We continue our weekly roundup of new tools for p2p lending investors with something a bit different. P2P Summit hasn’t launched yet but I have seen a preview of the site and I believe it has great potential.

Let’s be honest here, the Folio platform for Lending Club investors is more than a bit unwieldy. I am always surprised that so many investors stick with it and continue to buy notes there. The interface is unfriendly and the filtering capabilities pale in comparison to what is available to retail platform investors. That is why when I use the trading platform it is almost always as a seller, rarely a buyer. Of course, I realize that for many investors it is Folio or nothing when it comes to investing with Lending Club. For these people P2P Summit brings some good news.

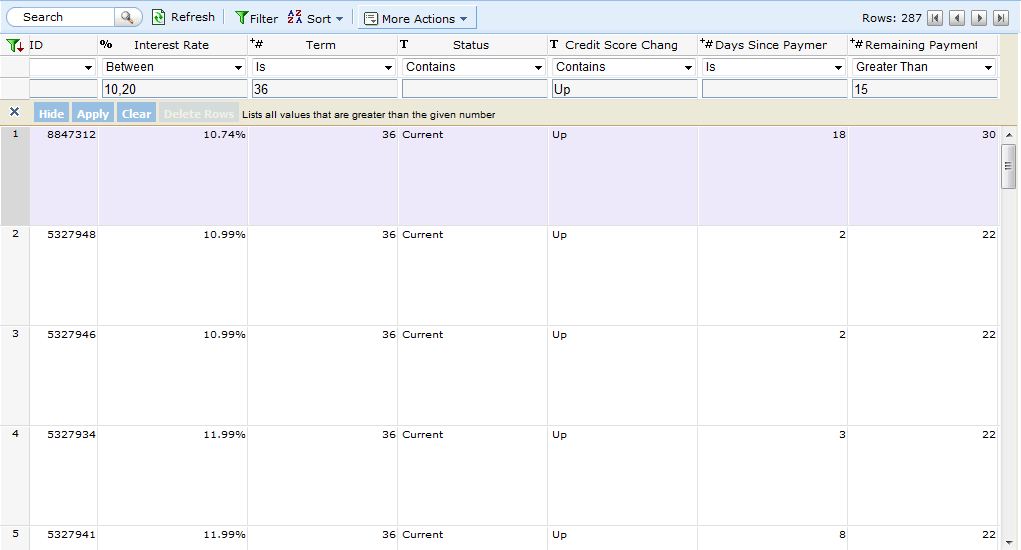

For the first time investors will be able t0 filter notes on Folio just like retail investors. P2P Summit includes not just Folio data but also the credit data from the original borrower listing. You can search all the usual fields you have on Folio right now but also current FICO score, number of inquiries, revolving credit, employment data, verified income, etc. Once you have isolated the notes you want, you can invest in them with just one click from within P2P Summit.

Here is a screenshot of the filtering screen. Click on it to view the screen in full size.

Today there are usually more than 40,000 notes for sale at any one time on Folio. P2P Summit will download every one of these notes once a day and match the original listing data. As you can imagine this requires some serious server power. So, before he launches his site the owner of P2P Summit wants to get some idea of how many people are interested in this kind of service.

If you are someone who uses Folio on a regular basis and would like a better investing tool then I encourage you to head on over to P2P Summit and request a beta invitation.