Hedge Funds have many advantages over individual p2p investors. One of them is that they have Ph. D level statistics gurus combing through the loan history of Lending Club and Prosper in order to develop sophisticated investment models.

Enter Bryce Mason. He has a passion for statistics and p2p lending. So, he has spent hundreds of hours developing an investment model for his Lending Club investments, a model that is similar to what the large hedge funds use. And he is about to make it available for small investors.

He first told me about his work at the beginning of last year and he has been sharing the picks from his model with me since last summer. A couple of months ago he launched his website, P2P-Picks.com, in private beta and a small group of investors have been putting it through its paces.

What is P2P-Picks?

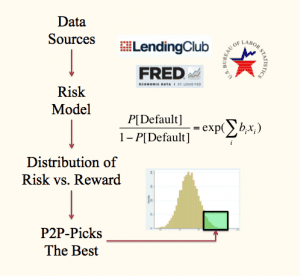

The simple graphic above demonstrates what he has done. He has analyzed the historical loan data at Lending Club focusing only on those loans that have matured. This way he can work out exactly how much each loan has returned for investors. And we are talking about quite a large sample size of loans. More than 10,000 Lending Club loans issued from 2007 through March 2010 have reached maturity.

P2P-Picks uses all the data in the historical file (and even some data that is not) in order to determine which loans on the platform will perform best. Bryce has developed a ranking system that can assign an expected return for every loan. The loans with the best expected returns (in the top 10%) are shared with investors on his site.

How much of a difference is there when investing with this model? Below is a chart that shows the projected performance. As it says this chart is based on backtesting the model on the loan history. The X-axis of this chart shows the percentage of loans included and the Y-axis shows the expected return. As you can see if you target the top 10% of loans the return can be expected to be between 12% and 13%.

How P2P-Picks.com Works

P2P Picks works off the Lending Club BrowseNotes.csv file. This is the file of all the available loans on the platform that any investor can download. Every 15 minutes P2P Picks downloads the latest file and then runs every loan through its proprietary scoring model. It then ranks each loan based on expected return and presents the top 10% of loans to its users. Then users can click on buttons to invest in $25, $50, $75 or $100 notes.

P2P Picks will not do your actual investing for you. When you click the green Go button on the site you are taken to Lending Club’s site where it will allocate the note amount selected to the particular loan.

This is how I use it. I look at my available cash to determine how many loans I need to get back to being fully invested. I then start at the top clicking on the $25 buttons of each note. Then I click the Go button which will launch a new browser window but then I quickly come back to P2P Picks again and click the next Go button.

Then when you are done you stay on Lending Club’s site and click View Order. Then Confirm the investment, assign it to a portfolio and you are done. Once you get used to it you can easily invest in 15-20 loans in less than a minute. I have been doing this, on average, once every two days since the site launched.

What is the Cost?

Right now while it is still in beta the price is free. Once it launches you will pay 0.5% of the value of the notes (50 basis points). So, a $25 note will cost $0.13, a $50 note costs $0.25 and so on. Then at the end of every month your credit card will be charged for all the picks you have made in the preceding month.

P2P-Picks is Launching in May

Almost $200,000 has been invested now by over 100 investors through P2P-Picks and the numbers are growing every day. The system is very stable and I have been using it on an almost daily basis for several months now with no problems.

I have been investing a portion of my main account with this model since August of last year. I have 325 notes totaling just under $10,000. While it is obviously too early to make a judgment call yet on how his model is performing for me I can say this. Of the 325 notes I have invested in I have had no charge-offs, there are no late loans and there are just two notes that are in grace period. My Nickel Steamroller ROI for this portfolio says it is 16.79%.

Bryce is intending to make P2P-Picks available for everyone next month. As of late April it is still in private beta but if you are interested you can join the waiting list by filling out the Contact form on his site.

I welcome a site like P2P-Picks coming online – it is one way to help level the playing field between the hedge funds and the small investors. What do you think?