In this analysis, we want to update the discussion of card networks, money movement, and the potential existential threat — or perhaps evolution — to existing infrastructure. It continues the thread on articles like Is Plaid cheap at $5.3 billion for $500 billion Visa? and Marqeta's $300MM of revenue & Ethereum's $20B in ann. transaction fees highlight opportunity and industry structure, and Who are the customers of Embedded Finance, and what do they reveal about Stripe, Affirm, DriveWealth, and Green Dot?, and more generally in this research section. We map Plaid’s progress in building out a payments ecosystem, and highlight Affirm’s debit card product powered in a novel manner through open banking. The analysis visualizes a likely evolution of the space with the introduction of Web3, and highlights a couple of early symptoms.

The fintech industry is coming up on the tipping point of funding, revenue generation, and user acquisition to rival traditional finance with $20 billion in YTD fintech financing, the several SPACs, and Visa’s $2B Tink purchased. Defensive barriers have eroded.

Let’s take a moment to compare capital. While it is not the money that wins markets, it is the transformation function of that money into novel business assets that does. And while the large banks have a massive incumbent advantage with (1) installed customers and assets, and (2) financial regulatory integration (or capture, depending on your vantage point), there is a real question on whether a $1 generates more value inside of an existing bank, or outside of an existing bank — even when it is aimed at the same financial problem.

In this conversation, we chat with Chris Dean, who is the Founder & CEO at Treasury Prime. Previously, Chris was the CTO & VP of Engineering at Standard Treasury, which was acquired by Silicon Valley Bank for an undisclosed amount.

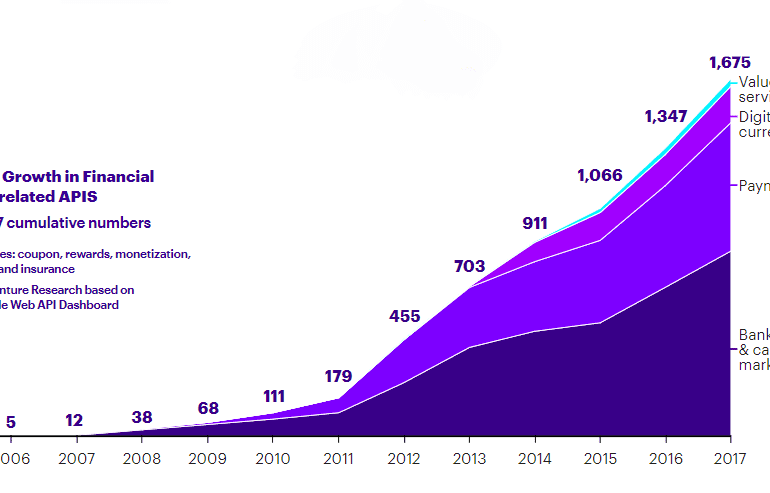

More specifically, we discuss all things banking-as-a-service, FinTech APIs, embedded finance, and the general evolution of the FinTech banking industry over the last decade.

In this analysis, we focus on Goldman Sachs launching an institutional embedded finance offering within Amazon Web Services, and Thought Machine raising a unicorn round for its cloud core banking platform. We explore these developments by focusing on the emerging role of cloud providers as distributors of third party software, think through some of the implications on standalone fintechs and open banking, and check in on AI company Kensho. Last, we highlight the difference between Web3 and Web3 approaches to “cloud”, and suggest a path as to how those can be rationalized in the future.