There has been a lot of uncertainty over the last 2 months, especially for fintech lenders. OnDeck found themselves in a particularly difficult spot since they lend to many of the small businesses hit the hardest by the coronavirus. Today, OnDeck shared a presentation providing an update on the business and the outlook isn’t as bleak as previously thought by many.

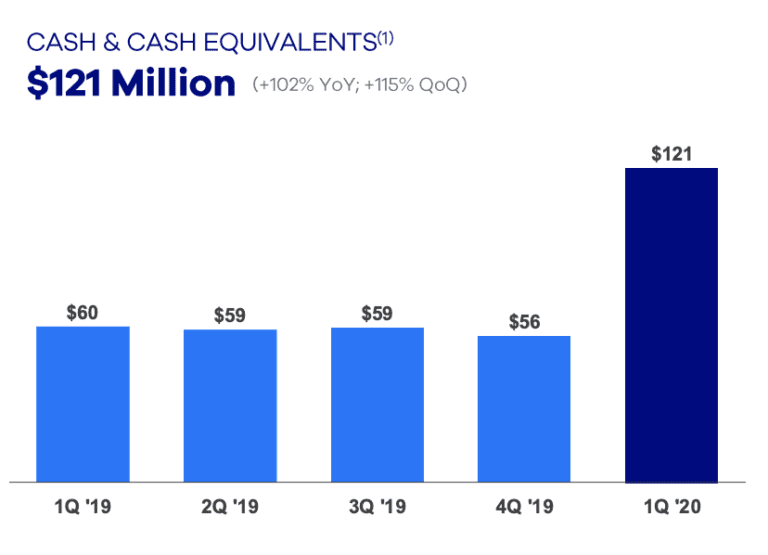

In order to protect liquidity, OnDeck has suspended substantially all new originations and is proactively amending certain credit facilities. They are working to drive down the cost of credit and reduce operating expenses to see them through the current crisis. As they entered the pandemic, the company held $121 million in cash and cash equivalents and subsequently drew down debt facilities and their corporate line. In April they maintained a cash balance in excess of $100 million.

Their actions to reduce Q2 2020 expenses resulted in $10 million in savings. About half was related to reduced marketing expenses, vendor/contractor spend, discretionary spending, partner incentives and pausing the employee stock purchase plan. Full time employees took a 15% pay reduction with CEO Noah Breslow as well as the OnDeck Board taking a 30% pay reduction. Some employees are working part time with a max of 24 hours per week. Others were furloughed and are receiving no salary but are having benefits paid by OnDeck. They also realized $3 million in international savings, concentrated on employee costs.

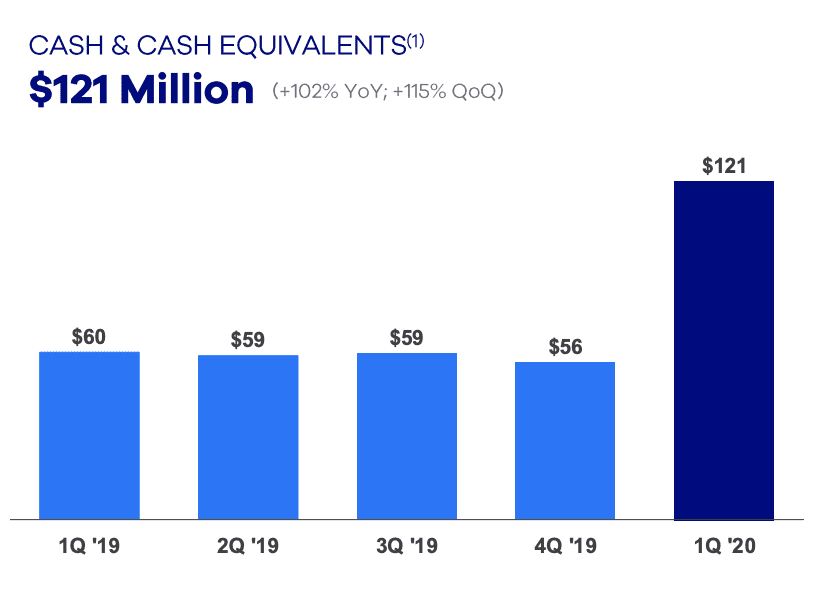

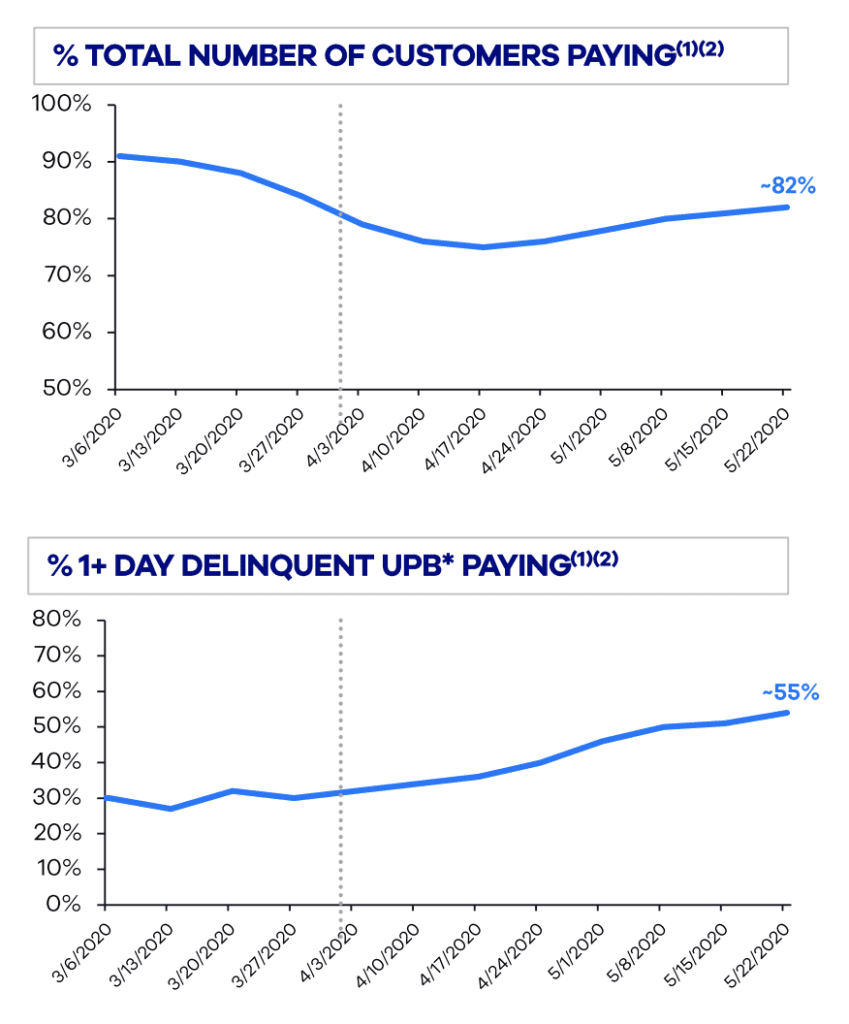

Like many lenders they saw customers looking for flexibility when it came to repayment of loans. Inbound calls and emails peaked at around six times the normal levels during the second week of April. Customers were offered temporary payment reductions, payment deferrals or term extensions. The below data is an interesting look at what industries are being the most impacted, with accommodation and food services reporting the highest rate of 1+ day past delinquency. While 1+ day delinquencies had doubled by the end of March, many small businesses are making some form of payment.

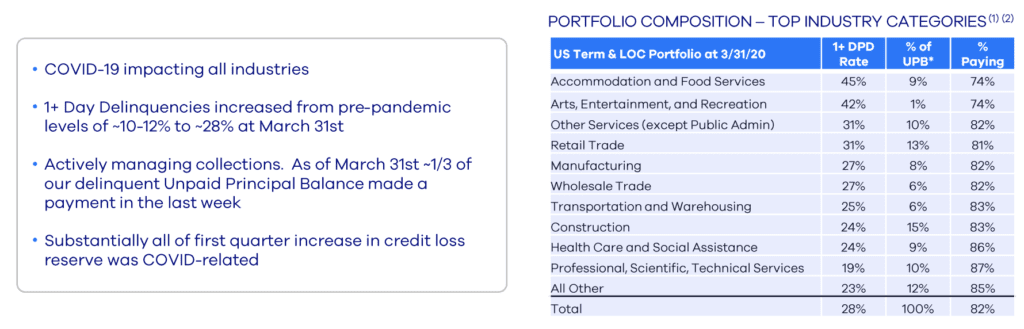

OnDeck reports improvements in the percentage of customers paying both their term and line of credit products. The data below is even more recent, showing continued improvements through the middle of May.

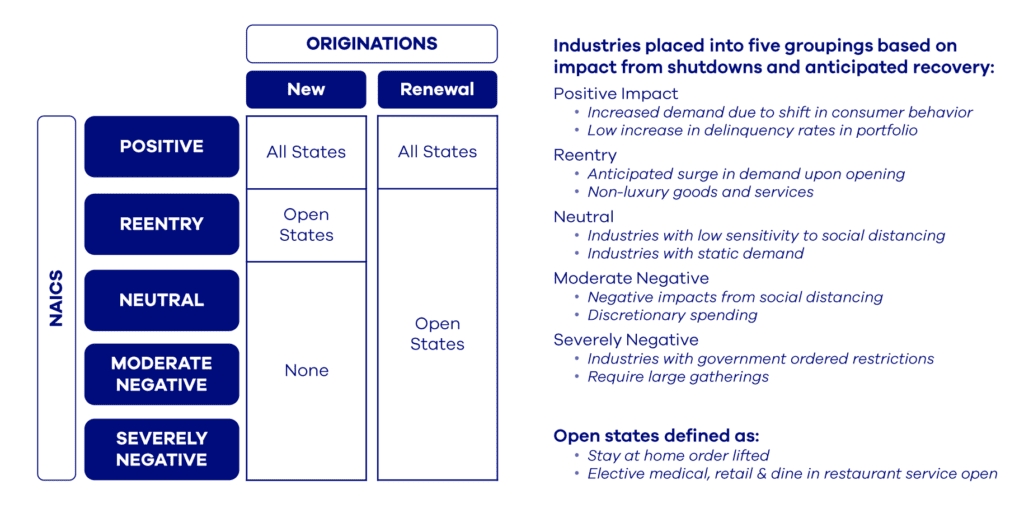

OnDeck also shared their plans for when they continue originations. Their plan breaks out new and renewal originations. Industries are put into five groupings based on impact from the crisis and the anticipated recovery. Also factored in is whether the stay at home orders have been lifted as well as services related to medical, retail and dine-in restaurants. It is also important to note that OnDeck is an SBA PPP approved non-bank conduit.

Conclusion

With the crisis still ongoing it is hard to say with any certainty what the ultimate impact will be on OnDeck. With states now reopening we will soon get a better understanding of what businesses are going to be able to survive. Clearly, OnDeck has been working hard to increase their probability of success. There is also a potential upside here as banks pull back further on small business lending so it will be interesting to see how this plays out.