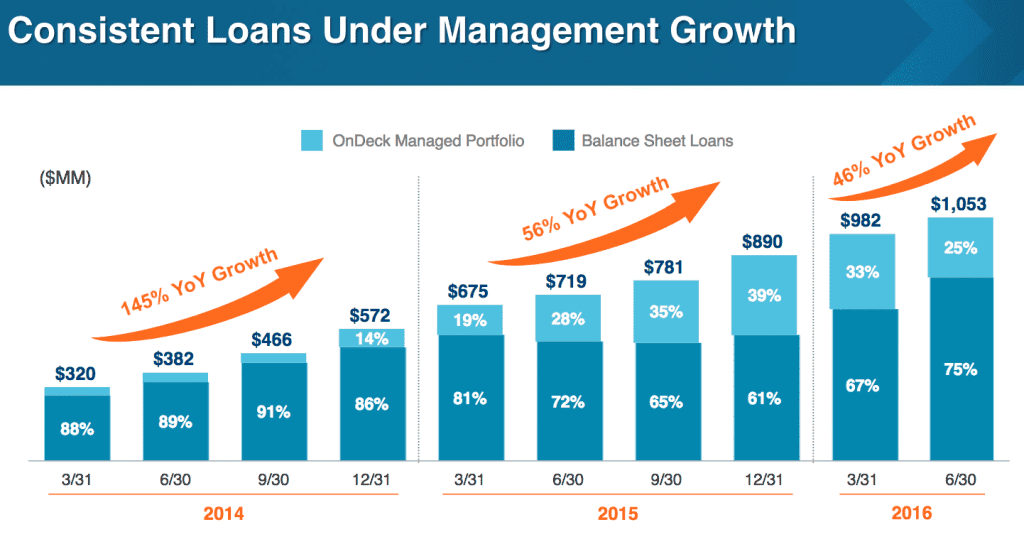

OnDeck announced a record $590 million in originations for Q2 2016 in yesterdays earnings report. This is an increase from $569 million from Q1 2016. They have also crossed the $5 billion mark in total small business loan originations.

As we reported on last quarter, OnDeck has continued to hold more loans on their own balance sheet and this trend continues. CEO Noah Breslow provided an update to this end in the press release:

Our leadership position and diversified funding model enabled us to produce solid results this quarter. Although financial comparisons continue to be affected by our planned reduction in Marketplace sales and its resulting accounting impacts, we believe that retaining a greater percentage of loans on our balance sheet is the right decision for the long-term economics of the business. To that end, our Unpaid Principal Balance grew 57% year-over-year, which will drive future gross revenue.

The Unpaid Principal Balance now totals $790 million and is up 57% from the prior year period. Cash and equivalents total $78 million, down from $160 million at end of December 2015. The decrease in cash is directly related to the increase of funding loans on balance sheet.

Below are the key financial highlights taken from the press release:

- Gross revenue was $69.5 million for the quarter, up 10% from the prior year period.

- Net revenue was $28.9 million for the quarter, down 33% from the prior year period.

- GAAP net loss attributable to OnDeck common stockholders was $17.9 million for the quarter, compared to net income of $5.0 million in the prior year period.

- Adjusted EBITDA was a loss of $12.4 million for the quarter, compared to positive $8.7 million in the prior year period.

- Adjusted Net Loss was $14.0 million for the quarter, compared to Adjusted Net Income of $7.3 million in the prior year period.

When trying to understand OnDeck as a company, it’s important to understand what holding more loans on their balance sheet means from a financial perspective. The financial highlights above at a glance paint a pretty negative picture but there is more to the story. Historically, OnDeck has captured more revenue directly from the sales charge called “gain on sale revenue” due to selling loans on their marketplace. This gain is realized immediately and boosts quarterly revenue when a larger portion of loans are sold.

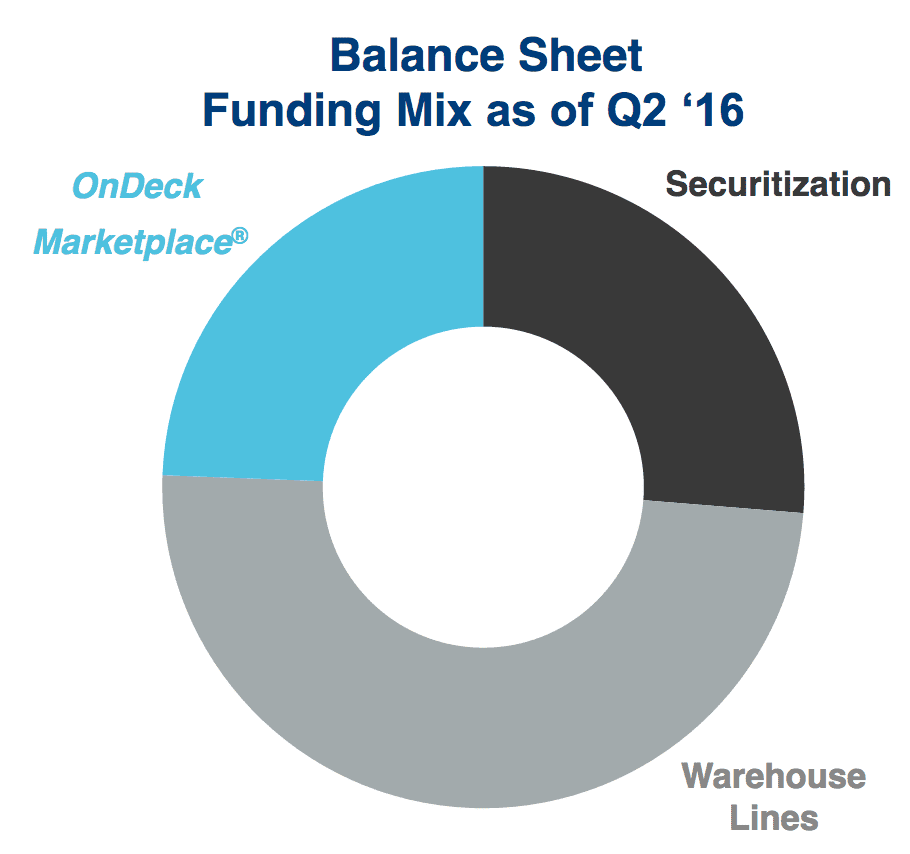

When loans are kept on their balance sheet, the income is realized over time as loans repay which explains in part the decrease in net revenue. In addition, the company has higher provision expenses since this expense for loans held on their balance sheet is realized immediately even though the loans pay out over time. Q2 2016 provision expenses were $32.3 million, up from $15.5 million in the same period last year. This increase is to be expected as there was a 74% increase in loans designated to be held on balance sheet over the same time period.

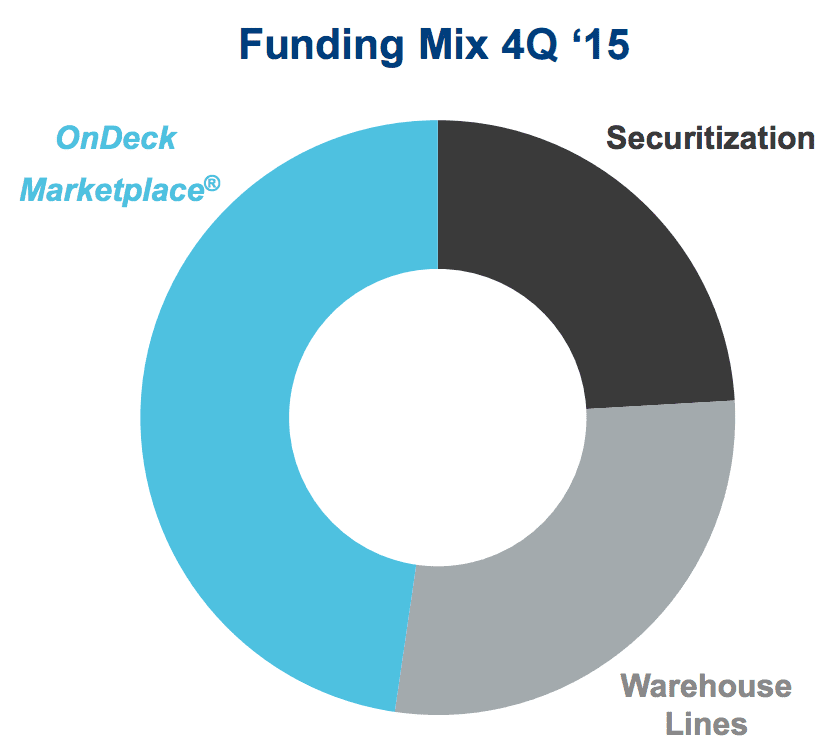

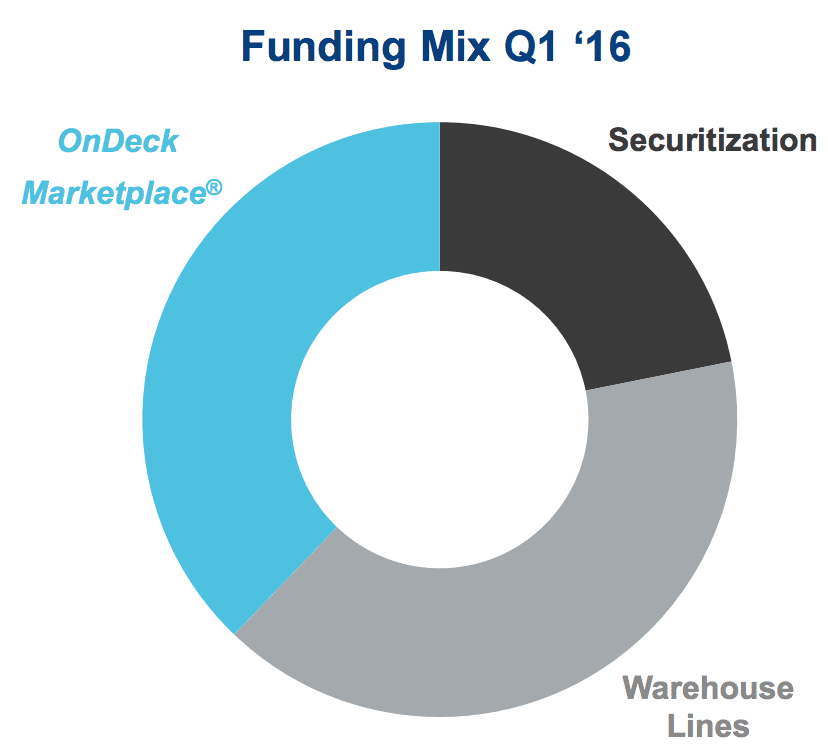

The below donut charts show the funding mix for the past three quarters. While the marketplace made up just under half of funding in Q4 2015, this has dropped to around 25% in Q2 2016. Securitization remains a fairly consistent source over the last three quarters.

This flexibility of funding, although important to OnDeck’s business model is something that might be challenging for analysts as revenues are directly affected by the mix on any given quarter. However, the market is responding favorably to their earnings with the stock price up around 12% at time of writing. OnDeck provided guidance for Q3 2016, projecting revenues between $73 and $76 million and an adjusted EBITDA loss between $9 million and $11 million.

Conclusion

It has been a challenging year on the investor side of the equation for many marketplace lenders. At least for now OnDeck’s hybrid funding model has served them well. They were able to grow originations quarter over quarter unlike many of their competitors. It will be interesting to watch the next few quarters to see if the trend of holding loans on their balance sheet continues. Stockholders of OnDeck looking to see more revenue will have to be patient, but it’s encouraging to see OnDeck continue their origination growth in turbulent times for the industry.