Today, a new global report was released from Nasdaq and Oliver Wyman on illicit money flows and the numbers are sobering.

The Global Financial Crime Report quantifies the total amount of illicit financial activity and the number is an eye-popping $3.1 trillion. Included in this number is bank fraud covering payments, checks and credit card fraud which is estimated at around $450 billion.

We haven't talked about crypto for a while in this newsletter. Coinbase reported earnings yesterday so this provides a perfect opportunity to reflect on the state of crypto.

Fintech Nexus Newsletter (March 14, 2024): Two fintechs are thriving one year on from the SVB crisis

This week marks one year since many fintechs thought their world was ending.

Almost every venture-backed fintech company banked with Silicon Valley Bank and for three harrowing days last March, many wondered if all their non-FDIC-insured money sitting at Silicon Valley Bank would be safe.

The SEC has not had a great track record in court cases against crypto firms in the last few months. And another important case is playing out right now in a New York federal courtroom.

Back in June of last year the SEC sued Coinbase arguing that it was operating illegally and that it should register as an exchange and be overseen by the SEC.

With the trial of Sam Bankman-Fried in the spotlight last month it is easy to forget that there is still the massive FTX bankruptcy that has to be sorted out.

The next step in that process has now been revealed in the form of a proposal. At this stage, it is just a proposal that must be approved by creditors before it can go to the bankruptcy judge. But the major creditor and consumer groups have agreed to the plan outline.

As the price of bitcoin goes, so goes Coinbase.

Bitcoin hit an all-time high in the first quarter, and Coinbase reported its best-ever results. The company made $1.18 billion in net income on total revenue of $1.64 billion. Those are impressive numbers, any way you look at them.

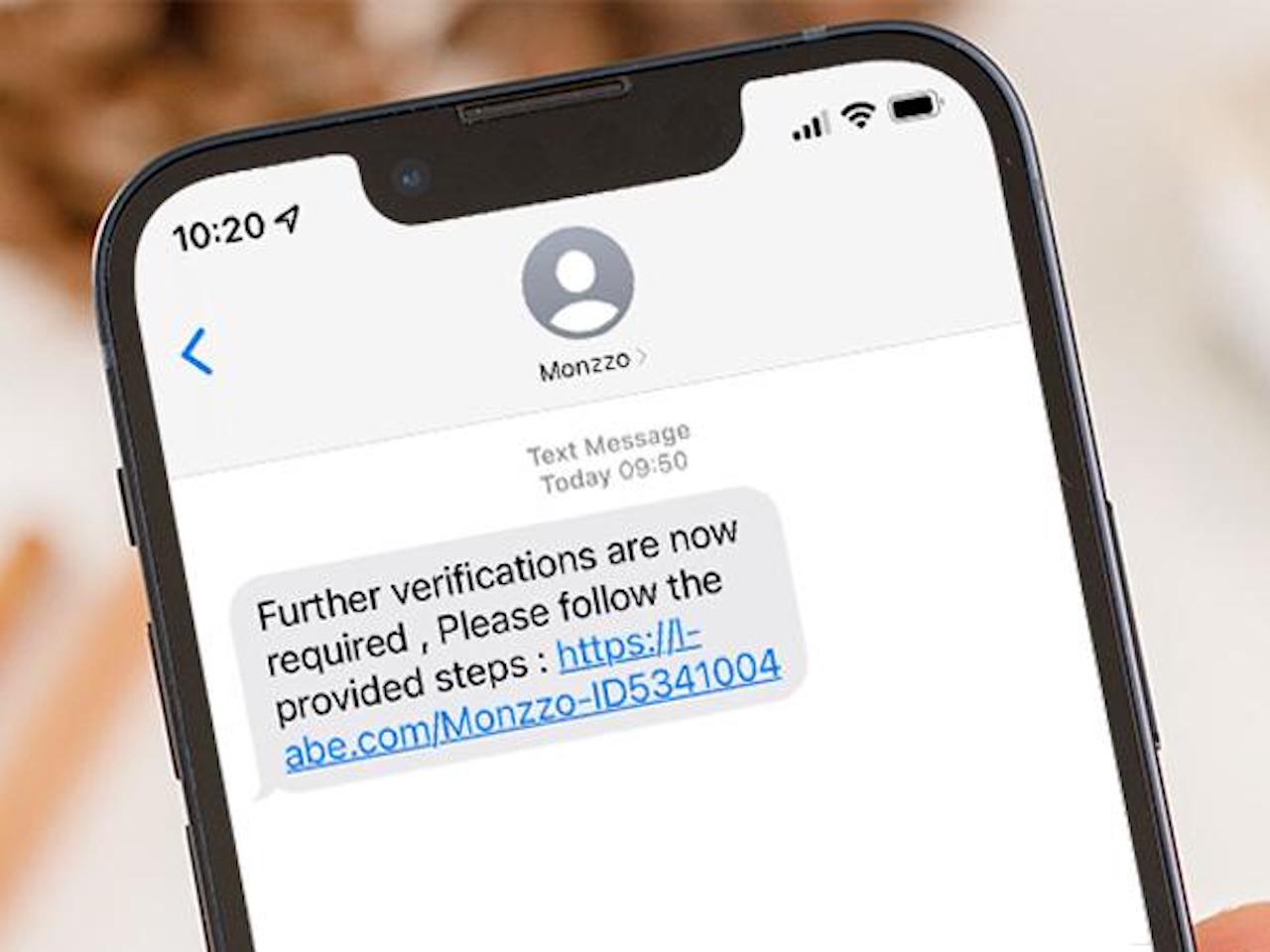

In lieu of a solution that stops the crimes from happening in the first place, bank reimbursement is the only source of protection.

We are almost one year removed from the banking crisis precipitated by the struggles at Silicon Valley Bank.

Now, another bank is having its own struggles. New York Community Bank (NYCB) has announced a new CEO and discovered "material weaknesses" in some of its internal procedures.

The Synapse debacle continues.

Former FDIC Chair Jelena McWilliams is the court-appointed trustee managing the bankruptcy process. She was appointed on May 24.

Late yesterday, we heard the news that Onfido, a pioneer in ID verification used by banks and fintechs all over the world, is going to be acquired by Entrust, a diversified security and verification company.