We are often told about the benefits of physical activity to health. Daily exercise can improve cardiovascular fitness, improve neuro function, and help you live longer. According to the World Health Organization (WHO), it can also boost the economy. The organization’s 2020 guidelines estimated that 150 minutes of moderate-intensity physical activity per week could contribute up to $8.6 trillion cumulatively by 2050 due to lowered healthcare costs.

However, that alone is not enough to motivate some.

“There are broadly two types of people,” said Oleg Formenko, Co-Founder of Sweat Economy. “Those who already do sport and care for their health and those who need some help and motivation to get onto this road.”

“For the first type of users, technology has already developed a countless number of tools that help people to understand their performance and to compare their performance against others – this is broadly called the “quantified self”. Countless pedometer and tracking apps fall into this category.”

“Where these tech tools fail is to provide an initial and ongoing motivation to those people who struggle to start or struggle to remain active.”

Studies conducted by the American Journal of Preventive Medicine found that financial incentives greatly improved motivation to exercise. Previously sedentary participants increased physical participation for longer periods of time, and motivation extended beyond the period people received rewards for their activity.

This realization sparked a surge of “move-to-earn” apps looking to reward users’ healthy habits.

“The interesting thing that makes “move to earn” work at scale is the fact that your physical activity has tangible value,” continued Formenko. “Everyone knows that being active is beneficial for them, makes them look and feel better, and extends your life expectancy, but it does not stop there – there are many parties that value your physical activity too and are prepared to pay for it.”

Developed initially as a rewards program, Sweat Economy is linked to some of the largest global brands, such as Nike, Apple, and Amazon Prime. The company has since made its way into Web3, favoring blockchain technology for its ability to create a “truly liquid” currency.

“We started Sweatcoin in 2015 with the view that it should be crypto from the start. Why? Because we believe that your physical activity has tangible value and can and should be turned into an asset that can be exchanged between parties to power those exchanges,” said Formenko. “This means that it needs to be a currency that is truly liquid. Unless we want to become a country, then the only option is to build a token on a blockchain.”

Pushing value in Move-to-Earn past the 2022 drop.

The launch of the Sweatcoin token in 2022 echoed the rise of many move-to-earn projects emerging out of the crypto space. Web3 technology allowed earners to use earned currency for purposes outside of linked rewards programs, with companies providing staking capabilities to increase earning potential.

During 2022, the popularity of move-to-earn spiked, fueled by a wave of applications offering earning capabilities. However, soon after, companies experienced a significant drop, with STEPN reporting a 90% decrease in users between June and September. While usage has grown steadily since then, it has yet to regain its previous heights, and analysts have criticized the lack of a unique business model.

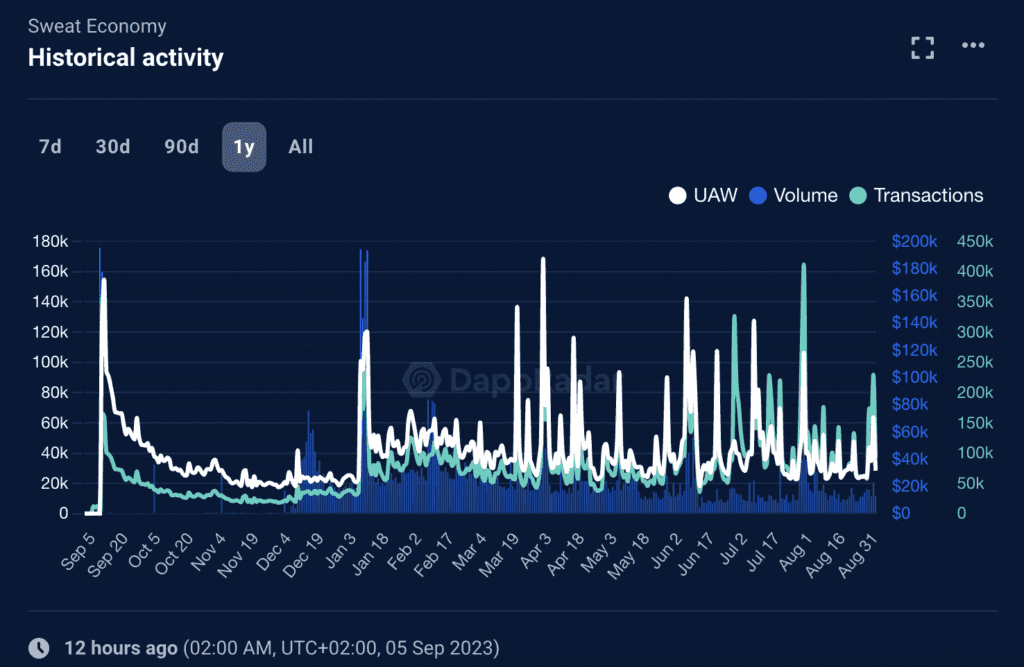

Sweatcoin also experienced a drop in activity since the 2022 spike, but associated wallets continue to be used regularly. Formenko explained that although the crypto industry had gone through a bear period of decreased trust, it had allowed companies like Sweat Economy to establish themselves as sustainable tools for users, increasing the utility of the rewarded tokens.

“As we create more utilities…the token will be more valuable and powerful and will act as an even stronger incentive to push people to take more steps,” he continued. “The more sources of demand there are, the more sustainable token economics are, and the more attractive Sweat Economy becomes as an ecosystem for new users.”

He explained that a goal of move-to-earn applications like Sweat Economy is to provide value for non-crypto natives. Added utility and increased acceptance of crypto into mainstream avenues could further incentivize non-crypto natives to adopt the earning potential of move-to-earn.

However, while interest in the move-to-earn space is sustained, it has slowly dropped in recent months, leaving the space a large hill to climb for mass adoption.