On Monday, BlockFi agreed to pay $100 million to settle SEC allegations; a couple of hours after the Super bowl ran with so many crypto ads, media began calling it the ‘crypto bowl.’

Through press releases and a post by CEO Zac Prince on LinkedIn, the crypto startup explained why paying the largest settlement in the crypto space so far is suitable for users of the BlockFi Yield lending product that came under scrutiny.

“HUGE day for BlockFi and our interest-bearing product, the BIA. We’ve reached a resolution with both the SEC and state regulators that identifies a clear path forward for folks to earn interest on their crypto,” Prince said in a post.

The firm came under the careful eye of America’s favorite securities gatekeepers for offering a lending product that let users “stake” their crypto holdings in return for a handsome percentage return. BlockFi offered about an 8% yield. The SEC said this was a violation of securities laws, which state’s firms that provide products that advertise returns on investment need to register as securities in the U.S.

Warning for other crypto lenders

“This is the first case of its kind with respect to crypto lending platforms,” SEC Chair Gary Gensler said in a release. “Today’s settlement makes clear that crypto markets must comply with time-tested securities laws, such as the Securities Act of 1933 and the Investment Company Act of 1940.”

The settlement featured $50M for the SEC and $50M toward 32 states that held similar charges against BlockFi. According to the order, BlockFi began offering lending on March 4, 2019, offering returns on-lent crypto for 18 months as an unregistered investment company. It held more than 40% of its total assets in investment securities.

The order said the young firm accumulated at most $14 billion in crypto assets under the program from nearly 600,000 retail investors, with about 400,000 in the U.S.

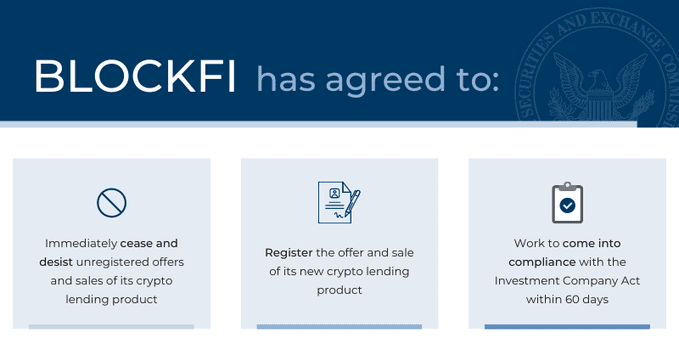

BlockFi agreed to cease unregistered offers, halting any new U.S. customers from signing up for lending, registering new lending with the SEC, and complying with the Investment Company Act while neither admitting nor denying wrongdoing.

“Today’s milestone is yet another example of our pioneering efforts in securing regulatory clarity for the broader industry and our clients, just as we did for our first product — the crypto-backed loan,” Prince said in a LinkedIn post. “We will be starting the registration process with the SEC for BlockFi Yield, a new crypto interest-bearing security… Once complete, BIA accounts will convert to BlockFi Yield, and new deposits and client sign-ups in the U.S. will be enabled.”

Prince said that current BlockFi lending accounts in the U.S. will go on hold and bared from new deposits until the firm registers and receives approval for the securities it created.

No one wanted to pick up the BlockFi check

The SEC order found that flaws in securities sales come down to false advertising, specifically a misrepresentation of the risks involved in the unlicensed security sales. For example, BlockFi advertised safe, “over-collateralized” institutional loans when the order found that most loans were not, and larger institutions did not want to lend to BlockFi.

“BlockFi made a statement in multiple website posts that its institutional loans were ‘typically’ over-collateralized, when in fact, most institutional loans were not. When BlockFi began offering the BIA investment, it intended to require over-collateralization on a majority of its loans to institutional investors, but it quickly became apparent that large institutional investors were frequently not willing to post large amounts of collateral to secure their loans,” the order said.

Not only was BlockFi allegedly selling unregistered security investments, but at most, only 24% of the loans were over-collateralized or backed by more than the cash value of the loans. That amount, less than one-fourth, was in 2019, and the percentage only lowered, down to 17% of the loans reaching over-collateralization.

The press release included a disclaimer that the release itself “does not constitute an offer to sell or the solicitation of an offer to buy BlockFi Yields or BIAs,” The release reads. “Any offers, solicitations or offers to buy, or any sales of securities will be made in accordance with the registration requirements of the Securities Act of 1933, as amended (“Securities Act”). We have not yet filed or confidentially submitted a registration statement with the SEC, and there can be no assurance that such a registration statement, when filed, will be declared effective.”

Other crypto lenders in the U.S., like Celsius Network, are also under regulators’ watchful eyes.