As earnings season winds down we are getting some strong numbers from leading fintech companies. Today, it was MoneyLion’s turn as they reported their earnings before the markets opened this morning.

Here are some of the key takeaways from their report.

Product Expansion and Customer Base Growth

MoneyLion reported adding an astounding 7.5 million total customers in FY 2023 bringing their total to 14 million, more than doubling the number of customers from Dec 2022. This growth is partially attributed to the expansion of its product offerings, aiming to better match customers with suitable financial products. The initiative appears to contribute to both attracting new users and increasing engagement among existing ones, within their framework of building a more comprehensive financial services ecosystem.

Focus on Performance Indicators

The earnings presentation (PDF link) highlighted the company’s reliance on year-over-year (Y/Y) key performance indicators (KPIs) to drive its growth and profitability, aiming towards achieving the “Rule of 40.” This industry benchmark signifies that a company’s growth rate and profit margin combined should exceed 40%, a metric often associated with sustainable growth. The emphasis on these KPIs is indicative of the company’s strategic planning and operational focus.

Membership Models and Partnerships

A shift towards a premium membership model was noted as a strategy to increase the total addressable market (TAM) and secure more consistent revenue streams. The model aims to provide additional value to users while establishing a more predictable revenue base in a competitive industry.

The company also highlighted its network of over 1,100 enterprise partners, which drives around 205 million annual customer inquiries. This extensive partnership network, enhanced by a strategic alliance with EY, aims to extend the company’s reach and distribution capabilities.

Financial Highlights and Future Projections

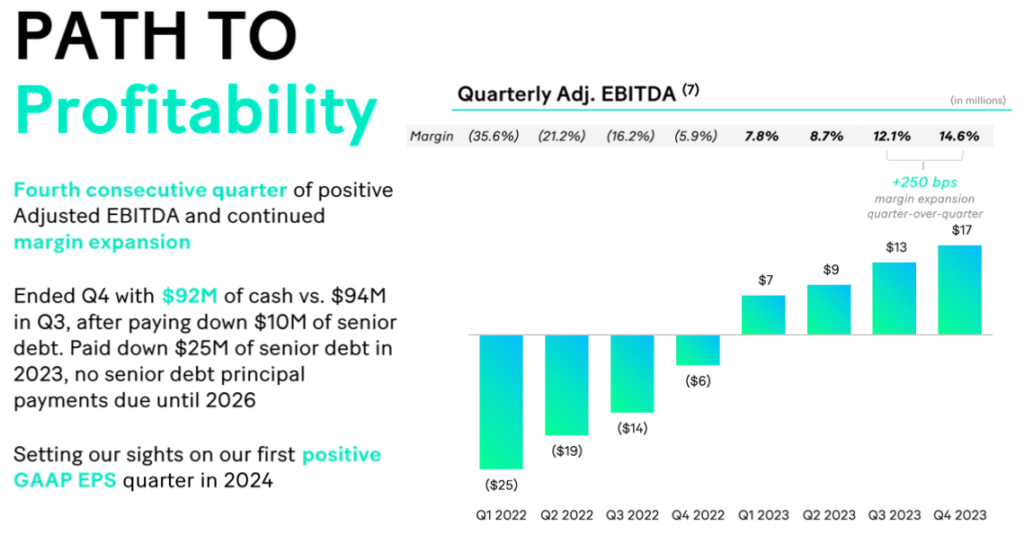

The earnings presentation reported a year of record revenue and an increase in gross profit margins, pointing to the company’s operational efficiencies and successful revenue generation strategies. The presentation also detailed the lifetime performance of consumer and enterprise cohorts, suggesting significant recurring revenue streams.

A comparison of the FY 2023 guidance against actual results was provided, demonstrating the company’s forecasting accuracy and operational performance. Looking ahead, the Q1 2024 guidance reflects an anticipation of continued growth and profitability, underscored by strategic customer acquisition and lifecycle management initiatives.

The Q&A With Analysts

The Q&A with analysts focused on a number of key areas:

- EY Partnership: A significant focus was placed on the recently announced strategic alliance with EY, aimed at co-building digital solutions for mid-sized financial institutions to enhance their digital capabilities, particularly in fraud detection, KYC, and onboarding processes. This partnership, leveraging MoneyLion’s consumer-facing technologies and EY’s banking sector expertise, is expected to significantly contribute to MoneyLion’s growth, particularly in distributing marketplace technology to banks.

- Credit Card Vertical Entry: The introduction into the credit card vertical is positioned as a strategic move to diversify MoneyLion’s marketplace offerings. The recent CFPB regulations on credit card fees were discussed, with MoneyLion’s marketplace model viewed as well-suited to navigate and potentially benefit from these regulatory changes by offering a broad range of financial products to consumers.

- MoneyLion WOW Membership: The subscription model, MoneyLion WOW, was highlighted for its potential to deepen customer engagement and increase lifetime value. This model offers a range of benefits, including cash back on products and exclusive features, aimed at consolidating customers’ financial activities within the MoneyLion ecosystem. Initial consumer demand for the WOW membership has been robust, contributing to the company’s strategy to expand its total addressable market and enhance recurring revenue streams.

- Growth Strategy: MoneyLion’s growth strategy for 2024 includes focusing on funnel optimization, expanding product verticals beyond lending (e.g., insurance, credit cards, mortgages), and enhancing distribution through strategic partnerships. The company aims to leverage these strategies alongside its marketplace technology to address the evolving needs of financial services consumers and enterprise partners.

A Positive Market Reaction

Investors welcomed this strong earnings report from MoneyLion as the stock finished up 28% today.