Neobanks

Featured

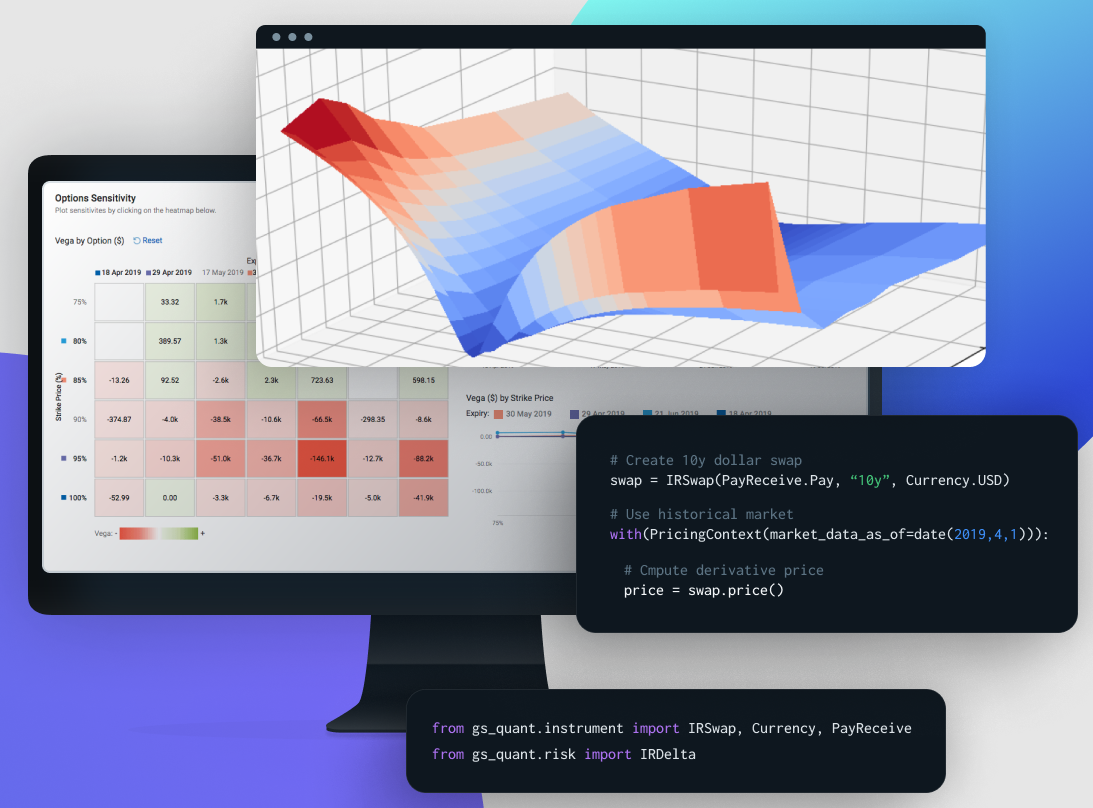

In this analysis, we focus on Goldman Sachs launching an institutional embedded finance offering within Amazon Web Services, and Thought Machine raising a unicorn round for its cloud core banking platform. We explore these developments by focusing on the emerging role of cloud providers as distributors of third party software, think through some of the implications on standalone fintechs and open banking, and check in on AI company Kensho. Last, we highlight the difference between Web3 and Web3 approaches to “cloud”, and suggest a path as to how those can be rationalized in the future.

In this conversation, we chat with Adam Hughes – the Chief Executive Officer at Amount, a technology company focused on accelerating the world’s transition to digital financial services via its digital retail banking platform, world-class digital authentication & fraud prevention tools, and ecommerce point-of-sale financing technology.

More specifically, we touch on digital lending industry Buy Now Pay Later (BNPL), as well as the trends of working with large banks and enabling their digital transformation to access some of these themes as part of embedded finance and banking-as-a-service.

In this analysis, we want to update the discussion of card networks, money movement, and the potential existential threat — or perhaps evolution — to existing infrastructure. It continues the thread on articles like Is Plaid cheap at $5.3 billion for $500 billion Visa? and Marqeta’s $300MM of revenue & Ethereum’s $20B in ann. transaction fees highlight opportunity and industry structure, and Who are the customers of Embedded Finance, and what do they reveal about Stripe, Affirm, DriveWealth, and Green Dot?, and more generally in this research section. We map Plaid’s progress in building out a payments ecosystem, and highlight Affirm’s debit card product powered in a novel manner through open banking. The analysis visualizes a likely evolution of the space with the introduction of Web3, and highlights a couple of early symptoms.

PayPal just launched what it calls a super app. It has a cash account with a 0.40% interest rate, direct deposit, money movement, bill pay, and remittance features. It also integrates shopping functionality with rewards and cash back. In this analysis, we compare this offering with Google Pay and Square Cash App, as well as trace the DNA of PayPal to understand whether such an offering will succeed where others failed.

Square upgrades Cash App into a payment processing powerhouse, completing the loop between the consumer and merchant side of the house. Goldman Sachs acquires GreenSky, adding a lending business at the point of intent. This analysis connects these symptoms into a framework explaining the increasing integration between commerce and finance, and the increasing role that demand generation plays. That in turn explains how the attention and creator economies interconnect with financial services.

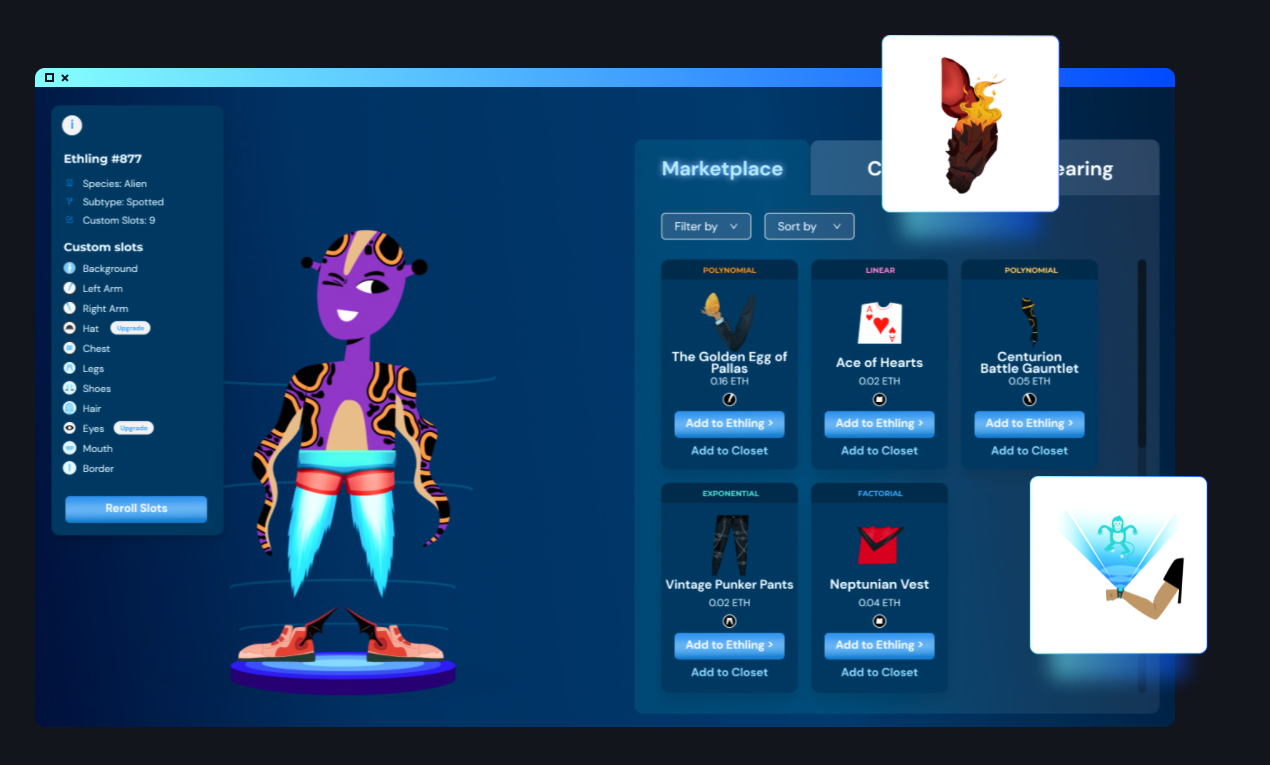

The evolution towards a financial metaverse is rapidly accelerating, with the growth in generative assets, profile picture avatars, the emerging derivative structures that build on their foundation, and DAOs that govern them. This article highlights the most novel developments, and builds the case for what a digital wallet / bank will need to be able to do in order to succeed on the way to this alien destination.

We look in detail at the state of marking recently-private-fintechs to the public market in mid-2021. Multiple industry segments have seen IPOs, direct listings, and SPACs transition fintech darlings into traditional stocks. How is performance doing? Is everything as magnificent and rich as we expected? Have multiples and valuations fallen or held steady? The analysis explores the answers and provides an explanatory framework.

In this conversation, we delve deep into next generation finance and banking with CJ MacDonald, the Founder and CEO of Step – an incredibly successful neobank on a mission to improve the financial future of the next generation.

More specifically, we discuss traditional vs. digital banking, how personal experiences influence entrepreneurial the spirit, immersive market research, banking-as-a-service, the importance of financial literacy amongst Millenials and Gen-Z, the power of influencers who actually believe in a brand, aspirational brands vs. plastic Wells Fargo stage coaches, and lastly the proliferation of crypto in the minds of the next generation.

The fintech industry is coming up on the tipping point of funding, revenue generation, and user acquisition to rival traditional finance with $20 billion in YTD fintech financing, the several SPACs, and Visa’s $2B Tink purchased. Defensive barriers have eroded.

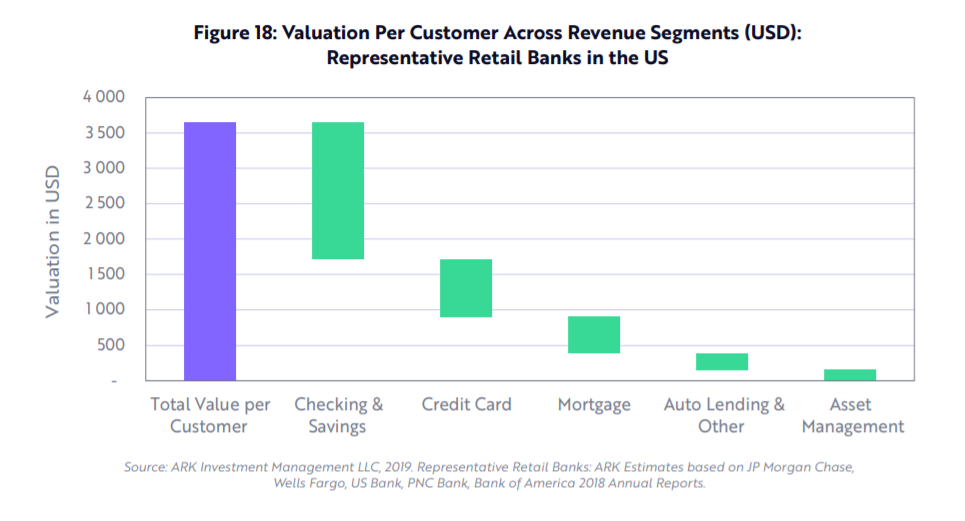

Let’s take a moment to compare capital. While it is not the money that wins markets, it is the transformation function of that money into novel business assets that does. And while the large banks have a massive incumbent advantage with (1) installed customers and assets, and (2) financial regulatory integration (or capture, depending on your vantage point), there is a real question on whether a $1 generates more value inside of an existing bank, or outside of an existing bank — even when it is aimed at the same financial problem.

This week, we cover these ideas:

-

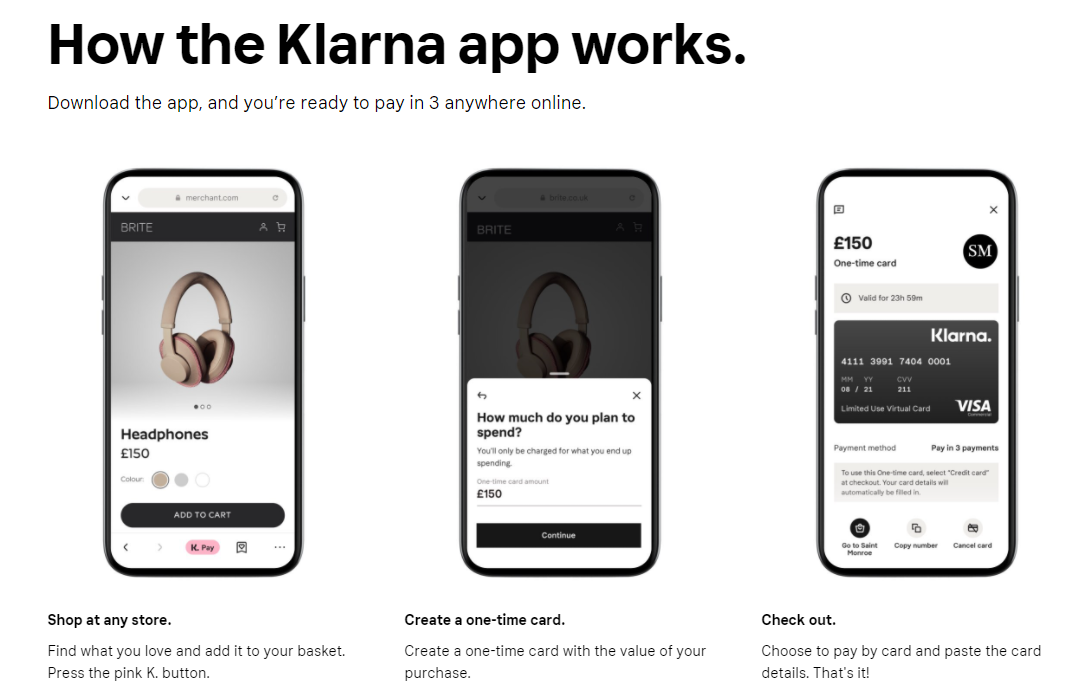

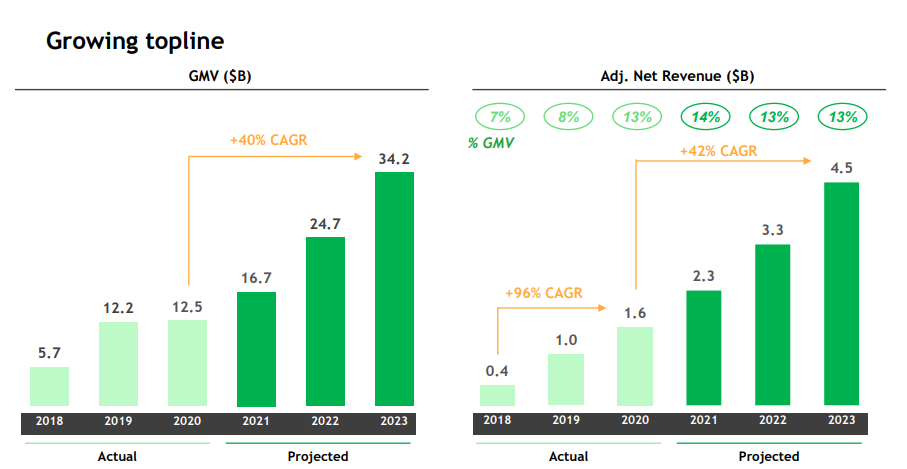

Klarna’s $640 million raise and its $45 billion valuation, and how its business model arbitrages the payments revenue pool to build a lending business

-

Pinduoduo’s growth path to a $150B marketcap, and the links between shopping, media, and financial mechanisms that help it compete with Alibaba

-

A comparison of approaches to growth and economics

-

Implications for crypto assets for capturing “the real economy”

Klarna is raising $640 million on a $45 billion private valuation, with over $1 billion in net operating income. The buy-now-pay-later company has over 90 million active customers and 250,000 merchants. It was founded in Sweden in 2005.

On the other side of the ocean, Chinese ecommerce company Pinduoduo is beating Alibaba with 820 million active buyers, generates over $3 billion in revenue per quarter, connects buyers to 12 million farmers, and has a market capitalization of $150 billion. It was founded in China in 2015.

This week, we look at:

-

The economics of Southeast Asia’s largest super-app and its $40 billion SPAC valuation

-

The industrial logic of building out financial features adjacent to the core business of transportation and delivery

-

Why this model has not worked for Uber, but has worked for Apple, and the broader impact on financial services.

This week, we look at:

-

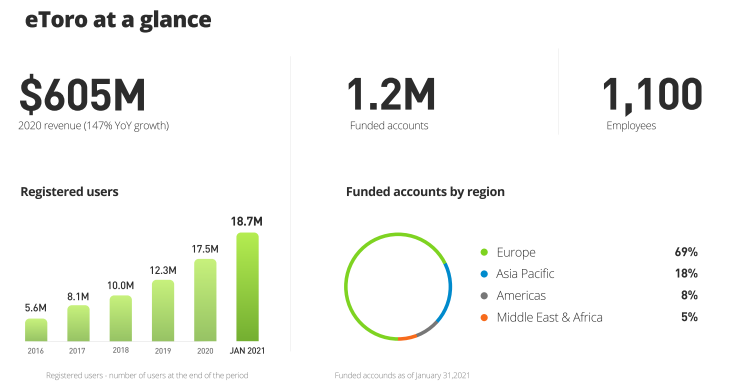

Chime, eToro, and Wise targeting the public markets through IPO and SPACs, and their operating performance

-

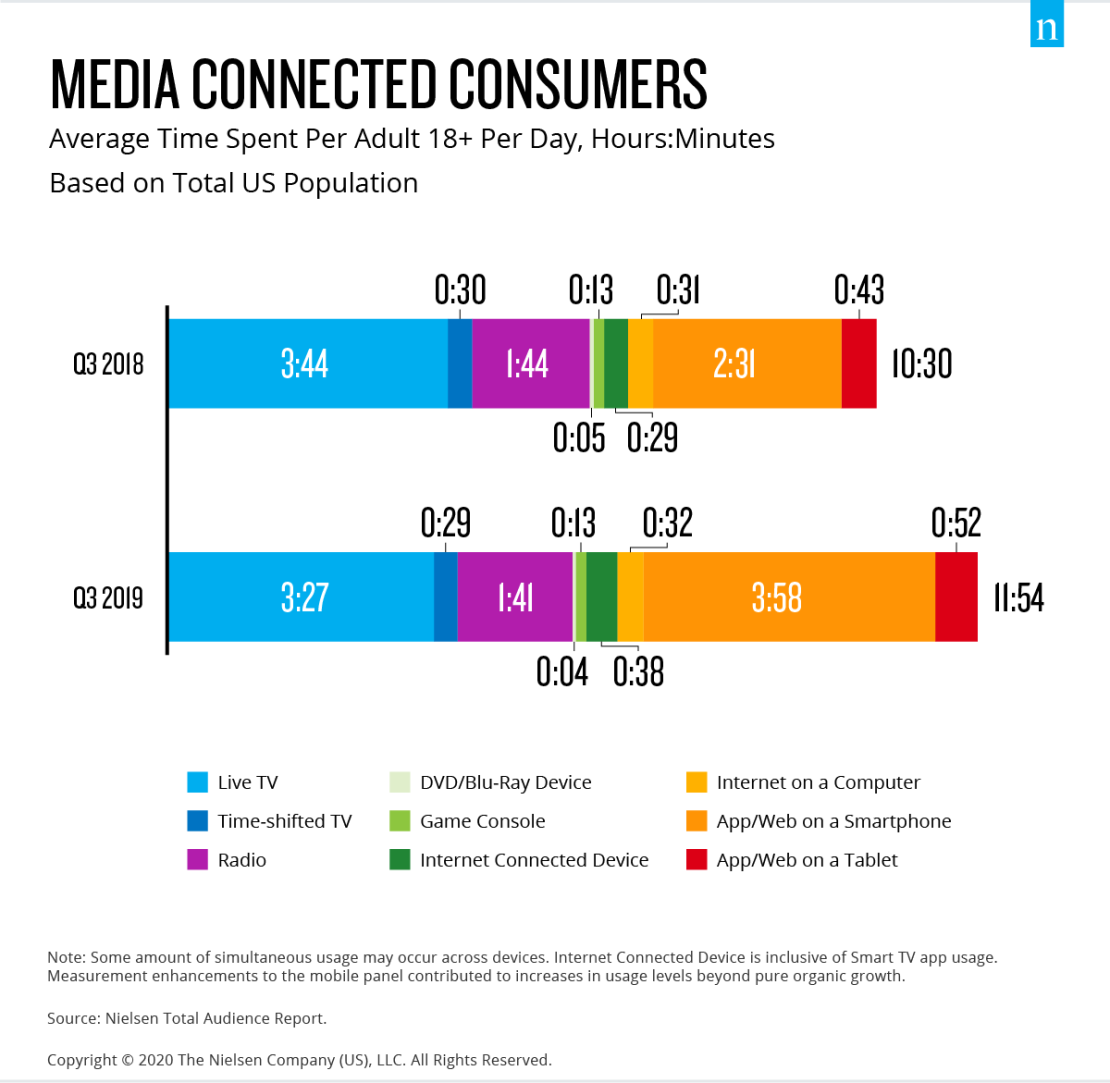

The overall growth in fintech mobile apps, their install rates and market penetration (from 2.5 to 3.5 per person), and whether that growth is sustainable

-

The implications for incumbents from this competition, and in particular the impact on money in motion vs. money at rest

-

Broader financial product penetration and an anchoring in how the technology industry was able to get more attention that we had to give

This week, we look at:

-

The $12 billion in cumulative SPAC capital focused on Fintech, of which $3.6 billion has been raised in 2021 Q1 alone

-

Analysis of the private and public financial services markets and their valuations of profitability and revenue

-

A deeper look at the fundamentals and business mix of SPAC targets MoneyLion, Payoneer, Apex Clearing, and SoFi

-

Not everything that glitters is gold

In this conversation, we talk with Brian Barnes of M1 Finance, about finance “super apps”, the cost-efficiencies of robo-advisors, fractionalized share trading, and tackling the titans of the Wealth Management industry. We also discuss the nuts and bolts of the financial infrastructure making this possible.

M1 Finance bundles together roboadvisory, neobanking and lending into a single “super app”, allowing for combined pricing power (i.e., charging nothing on asset allocation). The firm currently has $3 billion in AUM, a growth of 50% in the past four months and tripling their total in just over a year. Notably, the company has its own broker/dealer and offers fractional shares, and partners with Lincoln Savings bank on the deposit accounts. That makes for a compelling business model from securities lending, interchange, and order flow.

OCC, Treasury, IRS, BitLicense, Wyoming

OCC, Treasury, IRS, BitLicense, Wyoming

This week, we look at:

-

How banks and financial advisors have failed to deliver on $1 trillion in capital appreciation for their clients over the last 12 years

-

The role of bank regulators in the United States, and the tensions between state and federal agencies

-

How the OCC is laying the groundwork for national banks to custody crypto assets, bank stablecoin reserves, run blockchain nodes, and use crypto payment networks

And instead of financial advisors or other CFAs guiding the retail market in good decision making, a newsfeed of *what’s popular* has driven Apple, Google, Tesla and the other John Galt hallucinations to the stratosphere. Don’t get us wrong. We love the robot as much as the next Fintech commentator. But it is clear to us that “the masses” are not being “advised”. And that the capital appreciation that matters — cementing the next trillion dollar networks for global future generations in work yet to emerge — is misunderstood and misrepresented by most financial professionals to their clients.

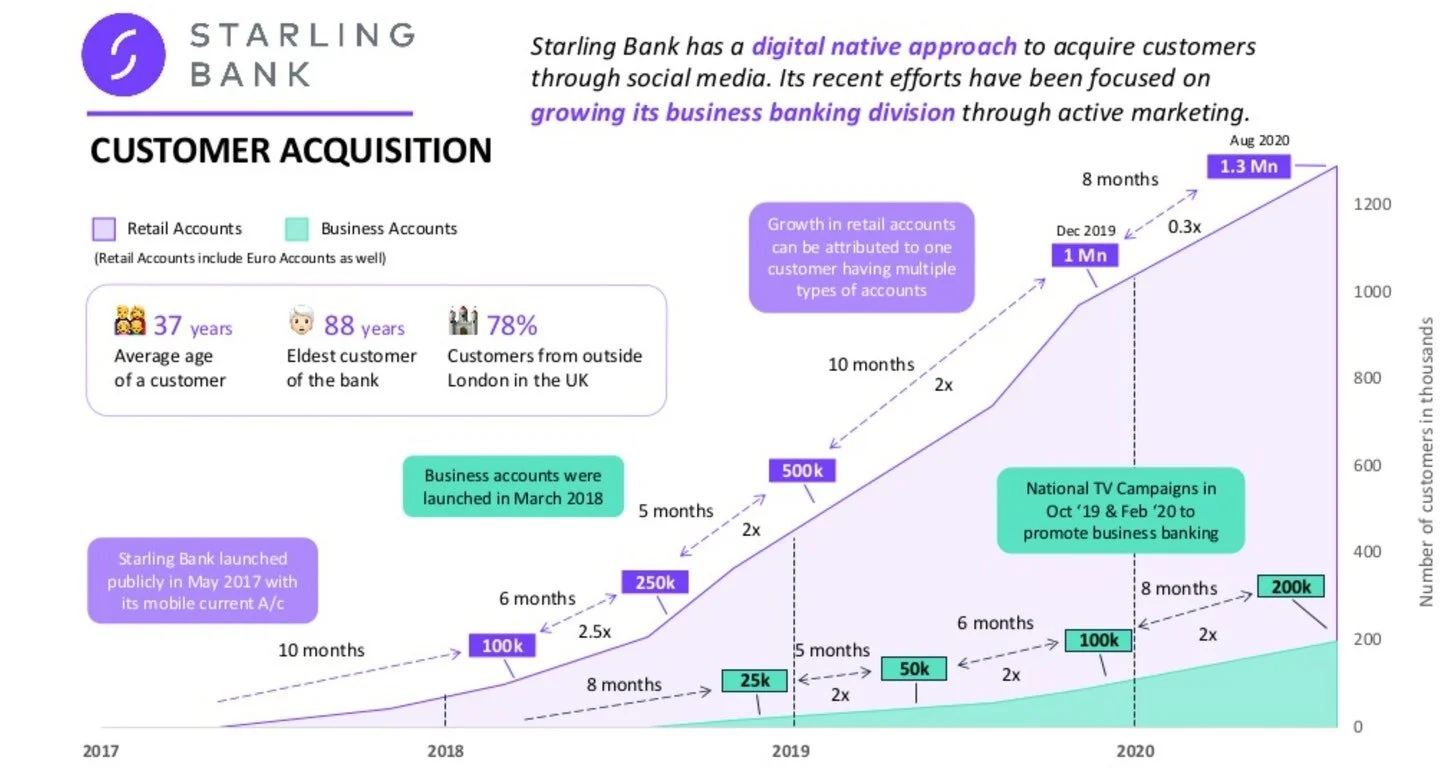

In this conversation, we talk with Anne Boden, the CEO of Starling Bank. Starling has just turned profitable, and reached several significant milestones in terms of 1.8 million clients, $4 billion in deposits, and $1.5 billion of lending.

That is quite meaningfully ahead of our model, and probably ahead of everyone’s model, of where neobanks would be in 2020. While COVID has accelerated the digital lifestyle, Anne credits deeper demographic, technology, and cultural insights and choices she has made in building Starling for success.

In this conversation, Will and I break down a few important pieces of recent news. MetaMask, the crypto wallet, hit 1 million month active users in yet another sign of the acceleration of retail adoption.

Square’s market cap is now equal to that of American Express, and the former also announced it has purchased $50 million of Bitcoin with its balance sheet. What do these pieces of news mean?

Greenwood Financial launched, a neobank led by Andrew J. Young, a civil rights legend, Killer Mike, a rapper and activist, and Ryan Glover, founder of Bounce TV network. How much scope is there for financial services for affinity groups instead of traditional geographical or product coverage areas?

This week, we look at:

-

PwC estimating that $900 billion has been wasted on digital transformation projects for enterprise, meaning finance is vulnerable

-

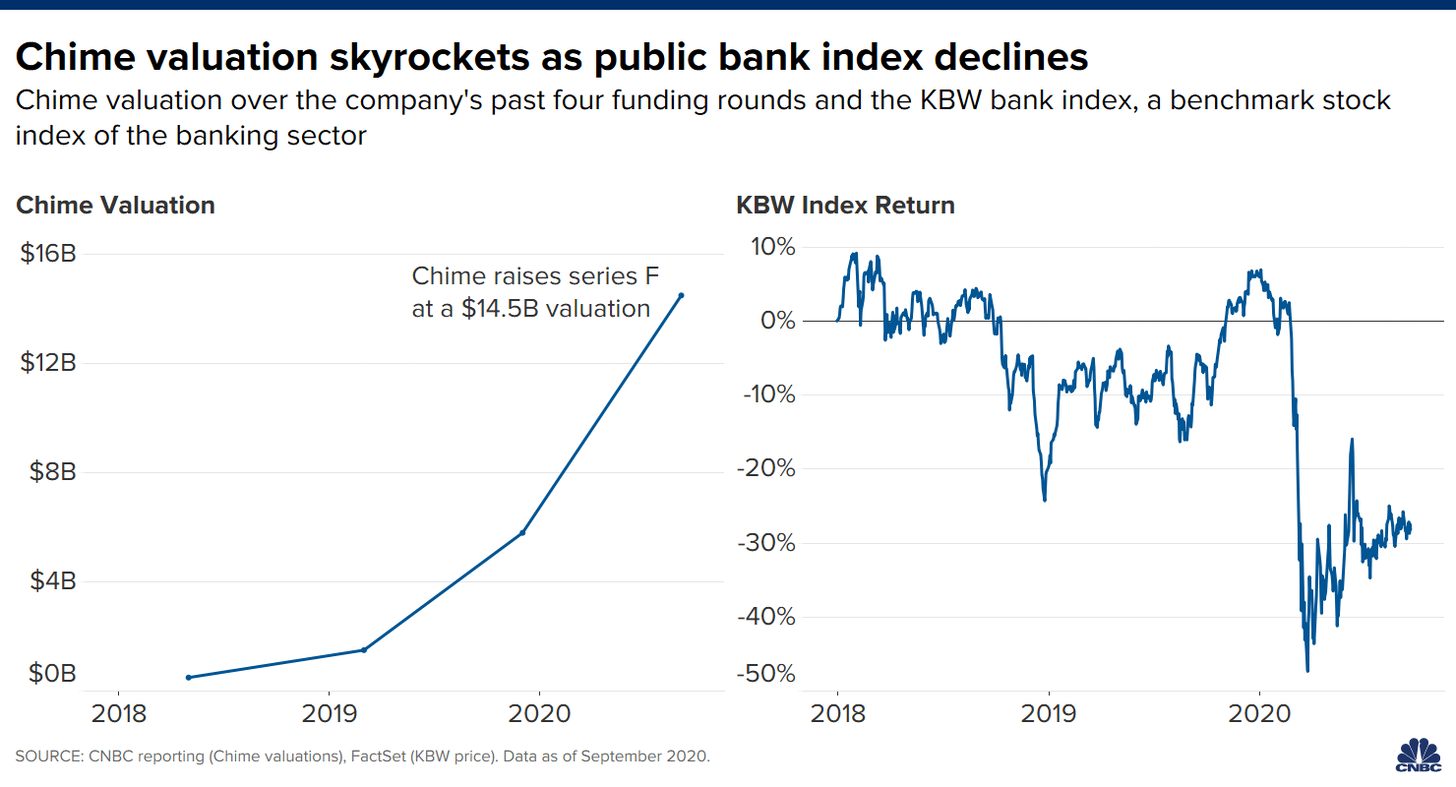

Chime is worth $15 billion in the latest round of valuation, same as $200B+ depository bank Fifth Third, which is quite the achievement

-

Decentralized exchange Uniswap distributing 60% of its token to the community, flipping the ownership and value accrual model

As a thought experiment — today, if you want to save for a house, you may create a financial plan in Betterment and wait for the portfolio to accrue. Tomorrow, you may bring cashflows to a housing protocol which intermediates property markets, and build your portfolio directly into your desired goal of buying a house. Your stated selection and articulation of that goal, by choosing the housing protocol, generates value on its own through rewards, participation, governance, and various interest rate products.

This week, we look at:

-

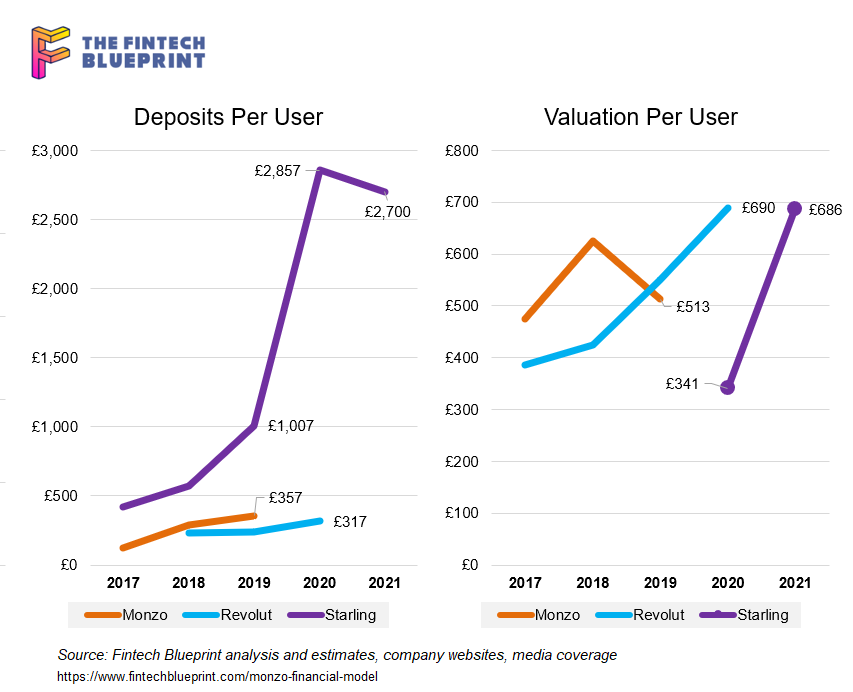

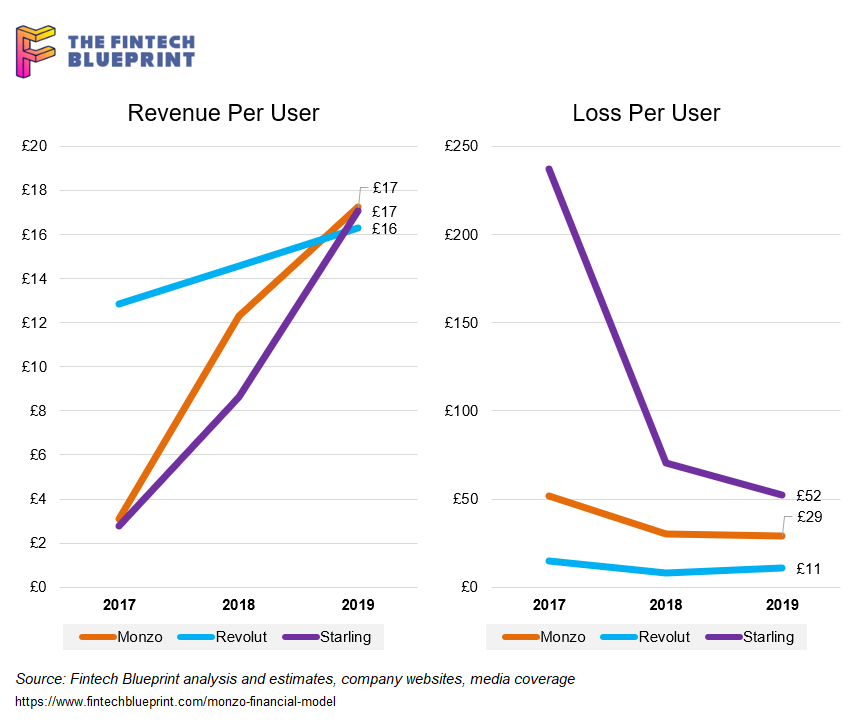

The financial model behind Monzo, and comparisons to Revolut and Starling

-

How the Eastern super apps inspired the marketplace model, and why that success is hard for neobanks to replicate

-

Paths from losing $100 million per year to break-even and enabling digital assets and other financial products

-

Facebook Financial forming to take over payments and commerce

In this conversation, we break down recently published annual reports from Revolut, Starling and Monzo, three of the leading European digital banks. There are some fascinating insights to be drawn from the documents, especially in the context of the broader global fintech market. This is rich subject matter, and we surely didn’t cover everything.

The tech companies will become the storefront to absolutely everything.

There is no Internet, there is only Google.

There is no commerce, there is only Amazon.

There is no finance, there is only WeChat / Tencent?

I don’t know about you, but I cannot pay for anything in cash in London anymore. COVID has made the city go cashless. For China, QR codes have long replaced the need for paper money. And if there is no cash, what is the point of ATMs, and ATM fees, and bank branches, and bank branch staff? Financial firms no longer need to be the place where you shop for financial product.

Mike Cagney is the Co-Founder and CEO of Figure, a full stack financial services blockchain company with consumer offerings in market or on the way in lending, banking and more. In late-2019, Figure raised $103 million at a $1.2 billion valuation and continues to grow.

Prior to starting Figure, Mike co-founded and ran SoFi, one of the most successful consumer fintech companies ever.

In this conversation, we discuss Figure’s routes to asset origination and capital markets disruption, Figure’s previously unannounced consumer banking and payments offering, lessons learned building and scaling multiple billion dollar companies and more.

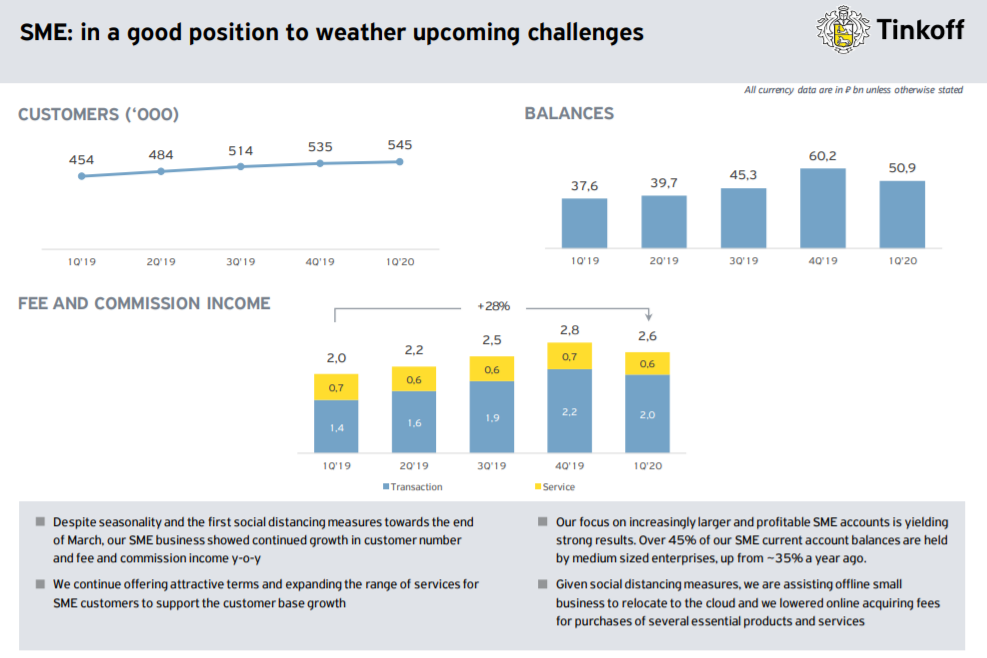

Oliver Hughes is the CEO of Tinkoff Group, one of the world’s most successful digital banking groups with over 10 million customers. This is one our most interesting conversation to date, full of fantastic operating advice.

Tinkoff is publicly listed with a $3.8 billion market capitalization, which brings clarity to its operating model in a time when many noteworthy consumer digital banks are pursuing customer acquisition at the expense of profitability.

Oliver has led Tinkoff through three financial crises, and brings experience and perspective to the current COVID crisis. This is a fascinating discussion about unit economics in digital banking and winning business models with a CEO with thirteen years of experience in this space.

Varo, Marqeta, Stackin, Gen Z, Fiserv, Jack Henry, Curve, Tinkoff, TikTok, LendingTree

Varo, Marqeta, Stackin, Gen Z, Fiserv, Jack Henry, Curve, Tinkoff, TikTok, LendingTree

Today, we talk through a few recent events that are indicative of what’s important in fintech right now.

Varo raised $241 million in preparation to start operating under its own banking license later this year. Is a banking license an asset or a liability if you’re a digital bank?

Marqeta is reportedly now valued at $4.3 billion, as banking-as-a-service continues its mature.

And LA-based fintech Stackin’ raised $13 million to scale its messaging-based offering designed to help Gen Z find the right fintech. What should we make of this?

ARK Invest, Square, Venmo, WeChat Pay, Ant Financial, Samsung, Apple, Goldman Sachs, Zelle, PayPal, N26, Bitcoin, Gen Z

ARK Invest, Square, Venmo, WeChat Pay, Ant Financial, Samsung, Apple, Goldman Sachs, Zelle, PayPal, N26, Bitcoin, Gen Z

Welcome back to the Fintech Blueprint / Rebank podcast series hosted by Will Beeson and Lex Sokolin. Max Friedrich is a fintech analyst a ARK Invest, a public markets investment manager focused on disruptive technologies including autonomous tech, robotics, fintech, genomics and next generation internet. Max recently published a report on digital wallets, including Venmo and Square’s Cash App, which is available for download on ARK’s website. In this conversation, we explain why Cash App has seen exponential growth.

Welcome back to the Fintech Blueprint / Rebank podcast series hosted by Will Beeson and Lex Sokolin. In this episode, we talk through a few recent events that are indicative of the Fintech world right now. Brex raised an additional $150 million at a slightly improved valuation vs. its last round just as Monzo is reportedly looking at a 40% down round. Why? Shopify launched bank accounts for its merchants and announced the Shop app, basically an Amazon competitor plus Klarna, just as it worked with Facebook to support the launch of Facebook Shops and joined the Libra Association. Lots going on. Lastly, we discuss why Goldman’s M&A activity over the past couple years leads to the natural conclusion that they should buy Schwab.

This week, we put on the Goldman hat and go shopping for companies. We buy a little bit of Folio and sell some Motif. We look at Personal Capital and the $1 billion it wants for its $12 billion of assets. We examine the private markets with Addepar / iCapital and SharesPost / Forge, and then move over to the banking sector. Should we buy Wells Fargo, as rumored, or some digital wallet apps? Read on for how to acquire a best-in-class Fintech.

Today we’re joined by Brett King, founder and executive chairman of Moven, one of the world’s original digital banks, and Lex Sokolin, global head of fintech at ConsenSys. Lex and I discussed Moven’s recent announcement to shutter its B2C business on episode 170 of Rebank. And we’re happy to have the opportunity to connect with Brett directly to discuss the decision in more detail.

This week, we look at Betterment launching a bank account and payments feature. They are not the first, but they could be the best! Still, it feels like the world has moved on. Barriers to entry around digital finance have collapsed, and shifted industry goal posts. Hundreds of companies are integrating API-based solutions that connect to banking and investment entities. Amazon, Google, and Apple are there already. And let’s not forget the incredible pressure from the COVID recession: 20MM+ unemployed, $100 billion decrease in global remittances, 1 in 8 banks being unprofitable. Is it time for incremental improvement, or a sea change?

We look at why venture capital investors are slowing down, and the dynamics of how their portfolios work under duress. We talk about the incentives of limited partners to derisk exposure, the implication that has on cash reserves, new deals, and fundraising. We also touch on how the various Fintech themes are responding to an increase in digital interaction while seeing fundamental economic challenges. Shrewd competitors will be able to consolidate their positions and gain share during the crisis, but that will have to come from the balance sheet, not intermittent growth equity checks.