The fintech ecosystem in Latin America and the Caribbean has doubled in size in the past three years, with trends showing signs of maturity.

With a focus on money education, fintech companies have a renewed sense of purpose in creating greater financial inclusion for all.

Notes from the launch party: ARK Invest is launching a fund for retail investors in partnership with Titan

·

The lawsuit against Navy Federal has financial institutions revisiting their fair lending practices and considering how AI fits in.

Despite the risks commonly cited by market participants, trading desks can leverage sensitive information to their advantage while complying with regulations and protecting that data.

Fintechs lose 50% of new accounts within the first year, according to Digital Onboarding SVP Adam Westley: Money walks right out the door.

A comprehensive 380-page document was released that explained the policy and future legislation.

·

Lendbuzz blends its founders’ early experiences with AI to disrupt traditional assessment methods and widen the pool of credit-worthy individuals.

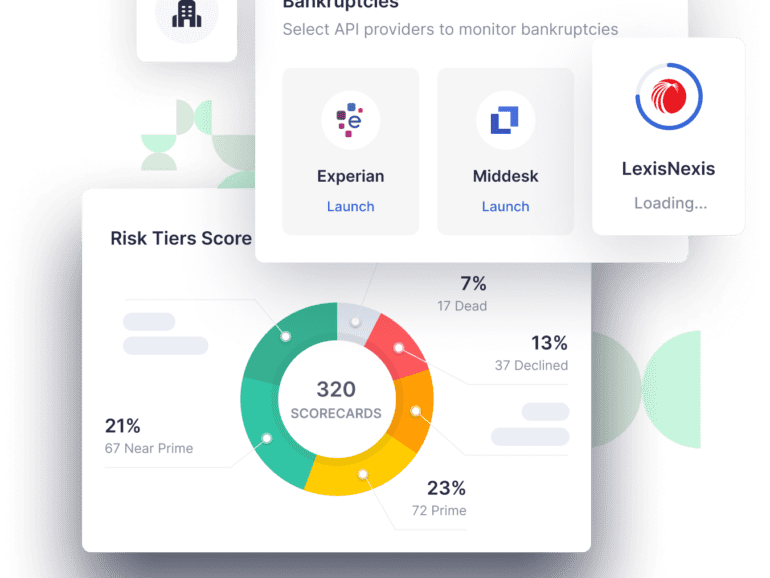

SMB lender Lendflow announced a partnership with Ocrolus to determine borrowers' viability and provide critical access to capital.

Embedded lending services provider Lendflow this week announced its new Credit Decisioning Engine that enables fintechs and vertical SaaS companies to build, embed and launch credit products