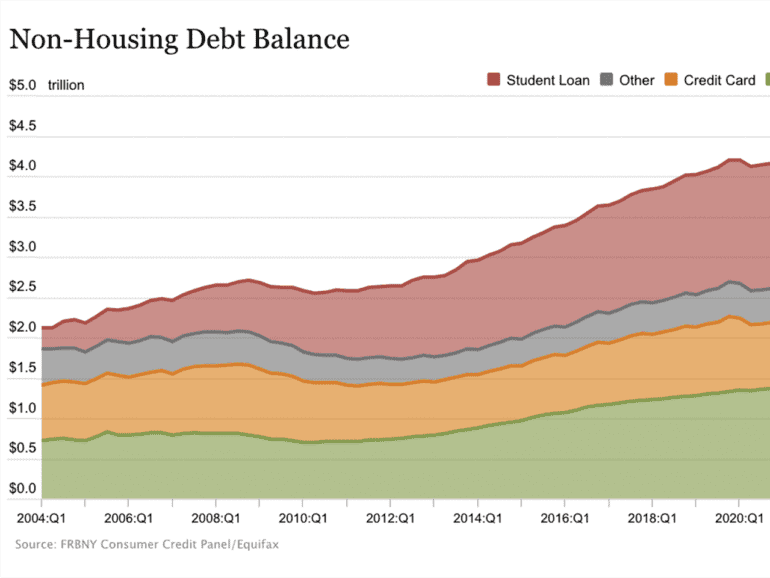

A New York Fed report shows Americans leaned heavily on their credit cards in June to offset growing financial pressures from inflation.

As Banking-as-a-Service develops into Embedded Finance, who holds the responsibility of compliance gets decidedly murky.

The DeFi regulatory landscape is experiencing a shift, and it seems, no-one is safe. Compliance is becoming ever more challenging.

Many companies use artificial intelligence and machine learning to deliver services in consumer fintech, but TIFIN uses those tools to drive the personalization of wealth management

The aid world’s drastic reconfiguring may have profound long-term effects on what makes for common sense within the fintech sector. ...

Many people have called Capital One the original fintech.

Founded in 1994 by Richard Fairbanks and Nigel Morris (of QED) Capital One broke new ground as a monoline credit card bank that married technology and data science before that was a thing in banking.

Fintech Nexus Newsletter (March 14, 2024): Two fintechs are thriving one year on from the SVB crisis

This week marks one year since many fintechs thought their world was ending.

Almost every venture-backed fintech company banked with Silicon Valley Bank and for three harrowing days last March, many wondered if all their non-FDIC-insured money sitting at Silicon Valley Bank would be safe.

·

The health-related benefits driving the move-to-earn economy are clear - but can it push past its 2022 crypto hype spike.

·

In today’s rate-shopping environment, it is important for Americans to be able to accurately compare credit products and make the best possible decisions for their financial future.

The correlation between stocks and crypto has increased over time as more institutional investors have invested in crypto.