In April 2018, LendingClub provided us with $5,000 to open a brand new account. Since then we have been chronicling the status of the account on a quarterly basis. Below are links to the full series of blog posts in chronological order:

- How to Open Up a New LendingClub Account in 2018

- Setting Up LendingClub’s Automated Investing Tool

- New LendingClub Account Performance – Q2 2018

- New LendingClub Account Performance – Q3 2018

- New LendingClub Account Performance – Q4 2018

No More E-Grade Loans at LendingClub

Before we get into the performance of the account I’d like to discuss a few changes that LendingClub has made since our last update. Probably the most significant news was that as of May 7, 2019 LendingClub stopped offering new grade E notes except those corresponding to certain previously qualified or approved loans. Beginning July 1, 2019 no grade E Notes will be available to investors. Long time readers will remember the days when E grade loans produced high returns, often over 10% annualized for investors. This changed in recent years as defaults increased, particularly around the higher grade loans. Most investors saw their returns begin to fall in mid-2016 or even before that.

Last year, LendingClub decided to stop offering F & G grade loans to investors so it is no surprise that they continue to focus on more prime consumers, especially when you consider that banks make up a majority of their investor base. LendingClub also included this statement in a recent blog post:

We view this change as a natural evolution of our dynamic platform that seeks to match consumer demand with investor risk appetite. Grade E loans have historically accounted for a small percentage of volume on the platform.

What’s also interesting is that last week during LendingClub’s Q1 2019 earnings call which we covered here, CEO Scott Sanborn discussed the possibility of partnering with institutional investors on expanding the credit box to riskier borrowers. The way this might work is that LendingClub would host an alternative credit model instead of their own, for instance a model targeting thin file borrowers. Then investors could invest in loans originated by this third party with LendingClub only facilitating these transactions. But that is probably some time away from happening.

In LendingClub’s Q1 2019 platform update published to their blog, they discussed that lenders as a group continue to tighten credit. They also shared news about new tools they are testing such as the ability to detect borrowers who are more likely to default earlier in the loan cycle. LendingClub made no interest rate changes in the quarter, but are continuing to selectively tighten certain higher risk segments, while simultaneously growing lower risk segments.

Update on New LendingClub Account

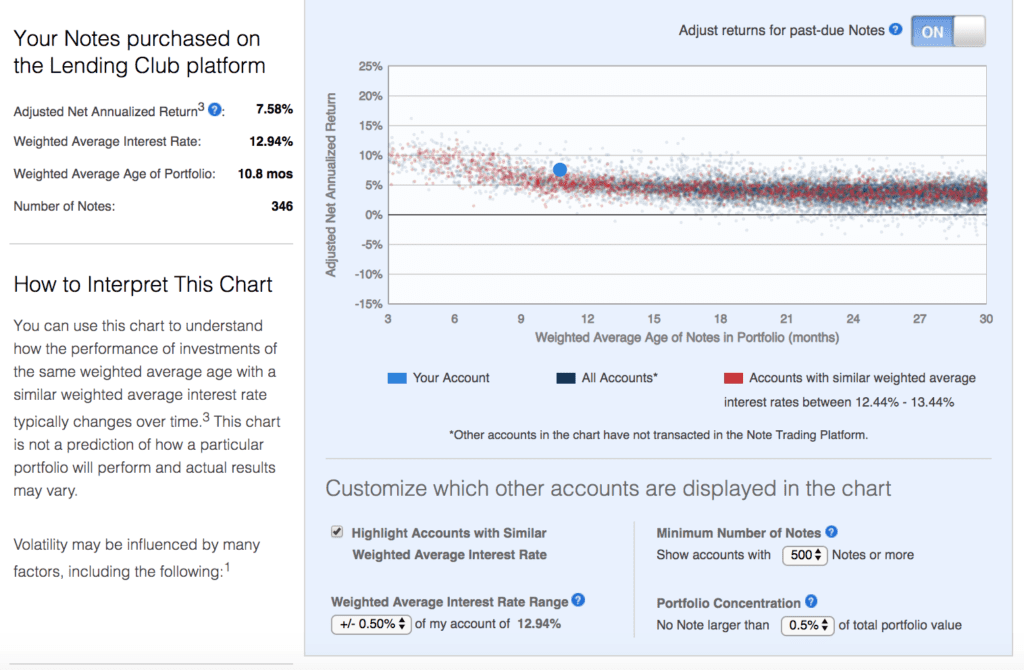

Digging into the account’s performance it is worth reiterating that investors don’t have a clear picture of returns until the account is seasoned, which is about 18 months weighted average age. This is demonstrated in the image below as stated returns continue to decrease with age and stabilize around the 18 month mark.

The capital in my account had not been fully deployed at the end of the first quarter of 2018. In our next quarterly report we will share returns using XIRR which will start to give us an idea of where returns will fall.

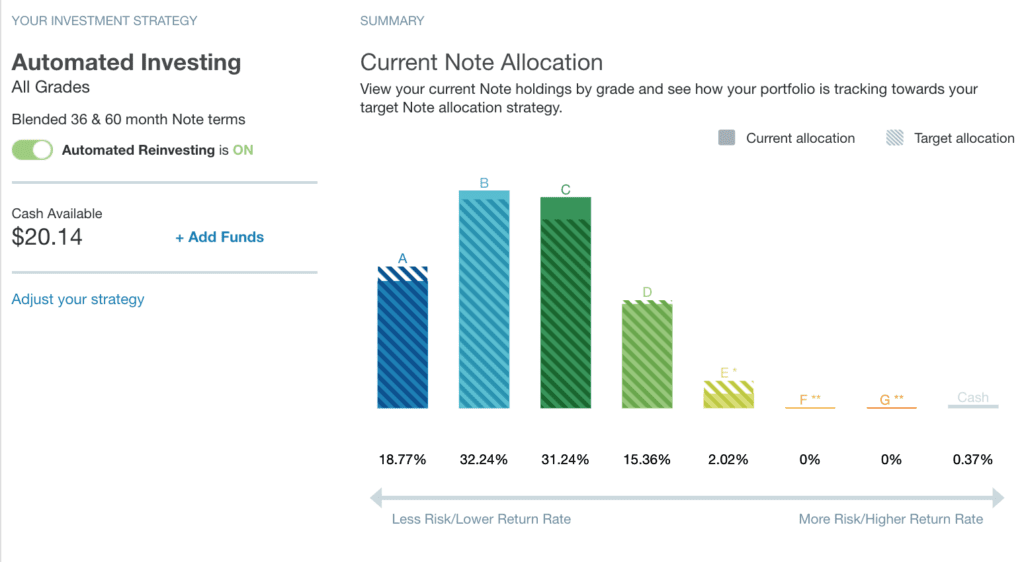

When I first created this account I used LendingClub’s Automated Investing which suggested the allocation below. You’ll note the small allocation to E grade loans which will eventually fall to 0% as loans start getting paid off.

Conclusion

It will be interesting to see where the returns on this account end up falling. With little changes to interest rates recently, LendingClub is still an attractive investment in my opinion with returns around 6-7%. For comparison, interest rates on 5 year CDs are now around 3%. One thing that surely attracted investors who found LendingClub before 2015 was the potential to earn 10%. With the removal of E, F and G grade loans this is something that would be nearly impossible to achieve today. Clearly LendingClub has made it clear the types of borrowers they want to focus on.