This week saw Plaid announce a new instant payments product, Visa is getting into P2P payments, venture capital funding for Q1, the CFPB director wants changes in bank supervision and we find out more details about Paze.

·

John Mack is a legend on Wall Street. He worked his way up through the ranks of Morgan Stanley and...

Nubank is the top receiver of customer data, outlining fintech's significant opportunities in Open Finance in Brazil.

BlueVine added new features to their business profile dashboard, like Quickbooks integration, and 1.2% interest on balances up to $100,000.

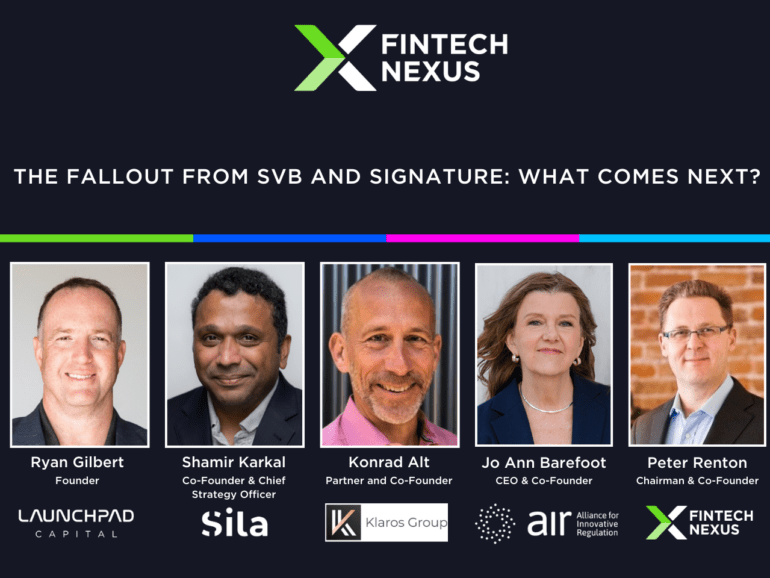

A week on from Silicon Valley Bank's fall, Fintech Nexus hosted a webinar to discuss what happened and what's next for the institution.

Nubank announced a $150 million loan from the International Finance Corporation as it seeks to strengthen its presence outside of Brazil.

Fintech is hot right now, that will not be news to many readers. While this publication is the longest continuously...

Total UK fintech investment dropped to $9.6 billion in the first half of 2022, down almost threefold from $27.8 billion in the same period in 2021, according to KPMG's Pulse of Fintech, a biannual report on fintech investment trends.

We have been following the recent developments in real-time payments with some interest. While adoption is increasing it is not going as fast as many industry observers had hoped.

OCR Labs Global claims it is the first company to independently verify that its identification verification software has been certified bias-free.