Anyway you slice it, Q1 2024 was a fantastic quarter for MoneyLion. They had record revenue, record adjusted EBITDA and record GAAP net income. Here are the pivotal takeaways from the earnings presentation that you should be aware of.

Robust Financial Growth

The company reported a record-breaking revenue of $121 million, marking a significant milestone in its financial journey. This top-line growth is complemented by an impressive adjusted EBITDA of $23 million and a GAAP net income of $7 million, with diluted earnings per share (EPS) hitting $0.60. These figures not only highlight the company’s profitability but also its efficiency in capital management and cost control.

Expanding Customer Base and Market Influence

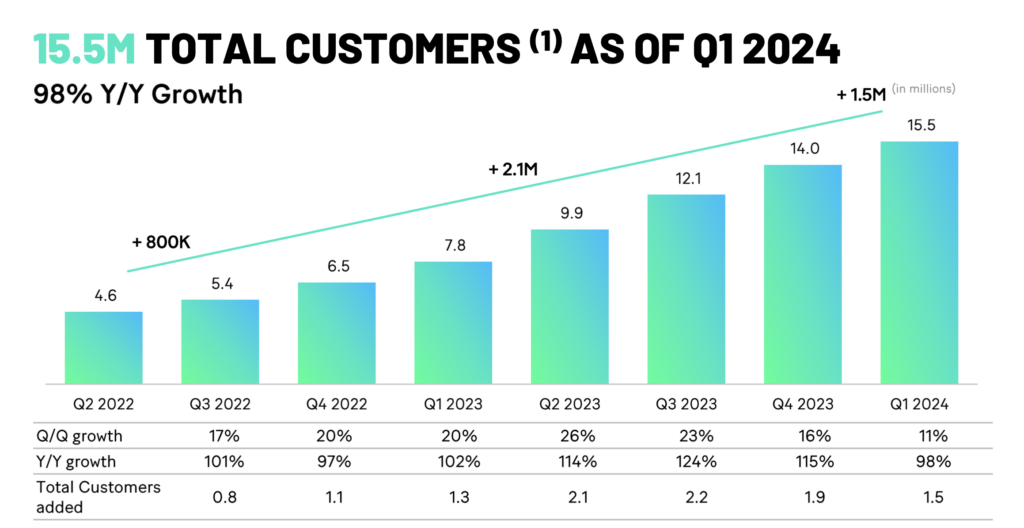

A standout statistic from the earnings report is the growth in customer base, now standing at 15.5 million people. This represents not just an expansion of the company’s direct consumer impact, but also an increase in the potential data and analytics that can drive personalized financial solutions. The company’s ‘marketplace-first’ strategy has propelled a remarkable year-over-year growth of 73%, showcasing its successful alignment with consumer needs and industry demands.

Innovative Platform and Partnership Synergy

The company continues to lead with the most full-featured Personal Financial Management (PFM) tool in the industry, a claim that’s substantiated by its robust growth metrics. Moreover, externalizing its technology to over 1,100 enterprise partners has been a game-changer, resulting in approximately 80 million customer inquiries in the first quarter alone. This approach not only amplifies the company’s reach but also enhances its scalability and integration capabilities within the fintech ecosystem.

Lifecycle Strategy and Recurring Revenue Streams

The presentation detailed a strategic focus on both consumer and enterprise cohort lifetime performance, which has been instrumental in driving significant recurring revenue. This ongoing revenue stream is vital as it provides financial stability and the ability to reinvest in innovation and customer acquisition, ensuring sustained growth.

Guidance and Future Outlook

Looking forward, the company is well-positioned for growth acceleration in 2024. This optimistic outlook is supported by its strong business fundamentals, innovative product offerings, and a scalable platform that meets diverse customer needs. The guidance provided suggests a trajectory that could redefine industry standards and benchmarks.

Key Strategic Initiatives

Here are key takeaways from the MoneyLion earnings presentation that underscore several strategic imperatives:

- Innovation as a Growth Lever: Continuous investment in technology and platform capabilities is crucial for maintaining competitive advantage.

- Data-Driven Strategies: Leveraging customer data to enhance user experience and product offerings can lead to higher retention and acquisition rates.

- Partnership and Ecosystem Development: Building and nurturing a partner ecosystem can extend market reach and enrich service offerings.

- Financial Health Monitoring: Robust financial tracking and adaptive strategies are essential for navigating the volatile fintech environment.

MoneyLion has both a direct to consumer business as well as a thriving enterprise business which makes them somewhat unique in the fintech space. The market is starting to recognize this potential as their stock is up 263% over the past year.