In many ways, the dot-com bubble is similar to the current scenario in the blockchain-cryptocurrency industry.

Entry into the real estate market is challenging for younger generations. For those who are "crypto native" perhaps there are options.

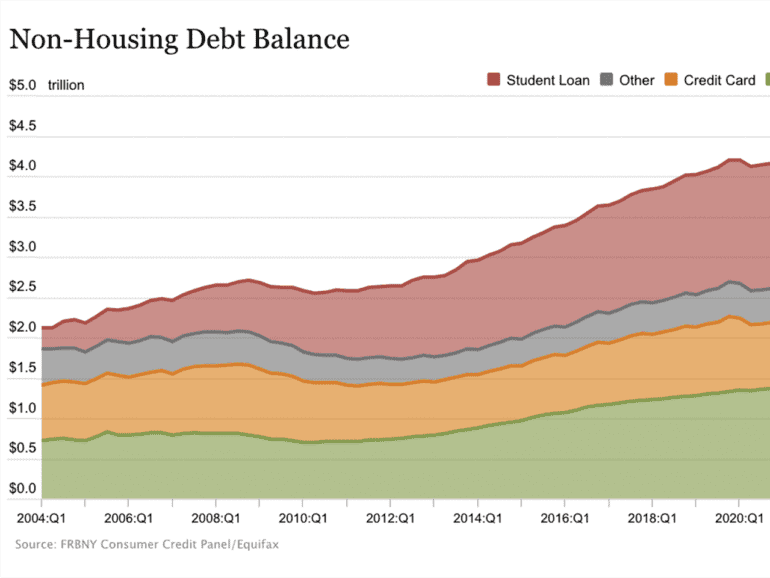

A New York Fed report shows Americans leaned heavily on their credit cards in June to offset growing financial pressures from inflation.

The financial services industry's approach to third-party risk management is changing in response to an increasingly complex environment.

With a focus on money education, fintech companies have a renewed sense of purpose in creating greater financial inclusion for all.

Stablecoins play an essential role in the crypto-asset ecosystem, although it does pose risks to market liquidity if they fail.

·

Environmental concerns drive many to reject the idea of CBDCs but research suggests they could actually be an improvement.

SMEs have been buffeted by the winds of COVID-19 and heightened inflation, and now comes the storm of political instability.

DeFi could be critical in creating effective carbon credit markets to meet COP26 goals by targeting issues in coordination and monitoring.

Security throughout the DeFi lifecycle remains a real challenge to mainstream adoption, and it is key to the market reaching its full potential.