Yesterday, OnDeck released their Q4 and FY 2015 earnings. 2015 was the first full year as a public company for OnDeck, who went public in December 2014. They continue to grow originations, something that is likely to continue as the partnership with JPMorgan Chase begins to ramp up.

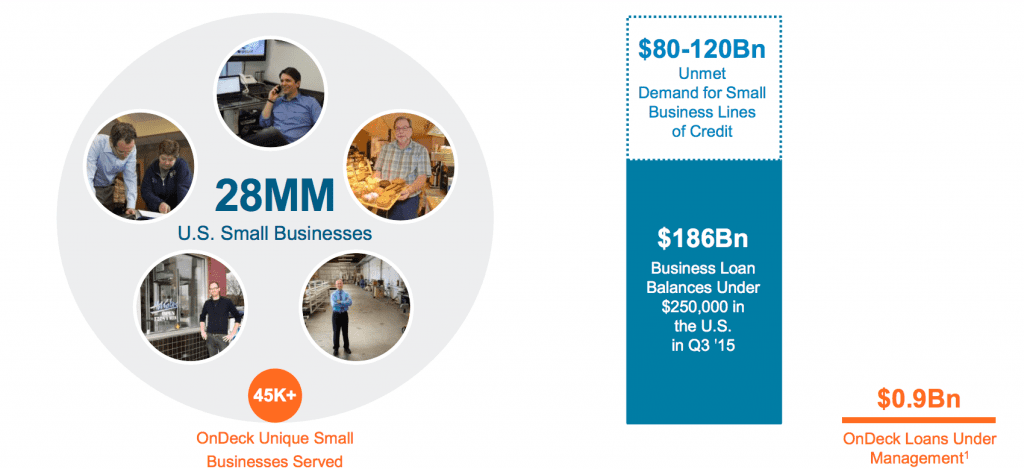

OnDeck originated $1.9 billion in 2015 across their operations in the U.S. Canada and Australia, up from $1.1 billion in 2014. In total, they have now originated over $4 billion to over 45,000 small businesses. Fourth quarter total originations came in at $557 million, up 51% year over year.

Other financial highlights include:

- Gross revenue of $67.6 million for Q4 2015, up 34% from the prior year period.

- Q4 Adjusted EBITDA of $0.3 million compared to $0.6 million in the prior year period.

- GAAP net loss of $4.6 million ($0.07 per share) for Q4 2015, down from a net loss of $7.3 million ($0.13 per share) from the same prior year period.

Despite OnDeck’s strong origination growth, the market is not responding favorably to their latest earnings. At time of writing, the stock is down 25% and currently trades at $6.60, approaching an all time low of $6.51 per share. OnDeck’s guidance for gross revenue is between $66 and $69 million for Q1 2016, which may be one of the concerns for investors. As a comparison, gross revenue was $67.6 million in Q4 2015. Gross revenue guidance for full year 2015 is between $320 and $328 million. Full year 2015 gross revenue was $254 million.

Digging into OnDeck’s presentation, they have shared how small the OnDeck’s penetration is compared to the addressable market. Although they have crossed $4 billion in originations there is still significant market share up for grabs.

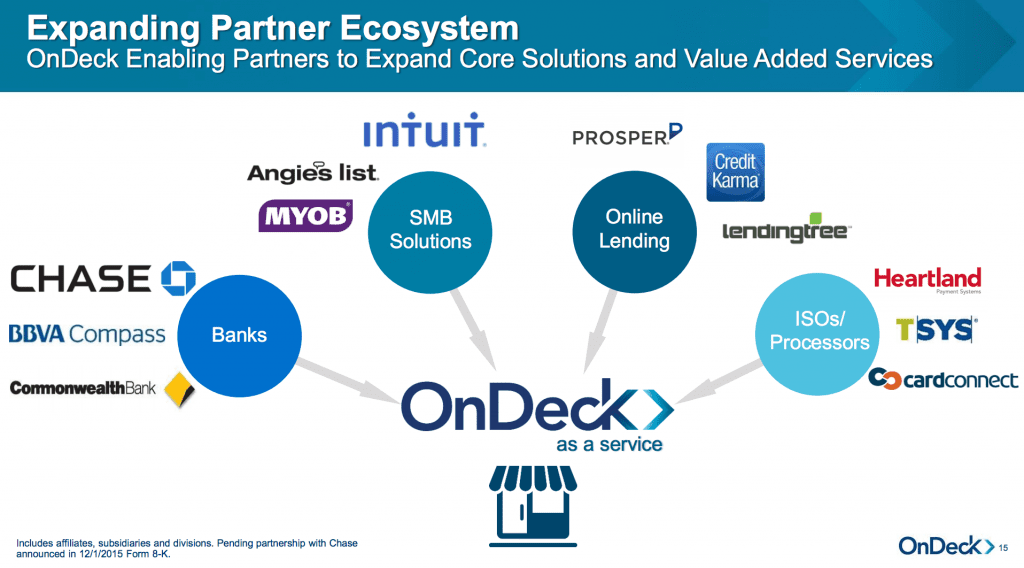

In order to expand the reach of OnDeck loans, they have highlighted their current partnerships which feed into what they are calling OnDeck as a service. As mentioned earlier, the JPMorgan deal was just announced and JPMorgan customers will begin to be able to take out small business loans that are serviced by OnDeck sometime this year. OnDeck also recently moved into Australia and established a partnership with the Commonwealth Bank of Australia, the largest of Australia’s big four banks.

While the latest financial results may be disappointing to some investors, there are many opportunities that we haven’t yet seen the results of. With these partnerships, OnDeck has access to many more small businesses who are looking for ways to finance their growth outside of traditional bank lending. If you’re interested in learning more about OnDeck, we recently interviewed Noah Breslow, OnDeck’s CEO on the Lend Academy Podcast.

Disclosure: Peter Renton, the founder of Lend Academy owns shares of OnDeck.