High inflation and unstable economic conditions are having significant impacts. In May 2022, the annual inflation rate in the UK was the highest since 1982, affecting the affordability of goods and services for households. Consumer prices were 9.1% higher than the year before, and domestic gas prices rose by 95%.

Due to this increased cost of living, 14% have reported a need to use credit more than usual. Low-income households are most affected by the high cost of living, yet they have the most difficulty accessing this credit.

Companies traditionally use credit file data to make credit decisions; however, increasingly, there are concerns that this approach may be providing an unnecessary barrier to entry for the most vulnerable.

“We’ve been using a picture of consumer finance that’s quite incomplete,” said Sho Sugihara, CEO, and Founder of Pave. “Primarily, decisions for lending products are made by credit file data, but one in five people have errors on their credit files. That means we are assessing people with incorrect information a lot of the time.”

Using solely credit data can also provide a very limited view of the customer, excluding applicants who may be eligible despite insufficient credit data or a low credit score.

“This is unfair to the customer, but it’s also very inefficient, and companies are not making accurate decisions as a result.”

Open Banking provides data for more accurate lending products

Open banking is seen by many to reduce the issue of inaccurate credit risk profiles. According to Pave, open banking data significantly improves lending options.

Using a like-for-like credit modeling strategy, Pave compared average Area Under the Curve (AUC) performance using its purely Open Banking data inputs vs. credit file data inputs. The results showed a ~2% higher AUC with the credit model powered with Open Banking data.

“This is a significant achievement,” said Sugihara. “It implies Open Banking credit models can have higher if not comparable performance compared to credit file-based credit models. Pave also showed that the two data sets combined into one credit model can uplift AUC even further.”

“With models combining the data, we can improve the Gini coefficient by 20%, leading to better and more profitable lending decisions.”

Fuse helps businesses tap into open banking

Since 2017, Pave has provided a B2C platform for users to build their credit scores and affordable credit options based on a combination of open banking and credit file data.

Fuse, their B2B solution released this month, allows businesses to provide credit options enriched with Pave’s wider data set for their own customers.

“Now, when customer income is so volatile, and will likely be over the next two years, it’s really important that a platform like Fuse comes in and helps companies make sense of open banking data to provide an accurate picture,” said Sugihara.

The Fuse platform and open banking model categorizes transaction data and provides customizable scorecards. Companies can add several features to assess affordability based on data relevant to their specific product. Additionally, the platform uses analytics to generate payment plans tailored to individuals’ income and expenditure.

Financial health can also be improved as Fuse can pull raw transaction and credit file data to generate actionable insights for customers.

Potentially, a significant effect on financial inclusion

The extensive data provided through open banking can also unveil new opportunities to create products for underserved clients.

“Pave, and Fuse in particular, at our core, is about including more people into the system, especially those that we think are unfairly excluded,” said Sugihara.

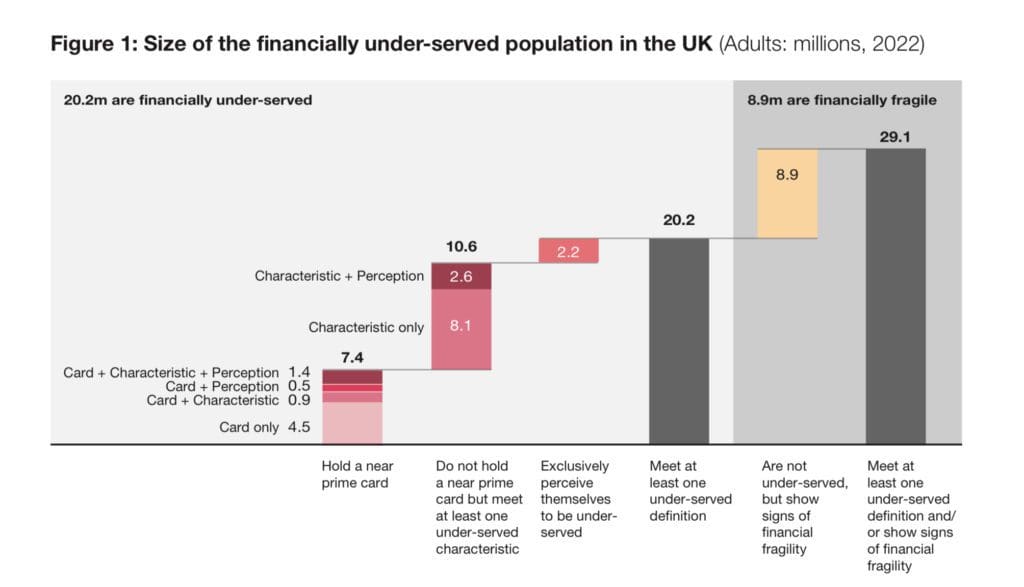

Solutions such as Fuse improve accessibility which could be critical in the current economic climate. Sugihara explained that one in three adults are currently struggling to access credit, and the number of underserved borrowers has grown by 50% in the last six years. Conditions are likely to worsen over the next few years.

“In this environment, it’s a good time to launch a lending product from a social and financial inclusion standpoint,” he said.

“The customers you acquire during economic downturns as a lender are often the most loyal and valuable over time. But you need some assurance and some technical capability to help serve those customers with more confidence.”

Although risks are higher, they could be mitigated through software that combines open banking and credit file data to continue offering credit solutions to a broader audience.

However, navigating open banking data can be complicated. Much of the data acquired needs to be sorted, categorized, and algorithms must be built to process it correctly. This can create challenges for businesses looking to bring products to market quickly.

Fuse allows businesses to leverage the years of experience and algorithms developed by Pave to utilize this data efficiently.

“Pave wants to be that thought partner and technical partner. With Fuse, we can help companies offer new and different products to make sure we don’t continue a trend of financial exclusion.”

RELATED: