We had an update from the Federal Reserve on FedNow this week. There are now 400 banks participating in the instant payments network as either a sender or receiver.

They launched last July with 35 institutions and have been growing steadily since then. The last public statement that I have heard was when FedNow chief, Mark Gould, spoke at the American Fintech Council's Policy Summit in November when they had 200 banks on the platform.

Celsius CEO Alex Mashinsky resigned on Tuesday, three months after the crypto lending scheme lost investors billions.

Marco, a fintech startup lending to exporters in Latin America, secured a $200 million line to expand its financing business.

Thursday afternoon, the Boston Federal Reserve and MIT Digital Currency Initiative (DCI) released Phase 1 of Project Hamilton.

As open data is seen as a necessity moving into the digital age, consumer permissioned data could be the key to manage privacy concerns.

By Peter Renton Since Visa announced late Monday their new $100 million fund focused on generative AI startups much has been written....

DAOs are the decentralized organizations running the Web3 space; despite legal uncertainty and general confusion, they pose new organisation structures that could disrupt society's entire ecosystem.

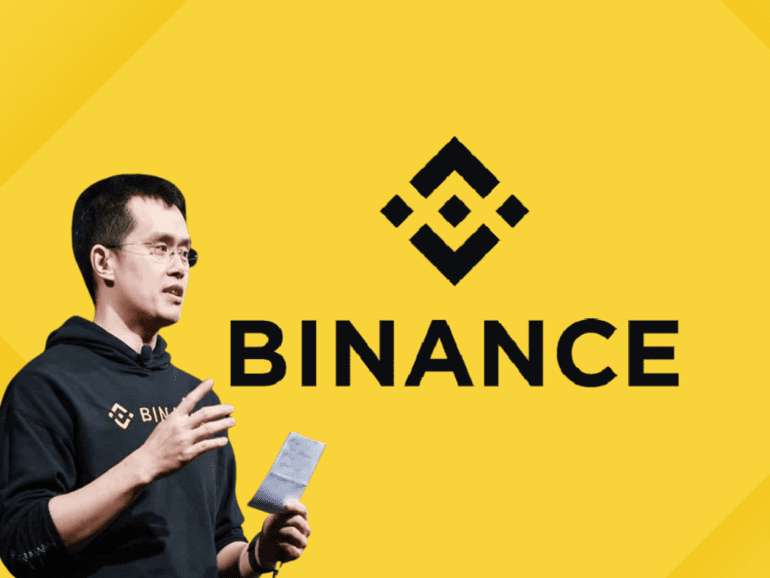

On Monday, Changpeng Zhao of Binance took to Twitter to talk about the failed FTX bailout and what the crypto industry can expect next.

This fall's looming student debt crisis will bring the worst environment we've seen in decades. Candidly founder and CEO Laurel Taylor said there's a way out for many, but few people are aware of it.

As August comes to a close, Metaplex, a Solana NFT platform, announced it surpassed $1 billion in direct NFT sales after one year.