OnDeck’s Q2 financial results included a handful of interesting updates from the company, but the news of losing JPMorgan Chase as a partner overshadowed any positive news coming out of last quarter. Today the company announced their Q3 2019 financial results which investors have responded positively to, sending the stock up 15% at the time of this writing.

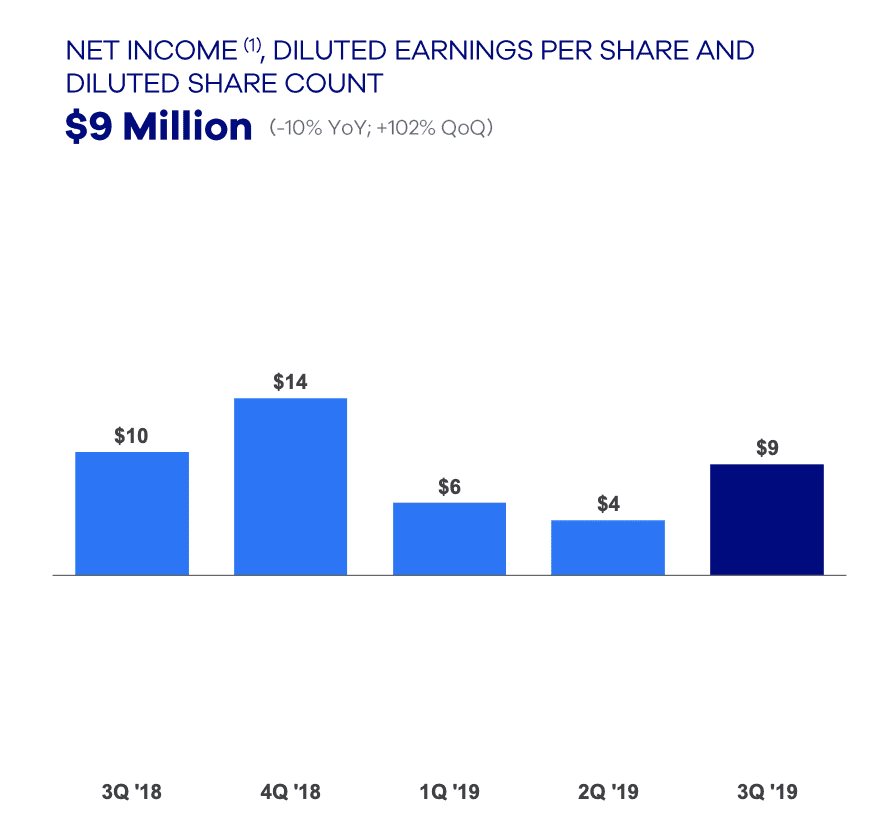

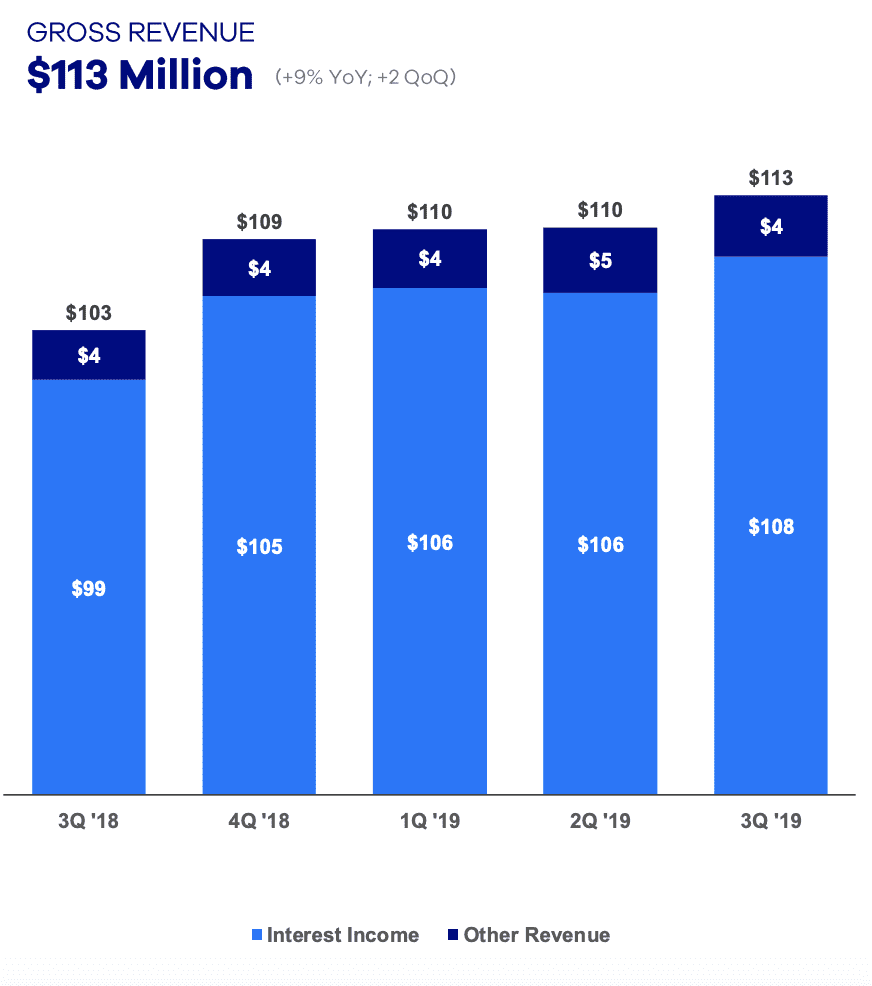

The company continues their profitability streak, posting net income of $8.7 million (up from $4.3 million in Q2) in the third quarter. Gross revenues also grew 9% to $112.6 million. This is a result of higher interest and finance income as the portfolio has also grown.

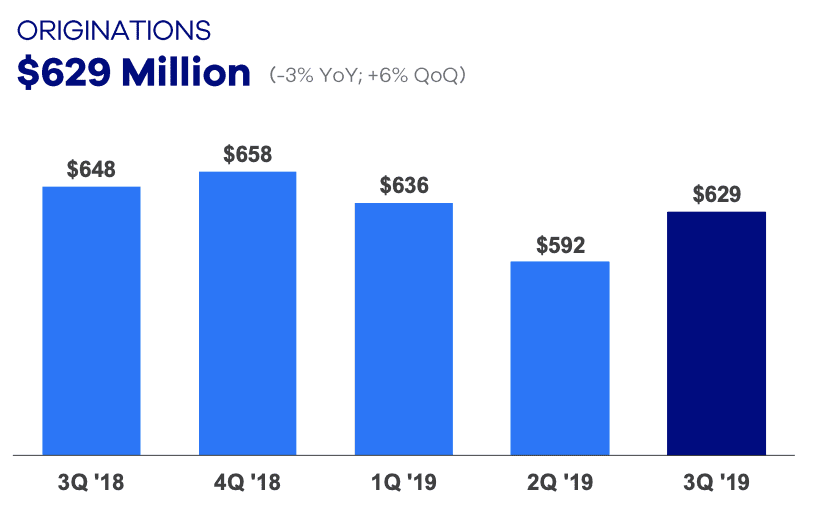

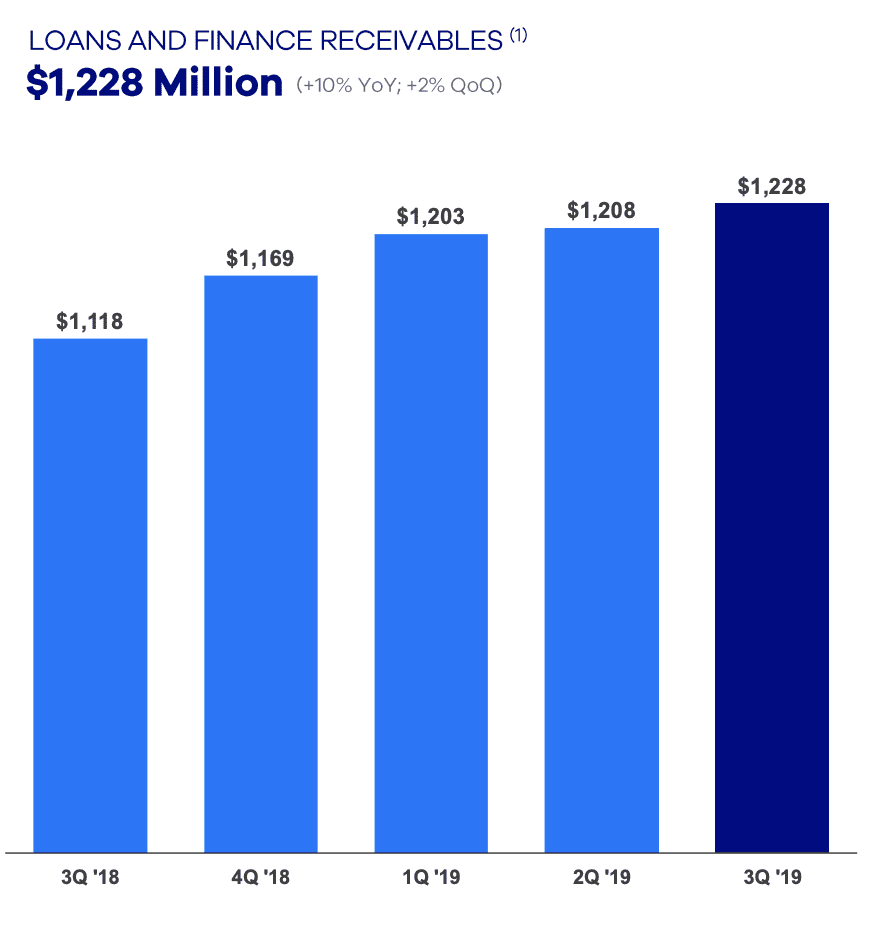

Originations were $629 million, up 6% from the prior quarter and down 3% from the prior year period. This is a result of OnDeck’s tightening of underwriting criteria along with market dynamics. Interestingly, lines of credit account for 21% of OnDeck’s total loans and finance receivables, up from 15% last year.

OnDeck also repurchased 3.2 million shares for $11 million as part of their $50 million share repurchase program announced in Q2. Other significant news was that OnDeck shared their most recent ODX client last week, Investors Bank. It’s good to see them still making progress here with the setback of JP Morgan Chase. Investors Bank is based in New Jersey and holds over $20 billion in assets, making them one of the largest banks with headquarters in New Jersey. In a prepared statement, CEO Noah Breslow also noted that the company is making progress on their pursuit of a bank charter which they first shared in last quarter’s earnings. If successful over the long term, this bank charter could set OnDeck apart from many other players in the industry. This is what is most exciting about the company’s future prospects.

OnDeck provided the following updated financial guidance for full-year 2019:

• Gross revenue of $442 million to $446 million,

• Net income of $21 million to $25 million and

• Adjusted Net Income of $28 million to $32 million.

Conclusion

I think what is under appreciated is OnDeck’s progress over the last few years. While the company hasn’t reported any significant growth in the short term they continue to execute on the path they have set out. Looking at the earnings presentation it is obvious that they have prioritized stability over growth as originations have fluctuated as they have reacted to current market conditions.

Looking to 2020, OnDeck projects a portfolio growth rate consistent with what they have seen in 2019. In addition they expect stable credit quality with a slightly lower net charge-off rate and a slightly higher reserve ratio assuming the macro-economic, small business lending and capital market environments remain steady.