out a short-term crypto loan to buy a home in cash. This solution allows them to extend the repayment term to 30 years and access the financing they would have preferred from inception.”

Considering the announcement that the company had reached $10 million in crypto mortgages after releasing the product 5 months prior, it seems they may be onto something.