CommonBond focuses on helping those with student loans better manage their debt. Earlier this week they released an interesting study which aimed to answer questions around employee financial wellness.

It’s worth noting that partnerships between fintechs and employers is not a new development. I first wrote about it in September 2016 which included the announcement of CommonBond acquiring a company called Gradible which enables employers to help with employees’ student loan repayment. Both Credible and SoFi have also announced efforts in partnering with employers.

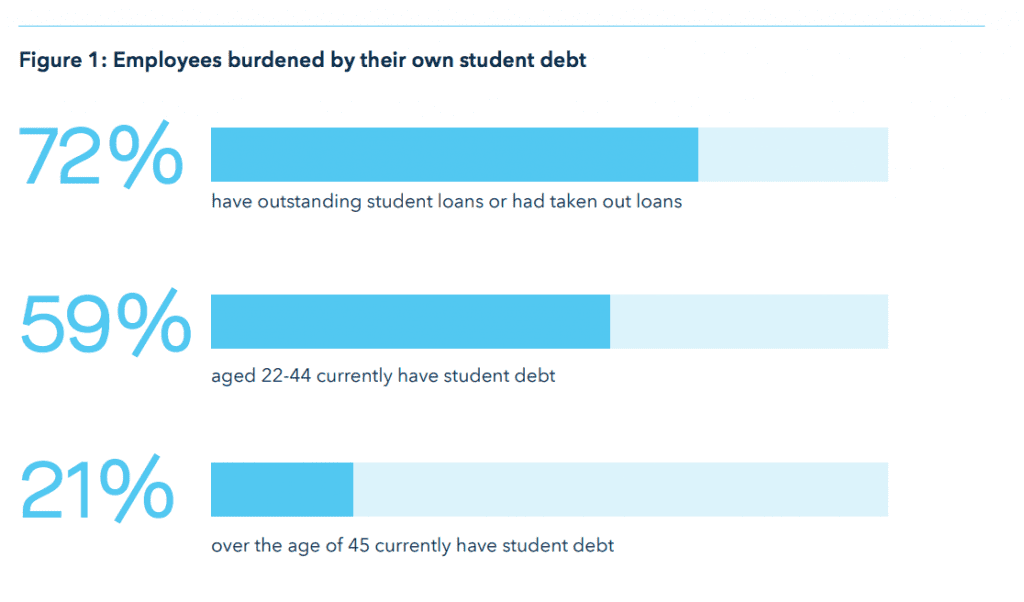

It is well known at this point that student loans are top of mind for new graduates. However, the burden of student debt is multi generational as CommonBond found with the results of their study.

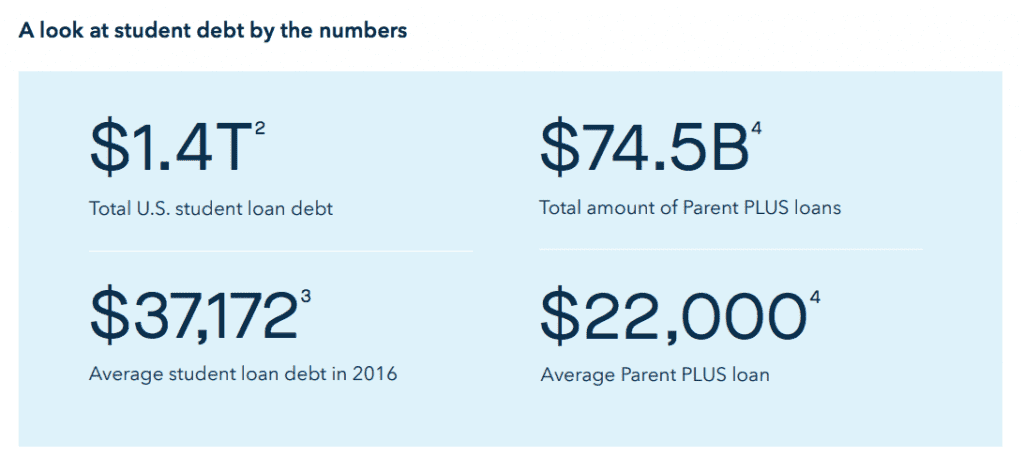

The market for student loans has continued to climb. According to data from CommonBond, 44 million Americans currently owe $1.4 trillion in student debt with the average student loan debt in 2016 coming in at $37,172.

CommonBond’s Findings

CommonBond’s study included 1,500 workers and 500 human resource executives. Their key findings as provided in their press release are copied below

- Student debt cuts across all age groups, including parents who are taking out loans for their children. Almost 75 percent of all workers have taken out loans to fund their own education, while 21 percent of workers expect to take out a loan for a child or other family member’s education in the next five years. This debt has a serious impact on well-being: employees with student debt were nearly twice as likely to be stressed about their personal finances.

- Human resources executives prioritize benefits for employees without student debt.For employees with student debt, student loan repayment is the most-requested financial wellness benefit; however, human resources teams rank student loan repayment as their third priority.

- Employees do not think their benefits are as innovative as human resources executives believe. Seventy-one percent of human resources executives see their benefits offering as innovative, compared with 50 percent of employees.

- Student loan benefits attract talent, retain employees, and improve work performance. Seventy-eight percent of employees with current or future student loan debt want their employer to offer this benefit, and 65 percent of employees over age 55 in these categories want the same.

Clearly there is a lot of work to be done from an employers perspective in meeting the needs of their employees. There is a disconnect between HR departments and what employees desire and there is certainly a balancing act from the employers perspective of providing a wide range of benefits to their employees.

As I mentioned earlier, the partnering with employers is an area that CommonBond has been focused on for some time. They now have 250 partners in their CommonBond for Business platform. If you are interested in learning more about the insights from CommonBond’s study you can download the full version of the white paper here.