In the declining European economy, teetering on the edge of recession, some say fintech could be the answer to its woes.

However, performance varies wildly between the countries, and Spain possibly isn’t the first place that comes to mind regarding Europe fintech.

Despite holding one of the largest economies in Europe and its capital recognized by some as a “thriving startup hub,” its fintech performance is decidedly average. McKinsey ranked the country in its recent “Europe’s Fintech Opportunity” report.

However, perceived by some as a natural point of expansion for the booming LatAm market into Europe, perhaps Spain should not be overlooked.

“Spain is a country where there is a great investment opportunity for foreign funds,” said Arturo Gonzalez, President of the Spanish Association for Fintech and Insuretech (AEFI). “There is a lot of talent, a lot of capacity for execution, a lot of capacity for innovation. We have to improve valuations, but while this is bad for companies, it is an opportunity for investors.”

Barriers to growth may lie in regulation

This being said, if there are so many advantages, why isn’t the sector racing ahead?

For Gonzalez, the problem is primarily regulatory.

“To date, there have been a series of bureaucratic barriers that make setting up any kind of company in Spain a more complicated process than in other countries,” he said. “Important steps are being taken there, however, and there are a couple of laws that are being processed and will facilitate the creation of a startup.”

This has made it particularly difficult for teams to set up in the country. With Portugal, its neighbor, positioning itself as a major fintech development hub, growth rates in the sector may have been restricted.

However, in 2020, the country adopted a law to support the digital transformation of the financial system. With it came the establishment of a regulatory sandbox which, although reasonably early in its application to the system, could affect the future landscape.

Gonzalez explained that increased agility in regulation could make a significant difference to the market.

Growth continues despite challenges

Despite the regulatory landscape restricting growth compared to its geographical neighbors, growth is happening, especially in specific sectors.

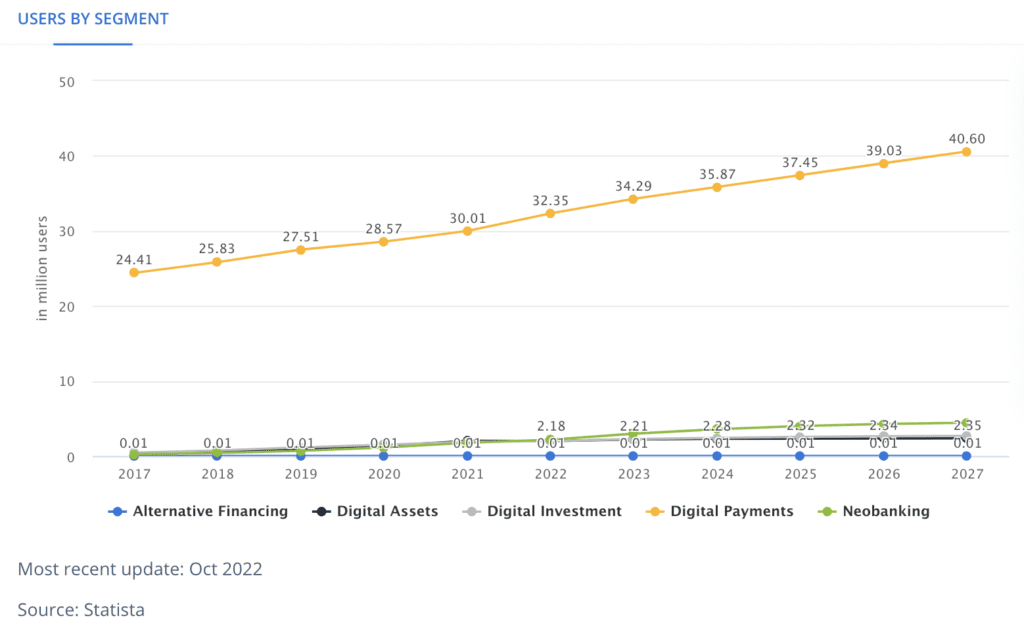

According to Statista, the Spanish neobanking sector is expected to show a revenue growth of 50.7% in 2023. Other reports have shown that already, the challenger banks make up 30% of the Spanish banking sector. Neobanking and Digital Payments have seen consistent transaction growth, and adoption of the two areas is projected to continue growing despite macroeconomic conditions.

Adoption of fintech as a whole, while lower than other European fintech hubs, is also steadily increasing. Ernest and Young ranked the country as 21st worldwide for adoption. According to MFAT, a lot of this adoption has been driven by the banking sector’s collaboration with fintechs and long-established innovation hubs within leading traditional banks.

Nevertheless, various reports state that the country is late to the fintech wave, which has resulted in stunted valuations and company sizes. Spain is in the process of catching up. While the government’s 2021 Entrepreneurial Nation Strategy is ambitious and extensive, the effects may still not be realized until the decade’s end.

A bridge with LatAm

A particular advantage for Spanish fintech is its bridge with LatAm.

South America is experiencing considerable growth in fintech, and many companies within the Spanish financial system already have bases across the pond. The continued development of fintech in LatAm could have knock-on effects on the Spanish ecosystem.

“Latin America is going to take the lead over Europe in not many years,” said Gonzalez. “Europe is very good at innovating legislatively, but there are 27 member states that have to agree on the application of the legislation. The consequence of this is that there is often no uniformity in the application of legislation. Thus a genuine single market, a strategic objective of the European Union, is not created. “

“In Latin America, what is often done is to copy the European legislative framework, but implement it country by country where there is a regulator that says this is going to be the case and pushes it with all its might and then, in the end, the adoption is faster and times even better.”

He explained that the continent is a natural area of growth for any Spanish business that aims to become international. At times even favored over other European markets for expansion.

“Spain is a very good bridge for Latin American and American companies to enter Europe. It could be very attractive to investors as a country with a great capacity to generate talent, ideas, and innovation. Our natural outlet is Latin America, so I think a crossroads of opportunities in both directions is very interesting.”