Payments Technology

Featured

In this conversation, we chat with Daniel Finlay – a former Apple software developer, co-founder and co-lead developer on MetaMask – a non-custodial Ethereum wallet, allowing users to store Ether and other ERC-20 tokens and make transactions. Further. With the growth of DeFi and NFTs over the past year, MetaMask has increased in prominence as an entry point for novice users. So much so that its user base is now over 20 million monthly active users.

More specifically, we touch on how Dan went from teaching kids to code to having an app rejected by the Apple App Store to MetaMask, the philosophy behind e-government, questioning the role and job of software engineers, how crypto wallets compare to neobanks, and so so much more!

In this discussion, we explore ways that Stripe — arguably the best American fintech company full-stop, although who would want to mess with Square — could be entering the crypto space. We consider approaches similar to the payment onramps, then discuss the underlying market structure powering those experiences, and highlight more generally the role of gateways relative to protocols. We touch on the role of custodians, banks, and wallets, as well as Square’s attempt, the tbDEX, where KYC/AML comes down to forms of opt-in identity. Finally, we address questions about Circle and USDC, and how stablecoins differ from the rails on which they travel.

In this conversation, we chat with Elizabeth Rossiello – the CEO and founder of AZA, an established provider of currency trading solutions which accelerate global access to frontier markets through an innovative infrastructure. Elizabeth founded the company in 2013 in Nairobi, Kenya and has expanded it to 10+ markets across Africa and Europe.

Before founding AZA, Elizabeth was a rating analyst for microfinance institutions across sub-Saharan Africa, consulting for Grameen Foundation, Gates Foundation and the Acumen Fund, as well as working with regulators and policy-makers on legislation for financial innovations. Elizabeth co-chairs the World Economic Forum’s Council on Blockchain and holds an M.A. in International Business and Finance from Columbia University.

More specifically, we touch on ratings agencies and the activity of rating intitutions, M-Pesa and how it influenced the thinking towards a crypto-centric future, Africa’s banking landscape and some of the outstanding issues it faces, Bitpesa and how it became Aza, banking infrastructure in Africa, and so so much more!

In this conversation, we chat with Adam Hughes – the Chief Executive Officer at Amount, a technology company focused on accelerating the world’s transition to digital financial services via its digital retail banking platform, world-class digital authentication & fraud prevention tools, and ecommerce point-of-sale financing technology.

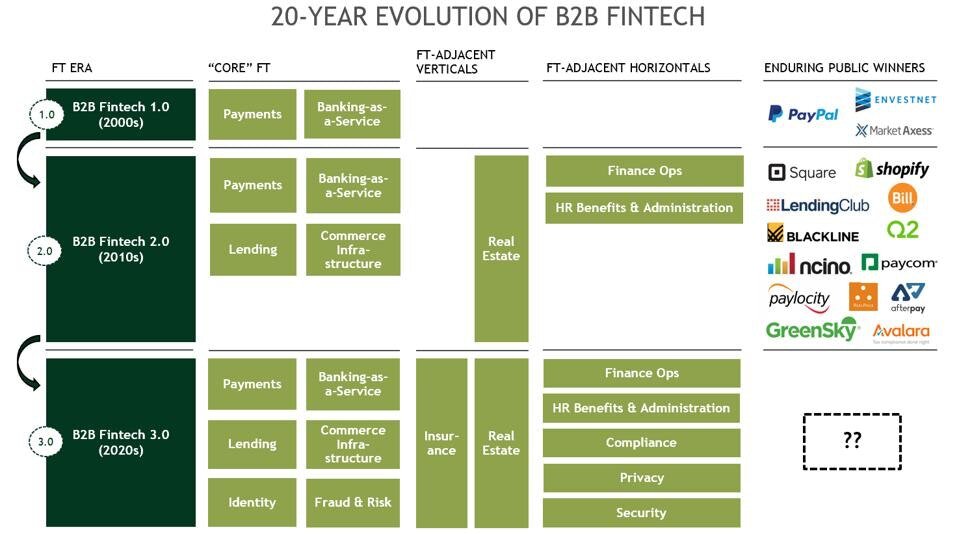

More specifically, we touch on digital lending industry Buy Now Pay Later (BNPL), as well as the trends of working with large banks and enabling their digital transformation to access some of these themes as part of embedded finance and banking-as-a-service.

In this analysis, we want to update the discussion of card networks, money movement, and the potential existential threat — or perhaps evolution — to existing infrastructure. It continues the thread on articles like Is Plaid cheap at $5.3 billion for $500 billion Visa? and Marqeta’s $300MM of revenue & Ethereum’s $20B in ann. transaction fees highlight opportunity and industry structure, and Who are the customers of Embedded Finance, and what do they reveal about Stripe, Affirm, DriveWealth, and Green Dot?, and more generally in this research section. We map Plaid’s progress in building out a payments ecosystem, and highlight Affirm’s debit card product powered in a novel manner through open banking. The analysis visualizes a likely evolution of the space with the introduction of Web3, and highlights a couple of early symptoms.

In this conversation, we chat with Richard Turrin – an award-winning executive, previously heading FinTech teams at IBM, following a twenty-year career, heading trading teams at global investment banks. He’s also the author of the number one international bestseller, Innovation Lab Excellence. One of his books is Cashless: China’s Digital Currency Revolution, which brings the story of China’s incredible new central bank digital currency to the west. He lives in Shanghai, China, where he’s had the privilege of living in China’s cashless revolution firsthand.

PayPal just launched what it calls a super app. It has a cash account with a 0.40% interest rate, direct deposit, money movement, bill pay, and remittance features. It also integrates shopping functionality with rewards and cash back. In this analysis, we compare this offering with Google Pay and Square Cash App, as well as trace the DNA of PayPal to understand whether such an offering will succeed where others failed.

Square upgrades Cash App into a payment processing powerhouse, completing the loop between the consumer and merchant side of the house. Goldman Sachs acquires GreenSky, adding a lending business at the point of intent. This analysis connects these symptoms into a framework explaining the increasing integration between commerce and finance, and the increasing role that demand generation plays. That in turn explains how the attention and creator economies interconnect with financial services.

Paying attention is the path to seeing and doing. Mastercard has bought CipherTrace to see blockchain-based finance, to launch new businesses, and to plug in more networks into its nexus. The crypto networks proliferate at every layer, creating more computation on Ethereum, Polygon, Arbitrum, Optimism, Fantom, and Solana. The US executive seeks to see more too, asking the banks for their records of financial transactions to enforce taxation compliance.

We talk about OnlyFans, and how its bank vendors pressured it to try to ban adult content, and how and why that failed. We also discuss the crypto tax provisions in the Senate version of the $1 trillion infrastructure bill, and their impracticality. These themes are tied together with a metaphysical hypothesis about the role of financial services, anchored in a discussion of the Platonic model of the mind. How are rationality, emotion, and social context involved to define the shape of our industry?

In this conversation, we chat with Chris Dean, who is the Founder & CEO at Treasury Prime. Previously, Chris was the CTO & VP of Engineering at Standard Treasury, which was acquired by Silicon Valley Bank for an undisclosed amount.

More specifically, we discuss all things banking-as-a-service, FinTech APIs, embedded finance, and the general evolution of the FinTech banking industry over the last decade.

Last quarter, fintech funding rose to $30 billion, the highest on record. $14 billion of SPAC capital is waiting to take these companies public. Robinhood and Circle are about to float on the public markets, via SPAC and IPO. In this analysis, we explore the fundamentals of both companies, as well as the unifying thesis that explains their growth.

In this conversation, we talk all things Wall Street, FinTech, and Venture Capital with Patrick Pinschmidt, who’s the general partner and co-founder at MiddleGame Ventures.

More specifically, we discuss the ups and downs of sell-side research in the early 2000s, the evolution of financial technology to today’s FinTech, an insight into the Financial Stability Oversight Council at the US Treasury Department, the founding of Middlegame Ventures and its impressive investment portfolio, and the transformation of financial services fueled by the rapid innovation in FinTech.

In this conversation, we have a really cool conversation on fintech, crypto assets, payments and all the things around it with Ivan Soto-Wright, the CEO and Co-founder of MoonPay.

More specifically, we discuss Liability-driven Investment (LDI), the proliferation of AI in personal finance to drive sound decision-making, innovation in finance is following the same trajectory that resulted in VOIP for the telecommunication industry, the geographical maze of crypto KYC, payment networks, and crypto payment processing.

This week, we cover these ideas:

-

How market structure determines the types of companies and projects that succeed

-

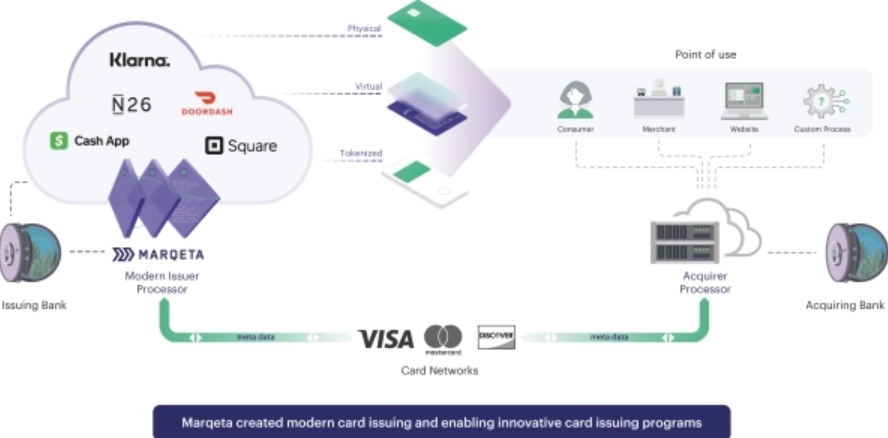

A walk through Marqeta’s economics and business model, and how Square’s Cash App and DoorDash were needed for success

-

The emerging $10B transaction revenue pool on Ethereum, MEV, and the changes to mining and gas

In this conversation, we talk with Marwan Forzley of Veem about how the rampant evolution of the mobile phone spurred his fascination to turn the phone into a business-to-business (B2B) payments network. Additionally, we explore how generations of companies have tried to use correspondent banking to solve for B2B cross border and failed, the intricacies of payment rails and the infrastructure to support them, the impact of COVID on global e-commerce, how the future will blend the distinctions between digital wallets, banking services, and crypto wallets.

In this conversation, we talk with Anil Aggarwal of Clarity Payment Solutions (acquired by TSYS) and TxVia (acquired by Google) about how he “stumbled” upon the payment space at the right time.

Anil is an absolute FinTech icon as the founder of renowned FinTech conferences – Money20/20 and FinTech Meetup. Additionally, we explore the various concepts of payment network utlity, the market timing large platform shifts, as well as, how social capital and community formation can serve as drivers towards the monetization of our attention even further.

This week, we look at:

-

Square acquiring Tidal and its 1-2 million of subscribers for $297 million, and the logic for what a payment processors has in common with the creative industry

-

How celebrities and creators like Mark Cuban, Gary Vaynerchuk, Grimes, 3LAU and others are generating millions in NFT sales

-

The impact on the economic model of the music industry, including a look at royalty structures, revenue pools, and financial vehicles when tokenized

-

The philosophical divide growing between a feudal platformed commons (e.g., YouTube) and a collectivist anarchist capitalism

Let’s do some math homework. It’s good for you:

-

The Federal Reserve money movement system broke for several hours. We look deeply into its volumes and transactions, and value it like a Fintech unicorn.

-

The Ethereum ecosystem is throwing around as much volume in settlement as the Fed check processing system. We explore scalability barriers and solutions.

-

Can eCommerce fit into our emerging infrastructure? We anchor to the market numbers in China and the United States.

Things break.

Sometimes the things that break are the US Federal Reserve ACH service, Check 21, FedCash, Fedwire, and the national settlement service. They were down for a few hours — discovered at 11AM on Feb 24th and still in trouble at 3PM that day. Everything is now up and running again.

This week, we look at:

-

The $12 billion in cumulative SPAC capital focused on Fintech, of which $3.6 billion has been raised in 2021 Q1 alone

-

Analysis of the private and public financial services markets and their valuations of profitability and revenue

-

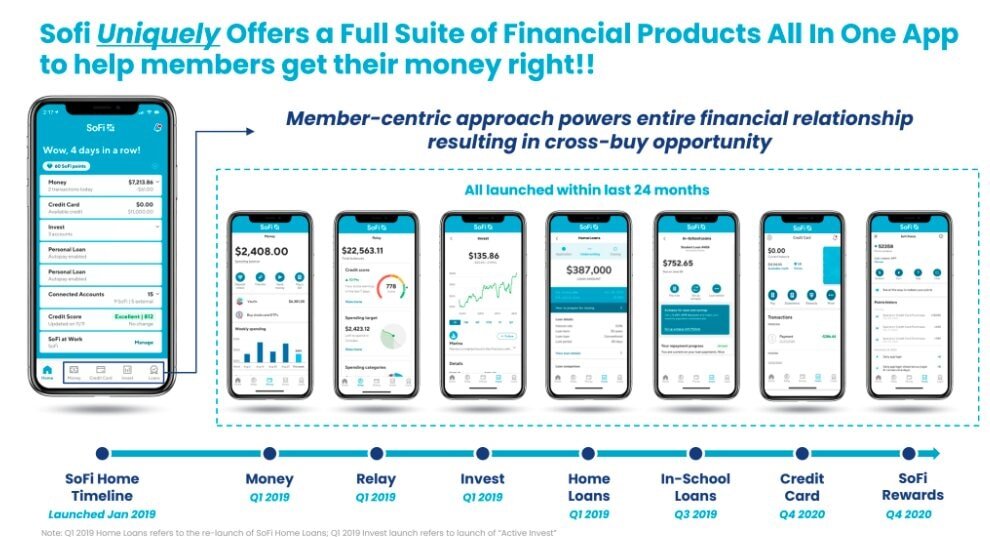

A deeper look at the fundamentals and business mix of SPAC targets MoneyLion, Payoneer, Apex Clearing, and SoFi

-

Not everything that glitters is gold

This week, we look at:

-

Over $1 billion in raises announced last week, and over $10 billion in Fintech company value creation: Checkout.com with $450 million at a $15 billion valuation, Affirm more than doubling after its IPO to $30 billion, lending enabler Blend raising $300 million, and payments enabler Rapyd raising $300 million.

-

A systems theory framework that explains the stocks and flows of goods and services, and what monetization strategies are available to fintechs

-

How transactional models are thriving and creating 50-100x revenue multiples

In this conversation, Will Beeson and I break down a few important pieces of recent news — the SPACs for SoFi and Bakkt, and Plaid/Visa falling apart.

SoFi is going public with a SPAC deal worth over $8 billion. A few things we touch on in detail: (1) this is still largely a lender, (2) there is a gem of an embedded finance play called Galileo that SoFi owns, and (3) the multiple is a little over 10x T12 revenues, which is not crazy expensive, but not cheap.

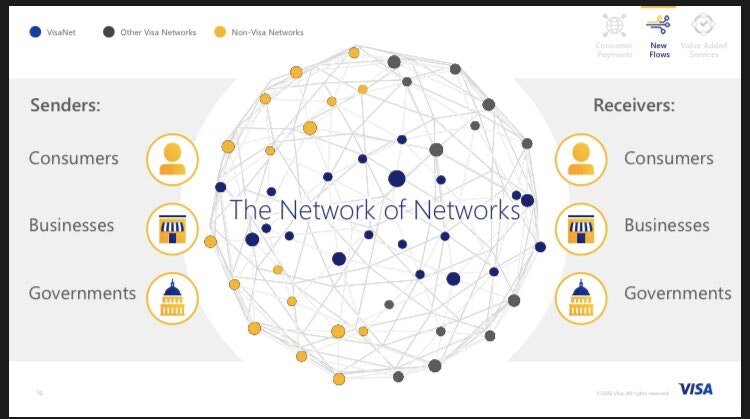

Speaking of Galileo and finance APIs, we transition to Plaid, and how it is is not going to be one of the networks in Visa’s network of networks. Who wins and who loses in the equation? And last, we cover the Bakkt SPAC of over $2 billion and our view on its future.

This week, we look at:

-

Embedded finance as a growing theme with the $10B Affirm IPO and Stripe’s launch of Treasury

-

The customer types that each of these firms is attempting to convert into their product, and what this tells us about economic growth

-

A framework for understanding the emerging value chain of digital finance, and the role of platforms and marketplaces

Google has done it. In a massive update to Google Pay, the company highlighted exactly the direction of travel for high tech, fintech, and the global banks. It has articulated a vision for competing with Apple Pay and Ant Financial. Let’s walk through the features.

Ant Financial, Bitcoin, Visa, Plaid, DOJ, PayPal, China, E-CNY / DCEP, Ethereum

Ant Financial, Bitcoin, Visa, Plaid, DOJ, PayPal, China, E-CNY / DCEP, Ethereum

This week, we look at:

-

The Bitcoin money supply being worth as much as the M1 of several countries

-

The Visa/Plaid deal DOJ anti-trust filing and the PayPal integration of Bitcoin

-

Understanding Central Bank Digital Currencies in the context of card networks, payment processors, and digital economies

-

Chinese CBDC and how it could relate to stopping the $34B Ant Financial IPO

How a CBDC ecosystem is like an operating system, rather than a payment rail

In this conversation, Will and I break down a few important pieces of recent news. MetaMask, the crypto wallet, hit 1 million month active users in yet another sign of the acceleration of retail adoption.

Square’s market cap is now equal to that of American Express, and the former also announced it has purchased $50 million of Bitcoin with its balance sheet. What do these pieces of news mean?

Greenwood Financial launched, a neobank led by Andrew J. Young, a civil rights legend, Killer Mike, a rapper and activist, and Ryan Glover, founder of Bounce TV network. How much scope is there for financial services for affinity groups instead of traditional geographical or product coverage areas?

In this conversation, Max Friedrich of ARK Invest, Will and Lex break down Ant Group’s highly anticipated IPO.

Ant, a spinout from Alibaba and the parent of Alipay, one of China’s leading payments companies, filed papers to IPO in Shanghai and Hong Kong.

Max, Will and Lex dig into Ant’s business, from the origins to today, discuss growth opportunities and potential headwinds and explore the multi-faceted relationships between Ant and other big tech companies and national governments.

We cannot understate how impressive Ant Financial has become, connecting 700 million people and 80 million merchants in China, with payments, savings, wealth management and insurance products integrated in one package. The company also highlights the likely road for traditional banks — as underlying risk capital, without much technology or client management.

In this conversation, we break down recently published annual reports from Revolut, Starling and Monzo, three of the leading European digital banks. There are some fascinating insights to be drawn from the documents, especially in the context of the broader global fintech market. This is rich subject matter, and we surely didn’t cover everything.

The fintech world is not taking the summer off. New developments are coming fast and furious, from fundraisings to product launches to government intervention.

Banking for brands startup Bond raised $32 million to capitalize on the exploding trend of B2B2C banking.

Samsung Money launched, leveraging SoFi’s infrastructure. As SoFi again seeks a national banking charter, they could become the de facto leader in this space.

Kabbage and Intuit launched small business bank accounts as extensions of their already deep relationships with SMBs.

And WhatsApp is trialing all sorts of financial services in India just as Chinese fintech super apps are being banned from the country.

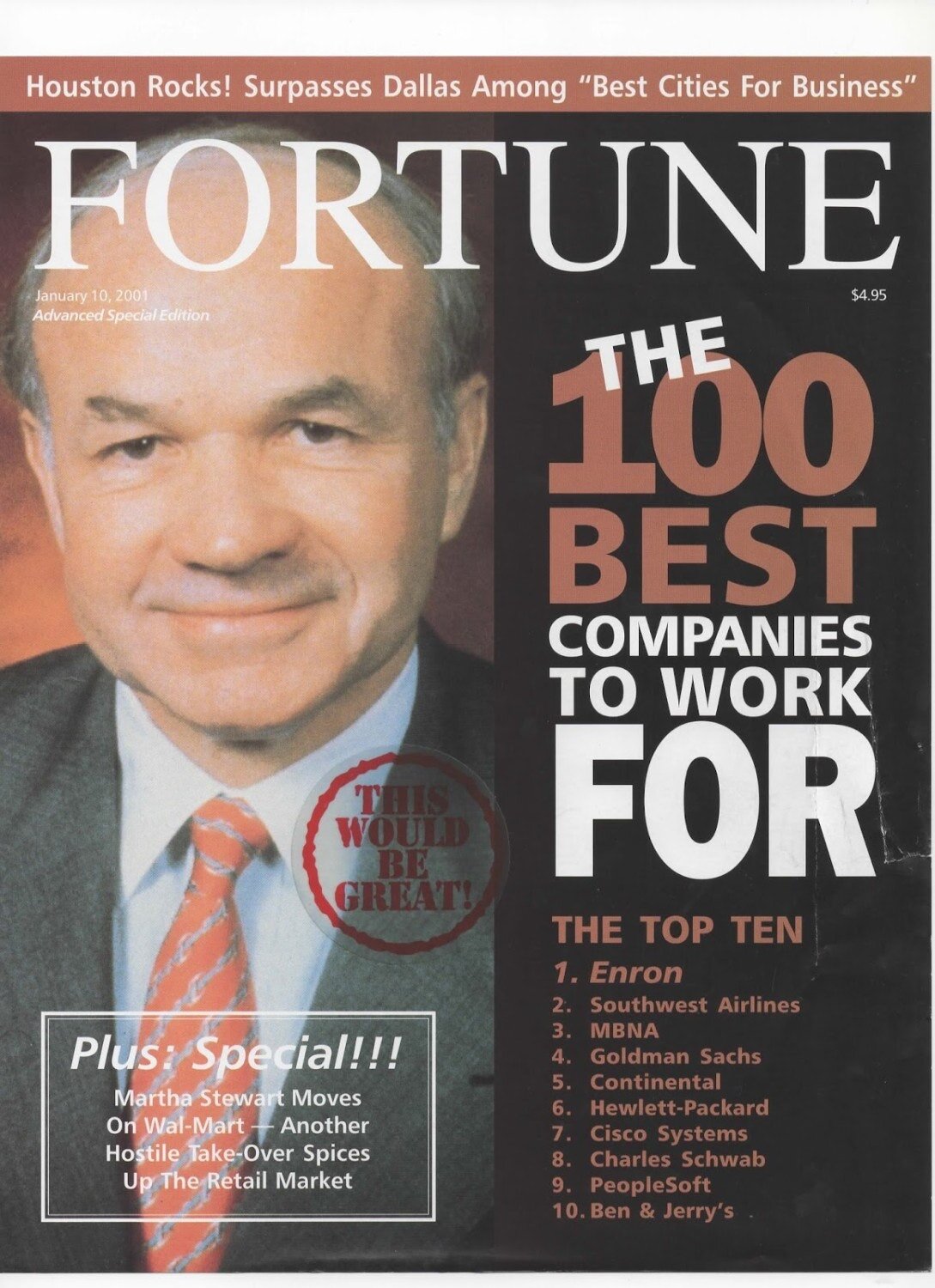

This week, we consider the impact of financial infrastructure collapse and who really gets hurt through the lens of Wirecard, Enron, and Lehman Brothers. Yes, there are investors in the entity that will lose value. But there are also clients and counterparties of Wirecard, like Curve, Revolut, and Crypto.com. In the case of Lehman, there was a $40 trillion derivatives notional amount that took twenty years to wind down. We also consider the most recent $500,000 hacking in DeFi of an automated market maker to see if there are common threads to be drawn between the two worlds.